The Data Digest: Profiling Chinese Luxury Shoppers

One of my responsibilities at Forrester is editing our Technographics® research deliverables globally. In recent years, we have regularly published reports on consumer behaviors in emerging markets, including the BRIC countries. One aspect of this global data really intrigues me: the success of luxury brands and the profile of luxury goods buyers in these markets.

China has emerged as one of the world's largest luxury goods markets: According to the World Luxury Association, shoppers from Japan represent 29% of the world market share of luxury goods sales; China, 27%; Europe, 18%; and the US, just 14%.

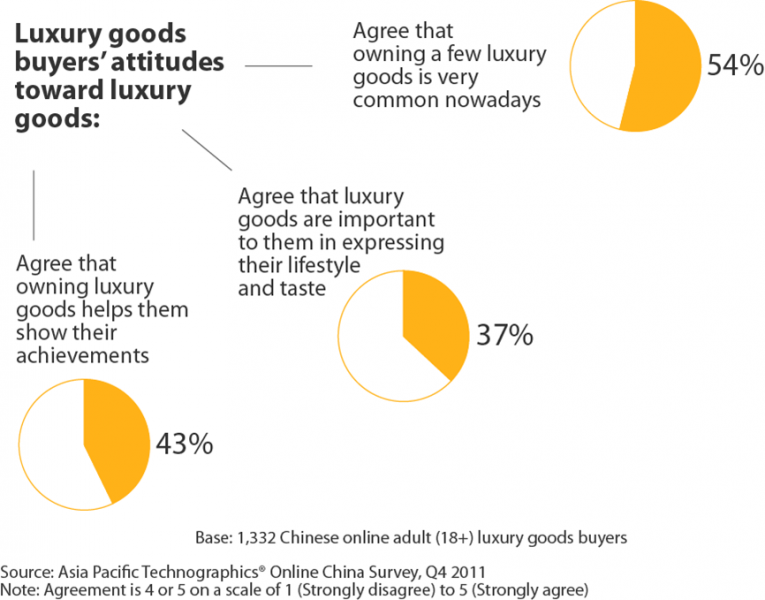

How are Chinese luxury goods buyers different from their non-luxury goods buyer counterparts? Forrester's Technographics® data shows that Chinese luxury goods buyers are similar in terms of age and gender to non-luxury buyers, but they tend to have higher incomes. However, they differ significantly with regards to lifestyle and social attitudes.

A recent Forrester report "Selling Luxury Goods To Online Shoppers In China" shows that despite the broad appeal of luxury goods across demographics, there is a difference in where consumers of different income brackets purchase luxury products. Shoppers in the high-income bracket are far more likely than lower-income consumers to go to a luxury brand's website to buy products, whether they end up buying from a localized site for China or a brand's global website. But their expectations aren’t always met: While some luxury brands have gone live in China with localized sites — examples include Louis Vuitton and Chanel — today’s online luxury goods experiences are, in general, rarely compelling.