Telefonica – Horizontal Play to Consolidate Global Networks through the Southern Hemisphere

Henning Dransfeld and Jennifer Belissent

Telefónica invited us recently to its European Analyst day at the headquarters of Telefonica UK (O2) in Slough. Jose Luis Gamo Global Solutions CEO Multinationals started off the day with an ambitious outlook on strategy and revenue growth. He highlighted Telefónica plans to deepen customer engagements by addressing their needs for global contract consolidation, as well as demands for M2M solutions, big data & s analytics and cloud services. Telefónica certainly has a lot to offer. But is Telefónica doing enough to position itself well in the evolution to markets driven by customer experience? We believe that there is potential because:

- Telefónica is increasingly competitive in winning global enterprise network contracts. After the global landmark deal with DHL, Telefónica has added large companies including Ferrovial to its customer base. Telefónica, the largest European operator by capitalization, is increasing contract values with existing customers through cross selling activities. Their ability to do so is enabled by a demonstrable focus on the following initiatives: Strengthening professional account management, increased commitment by Telefónica group to the enterprise market, as well as initiatives to improve service management, the technical architecture, customer services and the terms and conditions.

- Telefónica is developing the right portfolio to address market challenges.Through in depth briefings, we were provided with insights on the portfolio for M2M services, mobile communication, UCC and cloud-based platform services. There is a logical game plan for strengthening the market position including: improving core WAN and Ethernet services, a comprehensive mobile services portfolio to lead customer engagements, aggressive SIP trunking propositions to win TCO evaluations, expanded core cloud and security services and innovating through OTT and vertical solutions on M2M in banking, retail and public sector markets.

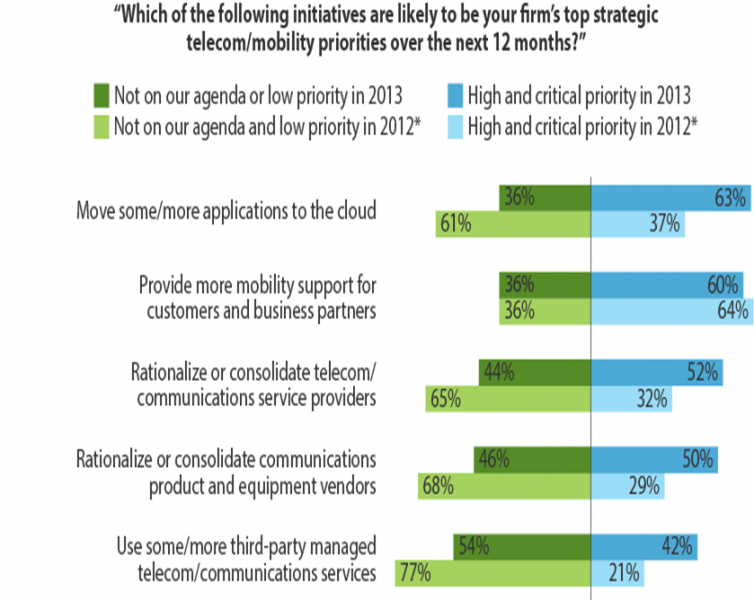

- The geographical play continues to be an important differentiator.According to a recent Forrester survey, consolidation of communication service providers has significantly moved up on the agenda of enterprise customers in comparison to 2012 (Reference 1). Telefónica aims to capitalize on this trend by ambitiously taking network customers with a stronghold in Europe or Latin America to the Asia Pacific region.That south-south connection is a differentiator that Telefónica should capitalize on. Telefónica remains selective on bids, weighing particularly RFPs where most of network requirements are offnet to their natural footprint beyond Europe and Latin America. But they offer extended coverage through partnerships with China Unicom in China and Telenor in the Nordic region.

Figure 1: Rationalizing telecom providers is a top priority in 2013

However, we note some challenges to Telefónica strategy execution. While Telefónica hits many of the right buttons in response to real trends, they fall short in compelling messaging in some areas. With several of the other global and regional powerhouses in telecoms taking very similar routes, proven innovation and differentiation is key. To do so, Telefónica must:

- Move beyond pilots in areas of innovation such smart city projects. Telefónica has long been an innovator and thought leaders in smart city technology and solutions, part of their M2M portfolio. However, it is time to move from thought to actually execution. Admittedly, constraints are not necessarily on the side of the vendors in these cases. But the onus remains on the vendors to create business models conducive to actual adoption rather than remaining in demo mode.

- And, differentiate in other areas where the messaging feels a little "been there." In a crowded unified communications market, vendors must stand out with innovation and compelling messaging focused on the pain points of their potential customers. Telefónica sees customers’ focus shift from cost savings to productivity growth. While certainly desirable as a goal, that productivity water has been tested. Enterprises are not going to jump in for that. It’s just too hard to measure. One avenue worth pursuing is the need enterprises have to attract and retain talent. As demographics shift, younger employees will demand better (and more unified) communication tools. Will this be the tipping point for UC? Better venture into new territory than rehash has-been messaging. Otherwise, the biggest differentiator remains the attack on voice revenues through SIP trunking. Although a vital move to expand market share, this is not enough to develop a sustainable enterprise value proposition.

Reference 1: The Expectation Gap Increases Between Business And IT Leaders, July 23, 2013, By Dan Bieler, Henning Dransfeld