Economic Uncertainty And Unicorn Carnage Spells Opportunity For Corporate VCs

Corporate VC and innovation teams are at a crossroads. Rampant speculation of an imminent global recession, election-fueled economic uncertainty in the US, and headline-grabbing stories of high-profile unicorn CEOs falling from grace dominate our headlines today. This environment could easily lead corporate VCs to tighten those purse strings in the coming year. But should they? Of course not. Our recently published infographic reveals the latest trends and growth rates across many of the hottest startup ecosystems around the globe.

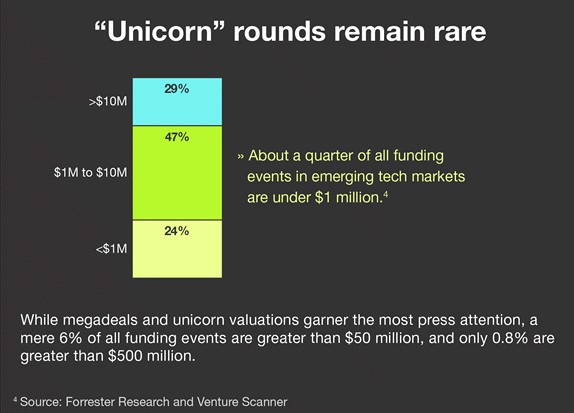

If and when the market turns downward, that’s the perfect time for corporate VCs to invest in tech innovation through startup equity investments or partnerships. If innovation is imperative to corporate survival (and we believe it is), then a down market means it’s time for the proverbial “buy low” mantra. And let’s face it, corporate VCs shouldn’t be hunting for unicorns anyway. The fact is, unicorn valuations are still quite rare. It may feel like we read about more of them these days, but that’s an illusion. Consider that only about 6% of all VC rounds are comprised of deals greater than $50M — and that’s far from unicorn territory. Moving up the food chain, only 0.6% are $500M or greater. So even with today’s ridiculous valuation multiples of 10x or better, we’re still talking very low single digits of deals in the $100M–$200M range. Leave the unicorn hunting to traditional VC and private equity firms.

So in the face of economic uncertainty and decreasing investor confidence in overly charismatic unicorn CEOs, opportunities abound for corporate VCs that proceed with clear vision. There’s a plethora of early-stage tech startups across industries seeking funding and/or corporate partnerships. The trick is finding the right ones for your business objectives. Take our advice and avoid the many pitfalls, biases, and conflicts of interest that can plague corporate VC teams. And just as importantly, take a data-driven approach to research markets more broadly before jumping into startup relationships based solely on personal and professional networks. I spoke about these issues with our partner Venture Scanner in a recent edition of Forrester’s What It Means podcast last December. Give it a listen, and let us know if we can help you scout for your corporate VC program.