Forecasting In Uncertainty: Warning Signs Inside The SaaS Vendors’ Recent Earnings Reports

How much will software spending fall during the pandemic recession? The answer to that question has major implications for the US and global tech markets. Software is the second-largest category in the tech market after telecom services and one that also directly feeds tech consulting and systems integration services revenue. Software-as-a-service (SaaS) subscriptions represent a growing share of the software market. SaaS vendors have argued that their revenues are not likely to decline due to pricing models, contract terms, and strategic value to customers. But we now have some evidence to test that thesis.

Over the past three weeks, six leading SaaS vendors have reported their earnings for fiscal quarters ending in April or May: Adobe (May), Coupa (April), Oracle (May), Salesforce (April), ServiceNow (April), and Workday (April). These earnings periods thus include six to 10 weeks of the pandemic and resulting recession. Despite this catastrophe, all of these vendors reported strong growth in their cloud subscription revenues, ranging from 17% (Adobe) to 45% (Coupa). But those reported growth rates were measured on a year-over-year basis. That’s the normal way that software vendors report revenues.

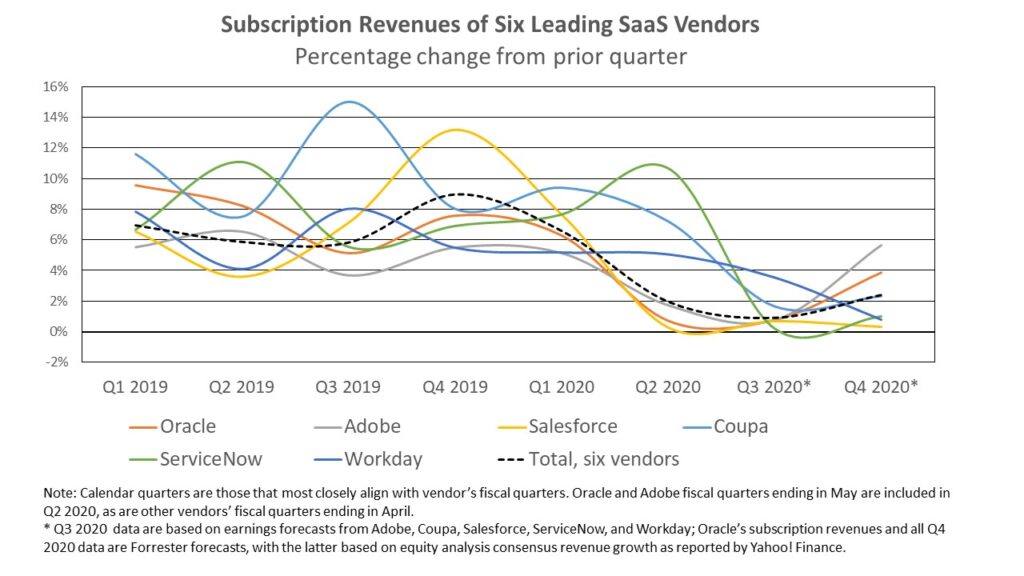

But if one looks at the quarter-to-quarter growth rates, a different and more worrisome pattern emerges. We added up the total subscription revenues of all six vendors and calculated the quarter-to-quarter growth rates individually and collectively (see chart below). Collectively, quarter-to-quarter growth dipped to just 2% in the fiscal quarters ending in calendar Q2 2020 and is likely to be just 1% in Q3 2020. On that basis, three of these SaaS vendors had little or no growth in subscription revenues from Q1 to Q2 2020. Two of these vendors — Adobe and Salesforce — included May in their results; Salesforce’s results were just through April. Looking ahead to Q3, five of the vendors anticipate little (under 2%) or no growth in their quarters ending in July or August. Workday is slightly more optimistic with 3% growth. Q4 2020 (fiscal quarters ending in October or November) will most likely continue that pattern of weak growth, based on the consensus forecasts of equity analysts at Yahoo Finance. And those forecasts could well be too high if the pandemic remains untamed, consumers and businesses remain very cautious, and the US and global economies fail to come out of a recession.

Why look at quarterly growth rates? Because these serve as leading indicators for what overall spending on SaaS software will be. Unlike licensed software, where there are big differences quarter to quarter in new license sales, SaaS subscriptions tend to grow steadily on a quarterly basis due to quarterly bills from the book of billings and a steady flow of new clients. Historically, as can be seen in the chart above, quarterly revenue growth for these vendors has been in the 5% to 8% range — consistent with annual growth of 20% to 30%. However, the 1% to 2% quarterly growth that we now project for the rest of 2020 translates into 4% to 8% growth on an annualized basis — far below the annual revenue growth that leading SaaS vendors have been posting. Most of these vendors operate with losses or small profits, and their stock price has been based on posting 25% or higher revenues. What will happen to their stock price when investors grasp that SaaS revenues are growing at single-digit rates will be interesting to see.

But I am looking at this data from a forecasting perspective. For me, the important questions are: What is driving this weak performance, and what do they tell us about the tech market outlook? The vendors in their earnings releases and investor calls have been very tight-lipped about this quarterly revenue slowdown. Still, the sharp slowdown in SaaS subscriptions is most likely due to two major factors: 1) a sharp slowdown in new deals (as Oracle, for one, acknowledged in its earnings call) and 2) cancellations of existing contracts or delays in payments. For example, Salesforce, in its 10-Q (but not its earnings) statement stated that “We supported certain customers who were experiencing distress as a result of COVID-19 by providing them with some temporary financial flexibility, such as payment delays. . . . [W]e experienced a decline in new business as compared to the same period a year ago.” (See Salesforce’s 10-Q filing for Q1 2021.) Salesforce and the other vendors are expecting or hoping that any payment delays will be reversed in future quarters and that new deals will pick up. Meanwhile, we have not yet seen evidence of SaaS vendors making adjustments in contract terms, as I have recommended (see my blog post, There’s Still Time For SaaS Clients To Ask For And SaaS Vendors To Offer A Recession Clause In SaaS Contracts).

I think pressure on SaaS revenues will build if and as the pandemic recession persists. So far, the pandemic and resulting recession have mostly impacted retailers, travel and entertainment companies, oil and gas, personal services, and other consumer-facing industries. These industries are relatively light spenders on technology. In coming months, many small companies — including many tech vendors, which populate the client lists of these vendors — will go out of business. Larger companies in financial services, manufacturing, business services, government, education, and healthcare that have avoided the initial wave of impacts from the coronavirus and containment efforts are likely to see revenues hit by that persistent recession. When this happens, SaaS vendors are likely to see subscription revenues actually drop as payment delays turn into cancellations and as new deals fail to materialize.