Frenemies Forever — The Tension Between CRM And CCaaS Vendors

There was a time when automatic call distributor (ACD) systems and customer relationship management (CRM) systems did very different things, with some integration but no real overlap. In the support world, CRM systems managed tickets and customer details, while ACD systems connected callers to agents and managed interactions.

In the 1990s, the concept of a screen pop and CTI (computer telephony integration) came into being. Leveraging a CTI interface, ACD systems were able to pop customer details onto the agent’s screen, improving the call experience and reducing handle.

Since then, the two technologies have evolved massively, both moving to SaaS cloud deployments and extending far beyond their original domain, intruding more and more into each other’s spaces. CRM vendors added routing of digital capabilities, dabbled in different approaches to telephony connectivity, and added “good enough” quality and workforce management. On the contact-center-as-a-service (CCaaS) side, vendors invested in extending the power of their desktops, started keeping and managing more customer data — at least as it relates to interactions — and expanded to digital routing.

This overlap is now significant, and it is up to the brands that deploy these solutions to decide what functionality to take from which vendor — and this is not a simple task. Brands ask for best practices and reference architectures, and now vendor frenemies deliver.

Let’s do a quick rundown on recent events.

Salesforce Plants A Flag — Service Cloud Voice

In 2019, Salesforce announced a new and improved integration between CCaaS vendors and Service Cloud that it dubbed “Voice.” It provided a deeper and more comprehensive connection as compared to the old CTI integration. In this model, however, Salesforce owned the agent desktop and reporting, relegating the CCaaS system to a smaller, more commoditized role. AWS quickly signed onto this approach with its Connect product. Vonage and Five9 were early adopters, as well, but many CCaaS players were reluctant to sign up for this reduced role.

In this first iteration, there were limited guidelines around best practices for integration and no reference architecture.

Genesys Gets On Board, And A Reference Architecture Is Born

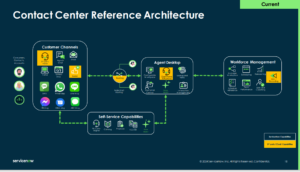

In 2023, Genesys and Salesforce announced a collaboration that added Genesys as a supporting vendor for Service Cloud Voice,and added Genesys’ Workforce Management as an option within the Salesforce desktop. This announcement was significant, as it included a reference architecture that clearly delineated the connection points and interactions between Salesforce and Genesys — and places where it was up to the customer to deploy. This reference architecture provides great value to Genesys and Salesforce customers by reducing the number of decisions they had to make it a pretty standard deployment.

More CRM and CCaaS vendors have come on board to this paradigm, as there are clearly capabilities that CRM does best and capabilities that CCaaS vendors do best. CRM systems, for example, excel at managing customer details, resolution workflows, and knowledge, while CCaaS vendor excel at omnichannel routing, quality, and workforce management. There are also capabilities on which the vendors compete; for example, both vendors can manage digital channel interactions.

It is interesting to see ServiceNow announce a similar and more detailed reference architecture for integration with its Customer Workflows. Once again, Amazon Connect was the first announced integration. More recently, ServiceNow and Genesys announced their integration, as well.

This reference architecture makes the delineation of capabilities clear and yet is only a best-practice recommendation to brands. The delineation of tasks between ServiceNow and the CCaaS vendor in this reference architecture is remarkably like Salesforce’s recommendation.

Helpful, But Not For Everyone

These best practices are not for everyone. For example, for brands that have gone “all in” on Salesforce, this reference architecture makes sense, as the experience, including reporting, resides within Salesforce. Yet for brands that only use Service Cloud and not much else from Salesforce, the shared data integration does not have the same appeal.

In addition, many brands use a myriad of back-end systems, and it is not at all unusual for an agent to access five or more systems to answer a customer question. In these cases, moving all interactions to Salesforce is not always the best answer.

But both these reference architectures provide a useful baseline for a significant portion of the market to enable them to take advantage of these new and more defined approaches to integration between CCaaS and CRM systems. Life will be easier for everyone as the frenemies build more defined roles moving forward.