Most Financial Services Firms In Singapore Struggle To Align Their Brand Promise To CX

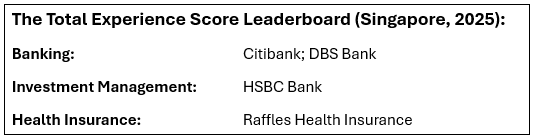

The results from Forrester’s 2025 study on total experience — covering major banks, investment firms, and health insurers — are in. But before we dive into the highlights, let’s set some context. Since 2016, Forrester has been tracking the quality of brands’ customer experience (CX) using the Customer Experience Index (CX Index™), which links customers’ perceptions of CX quality to loyalty. This year, we are excited to launch the Total Experience Score, which measures how well brands win and serve customers. It combines the long-standing CX Index and the new Brand Experience Index (BX Index™). This new composite score helps firms understand how both noncustomers’ and customers’ perceptions drive loyalty. Now, for the results:

Roses Or Thorns? Prospects Think Roses, Customers Get Thorns

In scoring each industry, we’ve looked at two components: noncustomers’ score and customers’ score. When both are aligned, judging by the industry-average score categories (i.e., very poor, poor, OK, good, and excellent), it’s safe to say that the industry players largely deliver (to customers) what they promised (to prospective customers). But when noncustomers (i.e., prospects) have inflated expectations and theoretical perceptions that don’t match the real customers’ perceptions based on their actual experiences, then we have a “rubber doesn’t hit the road” problem.

Unfortunately, that is the analytical observation we made with regards to Singapore’s major banking and health insurance players, whose average Total Experience Score stalled between 53–55 points on a 100-point scale. Only one brand, HSBC Bank (in the investment industry ratings), managed to get alignment by achieving good customer and noncustomer scores at the same time. All other brands received disbalanced perceptions about them, depending on whom you ask — existing customers or prospects. Generally, prospects thought they’d get roses (i.e., OK or good scores) while existing customers said they got thorns (i.e., poor or OK scores).

The State Of CX In 2025 Disappoints

Among all the brands we covered across the three financial services industries or subsectors, only HSBC Bank stood out for managing two distinct feats by becoming the only brand that 1) climbed above the 70-point marker, earning the “good” score distinction in the investment management industry and 2) won the number one spot back to back in overall CX Index rankings in both banking and investment management industries. The other positive highlight we observed is that the average CX Index score went up (from 63 to 64.5) in investment management, mainly thanks to foreign brands HSBC Bank (5-point gain) and Citibank (4-point gain) that lifted the whole industry average. DBS Bank tied with Citibank statistically for the banking lead. Unfortunately, the story was different for banks whose industry-average CX score (61.3) remained statistically flat for the sixth year in a row and for health insurers whose industry-average CX score (59.8) was subpar and technically in the “poor” score zone.

The Affluent Vs. Mass: The Richer And The Happier

For the first time in our Singapore CX benchmarking study, we managed to obtain enough data to compare affluent and mass consumers based on income and investable assets. Using these thresholds, we found that affluent customers and noncustomers give generally 15–20% more positive BX and CX ratings to their banks and investment managers. That realization is an important one for two reasons: 1) The personalized offerings and white-glove service models geared toward the wealthy are paying off and 2) there is a growing number of such affluent customers in Singapore. The flip side of the coin, however, is the substantially lower level of content and satisfaction among the mass retail customers who still account for the majority of addressable market and share of wallet (i.e., deposits, loans, policies). For brands that are intentionally going upmarket in pursuit of the affluent and walking away from mass (hint: these are foreign brands), this may not be such an acute problem, but for everyone else, it certainly is.

Trust From Singapore’s Consumers Is Hard-Earned But Worth The Effort

Trust, salience, and fit are the three levers that influence the way customers and prospects perceive a brand, with trust playing the most dominant role (though they are interrelated). Interestingly, brands that noncustomers trust the most aren’t always the ones that existing customers trust. That’s the difference between so-called “blind trust” and “substantiated trust.” The associated risks from that imbalance could result in short-lived success after new-customer acquisition as retention and cross-sell rates from recently onboarded customers begin to suffer.

Be that as it may, local brands such as DBS, OCBC, UOB, Raffles Health Insurance, and Great Eastern command a certain trust advantage among noncustomers (i.e., consumers who don’t yet have a relationship with them). Among existing customers, however, whom we’ve asked to rate their trust toward their current primary bank, investment manager, or health insurer, the trust pendulum swung in favor of other brands — often foreign ones, including HSBC Bank, Citibank, FWD, or Prudential, depending on customer demographics. Overall, only Raffles Health Insurance managed to win the “most trusted” mantle from both customers and noncustomers; for others, it was either or not at all.

The Message Is Clear: Singapore Financial Services Institutes Need To Do Better

The good news? The roadmap is right in front of them. Improving brand experience and customer experience requires a focus on what matters most to customers — and the ability to not just promise but deliver.

If you’re looking to benchmark how your brand’s perception and customer experience contribute to winning, serving, and retaining customers — or to uncover the strategies of top-performing brands — connect with me via a guidance session.

If you’re not a Forrester client, reach out to our sales team!

The full banking, investment firms, and health insurers reports are available to Forrester clients via the link below.

Forrester’s Singapore Banking Total Experience Score Rankings, 2025

Forrester’s Singapore Investment Firms Total Experience Score Rankings, 2025

Forrester’s Singapore Health Insurers Total Experience Score Rankings, 2025