Workday Rising 2025: A CIO’s Reality Check On The Vendor’s Heavy Bets On AI

Workday’s inherent strength has been built on the “power of one” — a unified, organic architecture that doubles down on stability and simplicity above all else. At Rising 2025, Workday committed to maintaining this foundation while simultaneously executing a fundamental strategic expansion.

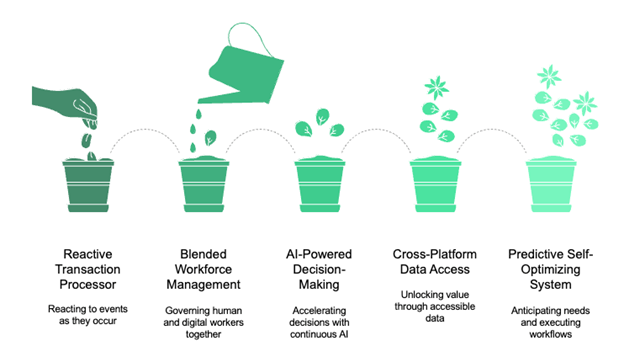

Workday is repositioning from a closed best-of-breed application suite to an open AI orchestration platform, a necessary but high-risk transformation driven by the existential threat of AI intermediation. The company emphasized that it is “doubling down” on core strengths while expanding the aperture to become a platform that manages “people, money, and agents.”

Transitioning To A Platform That Manages “People, Money, And Agents”

This dual mandate of preserving simplicity and stability while opening the platform creates inherent architectural tension. Achieving this vision requires Workday to successfully integrate its recent acquisitions, fundamentally open its core via the Data Cloud, and introduce a new consumption-based economic model — all while maintaining the operational resilience that its 11,000-plus customers depend upon. This strategy introduces integration complexity that challenges Workday’s historical engineering DNA of organic, controlled development.

This strategic direction is correct given market dynamics, but there is a meaningful distance to be covered between announcement to enterprise-ready reality. This will require consistent and stable execution across multiple complex transformations simultaneously, a challenge for most enterprise application vendors.

Key Highlights From Workday Rising 2025

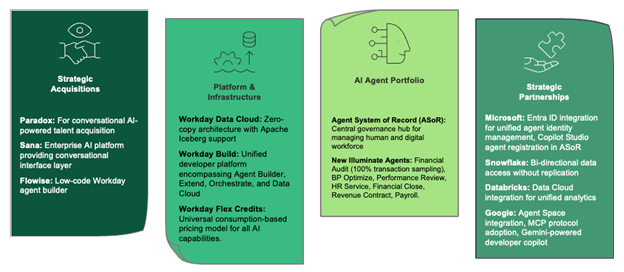

1. Sana Acquisition: Workday’s $1.1 Billion Strategy For The AI Interface

Perhaps the most aggressive move is the $1.1 billion acquisition of Sana. This is not a user experience (UX) refresh; it is a strategic battle to own the enterprise AI interface. This provides a new primary interface for enterprise AI. Workday’s goal is to become the new “front door for work.”

Sana aims to be the AI-native knowledge discovery and action layer across all enterprise data (including Microsoft 365, ServiceNow, etc.). This is a direct attempt to win employee attention and counter the intermediation threat from Microsoft Copilot and Google’s new Agentspace.

The Reality Check: Integration And Adoption

While Sana brings powerful capabilities, integrating it requires reworking the existing Workday UX, adding AI elements and natural language processing — a high-risk endeavor. Furthermore, winning the enterprise front end requires overcoming entrenched user habits with platforms such as Teams and Slack. This is a multiyear integration and adoption challenge.

2. From Closed To Open: Workday’s Data Platform Strategy

The centerpiece of the platform pivot is Workday Build, the new umbrella brand for its developer experience, incorporating the newly acquired Flowise (now the low-code Agent Builder).

Central to this is the newly announced Workday Data Cloud (early access, H2 2025), marking Workday’s first adoption of open data standards after two decades of closed architecture. By adopting the Apache Iceberg open standard, Workday is enabling zero-copy data sharing. This move was highlighted by a centerpiece partnership with Snowflake, emphasizing bidirectional data access without replication.

This is a defensive necessity in the battle for data gravity — Workday must provide open access to prevent customers from migrating data entirely to third-party data platforms and hyperscalers.

3. Transitioning From System Of Record To System Of Action

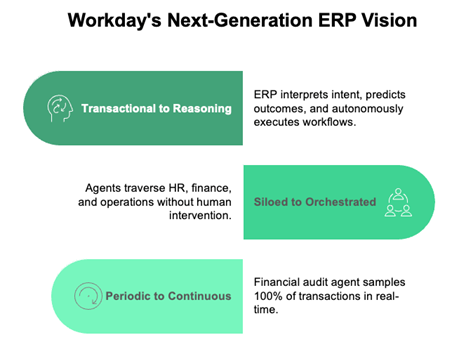

Workday goes all in on “next-generation ERP,” representing a fundamental reconceptualization of what enterprise resource planning means in an AI-native world. As explicitly stated during Rising 2025, Workday is attempting to transform ERP from a “static system of record” to a “system of action that understands your business, anticipates your needs, and helps you reimagine how work gets done.”

This ERP vision rests on three architectural pillars, with the goal of differentiating from traditional ERP:

The Reality Check: Process And Organizational Transformation

This vision requires fundamental process reengineering that most organizations underestimate. Moving from batch to continuous processing demands not just technical transformation but organizational restructuring. Finance teams structured around monthly cycles must evolve to exception-based continuous monitoring.

4. The New AI Economics: Workday Flex Credits

The pivot to an AI platform signals a pivot in the economic model. The introduction of Workday Flex Credits marks a definitive move toward consumption-based pricing for AI. The term “flex” denotes the ability for a customer to use any AI-related functionality across the Workday ecosystem. The specific information on credit allocation wasn’t presented.

Workday made a smart tactical move by including an initial allotment of these universal credits in the base subscription, de-risking experimentation and accelerating adoption.

The Reality Check: The FinOps Mandate And TCO Volatility

This fundamentally changes total cost of ownership (TCO) predictability. Successful AI adoption will lead to rapidly scaling consumption costs. CIOs must implement rigorous FinOps practices immediately to monitor credit consumption, attribute costs to business value, and forecast the potentially volatile expense of running AI agents at scale. While Workday has plans to introduce consumption monitoring tools, credits tied to value and outcomes, on/off controls, and credits consumption are for production environments only.

Organizations should negotiate rollover provisions and quarterly true-ups before committing, as even Workday’s value calculators cannot predict actual agent utilization patterns in nascent use cases. This will significantly add to pricing complications when existing clients already struggle to justify long-term ROI.

5. ASoR: Answer To Workday’s Central Hub For AI Agent Governance

Workday plans to continue the rollout of a fleet of Illuminate agents, including high-impact solutions such as the Financial Audit Agent (promising 100% transaction sampling) and the BP Optimize Agent (which turns AI inward to optimize Workday processes, a compelling proposition for existing customers).

Governing this blended workforce relies on the Agent System of Record (ASoR), which Workday introduced in February 2025 to integrate and manage Workday agents as well as third-party agents. At Rising, Workday took significant steps to position ASoR as an open ecosystem hub through major partnerships:

- Microsoft. Integration with Entra ID provides a unified approach to human and agent identity management, allowing agents built in Copilot Studio to be registered in ASoR.

- Google. Integration with Google’s Agentspace and adoption of standards such as MCP (Model Context Protocol) focus on cross-platform interoperability.

The Reality Check: Beyond Identity

While identity is addressed, the ASoR remains nascent. Enterprise-scale governance requires maturity across authorization, auditing, and accountability (e.g., who is responsible when an agent fails a SOX-compliant process?). The ability to manage the full lifecycle of heterogeneous, multiplatform agents remains unproven at scale.

What Does This All Mean For You?

Workday’s pivot reframes your role from an application customer to a platform co-investor; your success is now tied to the company’s execution. You must govern a nascent agent framework, master new AI economics with rigorous FinOps, and pressure-test an unproven open data architecture. The potential for custom, AI-driven advantage is significant, but it demands a new level of strategic oversight and technical due diligence before you commit your core processes to this new vision.

Learn More! Schedule A Guidance Session With Us.

To discuss how these developments impact your specific enterprise strategy and what preparatory steps your organization should take, schedule a guidance session with me or my colleague Akshara Naik Lopez.