Should Financial Services Firms Engage With Fintech Startups?

At least two dozen accelerators and incubators have been launched by financial services firms in the last two years. I believe that in five years’ time, most of these corporate accelerators will have disappeared. Why? A fully-fledged, multi-startup accelerator is expensive to run. The cost of searching, selecting, and providing seed investment and support for startups could easily reach $1 million a year. Many accelerators aren’t focused enough on customer problems or business objectives to deliver return on that investment.

So why are so many banks, insurance, and wealth management firms eager to loosen their purse-strings? Some want to identify and co-opt future disruptors, others are looking to startups for innovation. There’s been a palpable change of tone in discussions of digital disruptors in retail financial services. The ubiquitous stories about voracious startups that want to eat incumbents’ lunch have been replaced by tales of successful collaboration. Financial technology startups deliver innovation, established firms bring customers, and together they live happily ever after.

Too rosy? I think so. In some cases, including disruptors in their digital ecosystem can help incumbents attract and serve niche customer segments or think holistically about their customers’ needs. However, partnering with startups is just one of many options available to executives at financial services firms who are pondering how they should respond to digital disruption hitting their industry. And it’s not always the best one. As I have found whilst researching my report, Financial Services Firms Flirt With Startups, executives who think fintech startups are onto something (and many are just smoke and mirrors) have three options to consider: build their own solutions to compete with the disruptor, buy the disruptor, or partner with it. The answer to this question is nuanced and depends on whether a disruptor presents a genuine threat or opportunity for your particular firm, what your own capabilities are, and what the technology market phase and the potential of individual startups are.

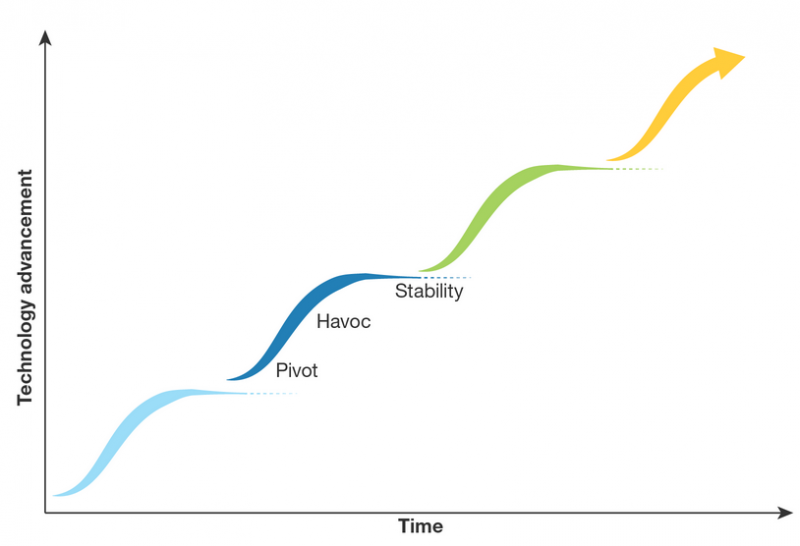

Consider, for example, just the impact of the technology market phase on your strategy. As Forrester has written previously, most emerging technology markets – clusters of innovative products and services driven by disruptive technologies – develop in three predictable phases (see below). Each phase affects how many firms there are within each technology cluster, the valuation of the startups in that cluster, and the level of innovation and maturity. Invest too early and you risk getting an immature technology that fails; invest too late and you face very high price tags and few options to choose from.

For more information on tackling digital disruption, download a free copy of my report, "Digital Innovation Is The Antidote To Disruption."