The Wounded Unicorns Of Fintech

Finovate, KPMG, and CB Insights are all reporting on record investments in financial technology (fintech) in 2016.[i] According to Finovate, the total number of deals year-to-date stands at 737, double last year’s 371. The amount invested has more than doubled, too — from $8.4 billion raised during the same period a year ago to $17.4 billion year-to-date.

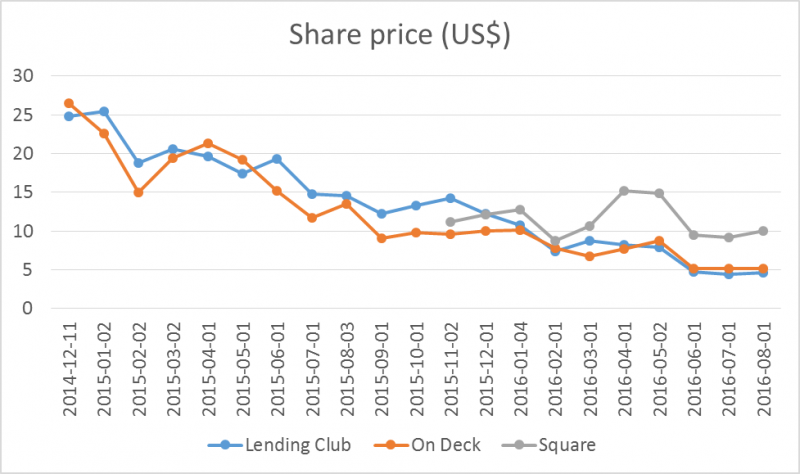

There seems to be a lot of optimism in fintech, especially when you consider this chart:

Source: Yahoo Finance.

The share prices of fintech darlings in peer-to-peer (P2P) lending, small-business lending, and mobile payments have collapsed post-IPO. And devaluations aren’t affecting only publicly owned companies. Zenefits — which offers cloud-based software to manage payroll, health insurance, and other benefits — was valued at $4.5 billion in May 2015. Since then, Fidelity, which led the funding round, has written down the value of its investment, now estimating Zenefits' share price at $5.60 — down from $14.90 a year earlier.[ii]

Why are fintech startup valuations falling? Because of the mismatch between these companies' inflated valuations and their actual revenues. TransferWise, a UK P2P currency exchange startup that achieved unicorn status with a valuation of $1.1 billion, had an annual turnover of just £9.7 million ($13.8 million at the time) at the end of March 2015.[iii] As I discuss in my latest report on the impact of these devaluations on financial services, many investors have forgotten about the significant obstacles that fintech startups face.

So what does this mean for investors and incumbent firms? We will see more devaluations, but this is no time for smugness. The digital disruption of financial services will march on, even as the number of unicorns shrinks. Why? Because its drivers — empowered customers, emboldened entrepreneurs, and the ability to launch digital businesses quickly and cheaply — haven't changed. But if you’re going to flirt with startups, you need razor-sharp focus and strategic matchmaking. Not all that glitters is gold.

[i] Source: Jim Bruene, “Fintech Fundings: 186 Companies Raised $1.6 Billion in June,” Finovate blog, August 1, 2016 (http://finovate.com/q2-fintech-fundings/) and KPMG and CB Insights, “The Pulse of FinTech, Q1 2016 Review” (https://www.cbinsights.com/research-fintech-Q1-2016-recap).

[ii] Source: Scott Austin, Rolfe Winkler, Renee Lightner, and Lakshmi Ketineni, "The Startup Stock Tracker," The Wall Street Journal, July 16, 2016 (http://graphics.wsj.com/tech-startup-stocks-to-watch/).

[iii] This data comes from amended full accounts that TransferWise filed with Companies House. In the year ending March 31, 2015, the firm lost £11.4 million ($16.7 million) on revenue of £9.7 million ($13.8 million). Source: "Amended total exemption full accounts made up to 31 March 2015," Companies House, January 19, 2016 (https://beta.companieshouse.gov.uk/company/07209813/filing-history).