Data And Insights For Smart Go-To-Market Decision-Making

Imagine trying to cook a complicated dish for the first time without a recipe, guessing at the ingredients and their proportions. This trial-and-error process is much like a B2B organization attempting to craft go-to-market strategies in absence of sufficient data and insights. Just as chefs rely on the right mix of ingredients and a recipe to guide the creation of a fantastic dish, portfolio marketers must leverage the right mix of data and insights to ensure that their organization’s go-to-market strategy is a recipe for success.

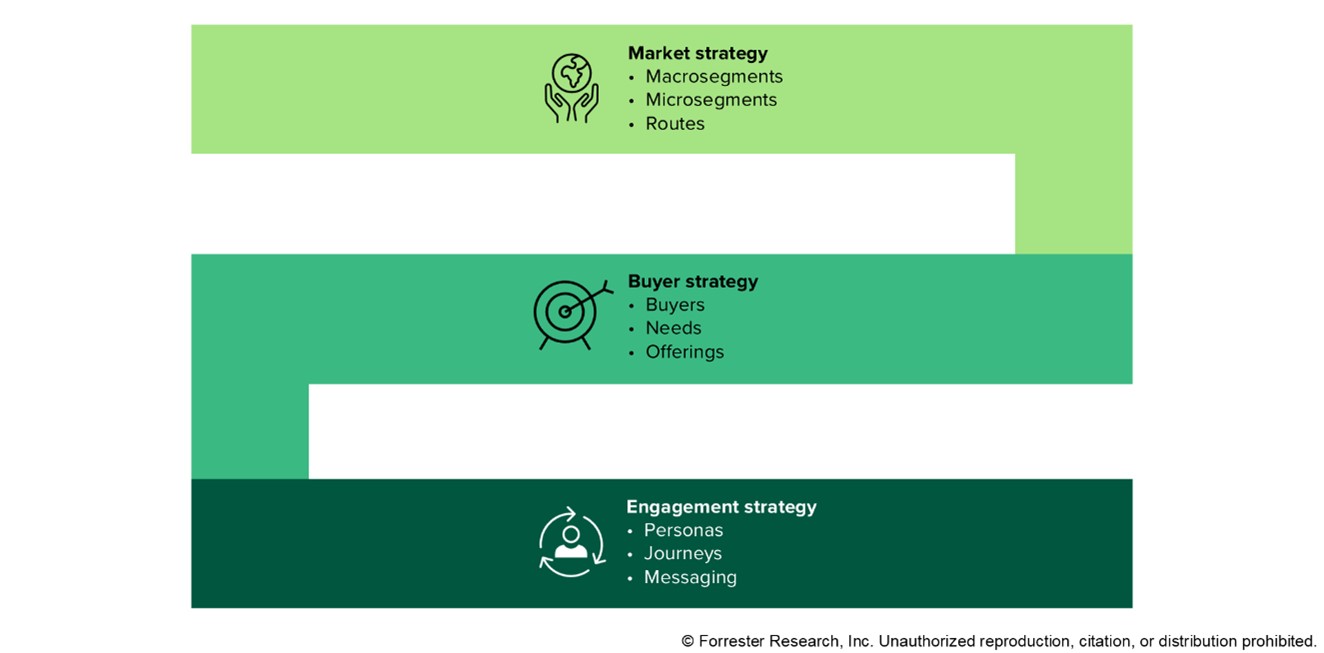

B2B leaders should think of the Forrester Go-To-Market Architecture as the recipe for making smart go-to-market decisions.

The Forrester Go-To-Market Architecture

But the right data and insights must be leveraged at every strategy level:

- Market strategy. Market strategy decisions set the direction for the entire go-to-market approach. Portfolio marketing leaders and senior management prioritize market segments and decide on the most suitable routes to reach them. Data and insights required include market sizing and forecasts, historical revenue performance (by segment), customer needs, and market trends. Reliable sources to leverage are internal systems (such as financial systems or customer data platforms) as well as market research or analyst firms.

- Buyer strategy. This level puts the customer at the heart of the go-to-market strategy. At the buyer strategy level, portfolio marketing and senior leadership determine the ideal offerings within the portfolio that align to customer needs and then prioritize the most important personas based on their role in the buying process. Qualitative data plays an important part at this level, including insights on buyer roles and the composition of the buying group, as well as an understanding of core business initiatives. Both internal and external sources help to paint the full picture; insights from analyst firms, industry associations, and customer advisory boards complement internal data extracted from sales and marketing systems.

- Engagement strategy. An effective engagement strategy is all about understanding buyers, including their needs, preferences, and behaviors. This level pinpoints where go-to-market teams will concentrate their execution efforts. A holistic view of buyers and their purchasing journey relies on both qualitative data (buyer initiatives, challenges, and preferences) and quantitative data (website traffic, conversion rates, and behavioral patterns). Ideal sources include direct conversations with buyers or customers (via interviews or focus groups) as well as industry or market reports. Third-party intent data and conversational intelligence support further understanding of buyer needs and behaviors.

For a more in-depth read on the top data challenges that portfolio marketers face and how to overcome them by focusing on go-to-market strategy best practices, Forrester clients can check out the recently published report from my colleague Brittany Viola and I, Data And Insights For Smart Go-To-Market Decision-Making. And if you would like to have a conversation with me on how to make smart go-to-market decisions, you can request a guidance session or inquiry.