Is Your IT Organization A Ponzi Scheme?

Every Ponzi scheme pays old obligations with new investment, creating a mirage of growth while speeding toward collapse. Your IT organization may be doing the same — funding yesterday’s shortcuts with today’s headcount. The test: What share of new engineering hires are building the future versus maintaining the past? If the majority are patching old systems, you’re using growth capital to service debt, not create value. When hiring slows due to freezes, cuts, or shortages, the illusion collapses. Systems fail, features stall, and your best engineers walk out the door.

Unlike a financial Ponzi scheme, there’s no “declare bankruptcy” option for technical debt. The interest compounds opaquely, buried in code, architecture, and process. And when payment comes due, it’s often sudden — a critical outage, a security breach, or a wave of resignations.

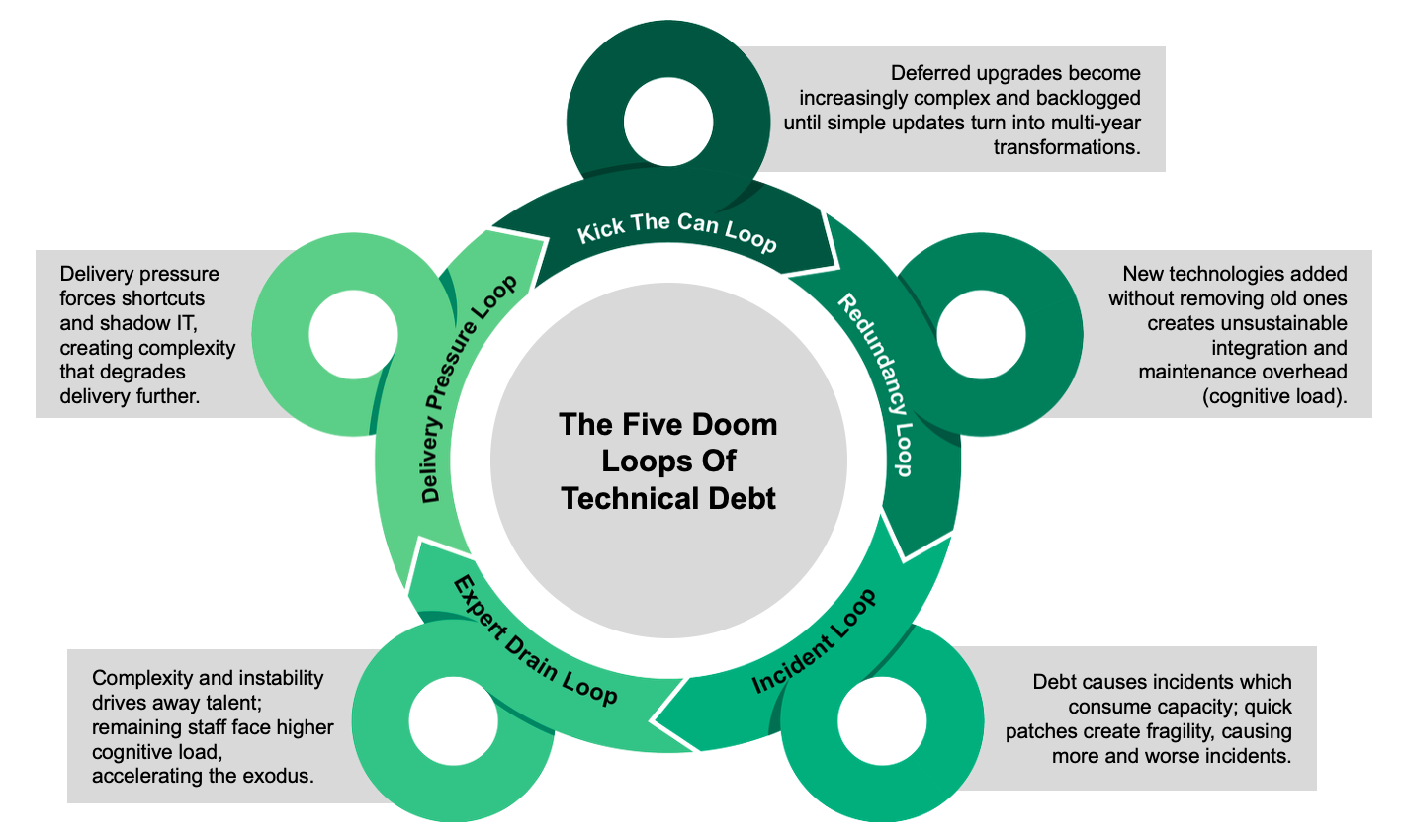

The underlying dynamics aren’t random. They form reinforcing “doom loops” that keep organizations trapped:

- The Delivery Pressure Loop. Delivery pressure forces shortcuts that make debt grow faster, increasing the pressure.

- The Kick The Can Loop. Deferred upgrades get more and more difficult until they are overwhelming.

- The Redundancy Loop. “Digital transformations” bring in the new but don’t sunset the old, and the overhead mounts.

- The Incident Explosion. Quick fixes under pressure add complexity, increasing the likelihood and severity of the next failure.

- The Expert Drain Loop. Debt makes everything harder and the firefighting just wears people out, and when experts leave the remaining experts are even more overstressed.

Breaking The Cycle

The only way out is to stop borrowing against the future and start paying down the past. Escaping requires sustained platform investment — enough to reach equilibrium where debt stops growing. This means:

- Refactoring to improve code structure and reduce the cost of future changes.

- Refreshing technologies before they become emergencies.

- Rationalizing redundant systems to reduce complexity and risk.

Big-bang modernizations are often problematic. They’re disruptive, tend to ignore on-the-ground expertise, introduce new debt through rushed implementation, fail to complete migrations (leaving legacy systems running, as there’s “no ROI” on sunsetting them), and cost more than promised while delivering less.

The sustainable path is continuous, disciplined investment, treating technical debt like a mortgage that demands regular, gated, and guaranteed payments regardless of shifting priorities. There’s emerging industry consensus that 20% is a good place to start: 20%, ongoing, of the available engineering budget and time dedicated to platform health and debt reduction.

This commitment creates a virtuous cycle: Debt shrinks, incidents drop, capacity grows, and investment accelerates. You can keep the illusion alive until the collapse, or face reality now. Every day you delay, the compound interest grows. Will you act while you can still escape — or wait until it’s too late? Just ask Bernie Madoff how that worked out.

Learn More

Want to learn more about managing technical debt? Come to our upcoming Technology & Innovation Summit EMEA in London October 8–10, where I’ll be hosting a workshop called “The Hidden Costs: Managing Tech Debt Through M&A And Organizational Change.” In the workshop, we’ll show you how to prioritize and address critical technical liabilities, provide some best practices for technology integration and consolidation, and help you foster a culture of proactive tech debt management in your organization.

And see my new report on “The Doom Loops Of Technical Debt,” just published!