It’s 2025, And The Consumer Is Hurting

For those of us in the US who track the economy and its implications for consumers and the brands that sell to them, it’s been a head-spinning couple of months. Policies have been coming at us fast and furious as a new administration looks to stamp its mark on the economy. Of course, the US is not alone in its volatility; the Canadians are going through their own brand of turmoil and looking at fresh elections early in the year, and in the UK, a different party is now at the helm of an economy that is proving to be extremely sluggish.

In the eye of these political storms sits consumers at their kitchen tables, working out what all of this means for them and their families. That is what interests us, and it’s what interests brands that sell to these consumers. To better understand these kitchen-table discussions, we surveyed consumers in the US, Canada, and the UK using Forrester’s ConsumerVoices Market Research Online Community earlier this month. Here’s what we found.

By The Numbers

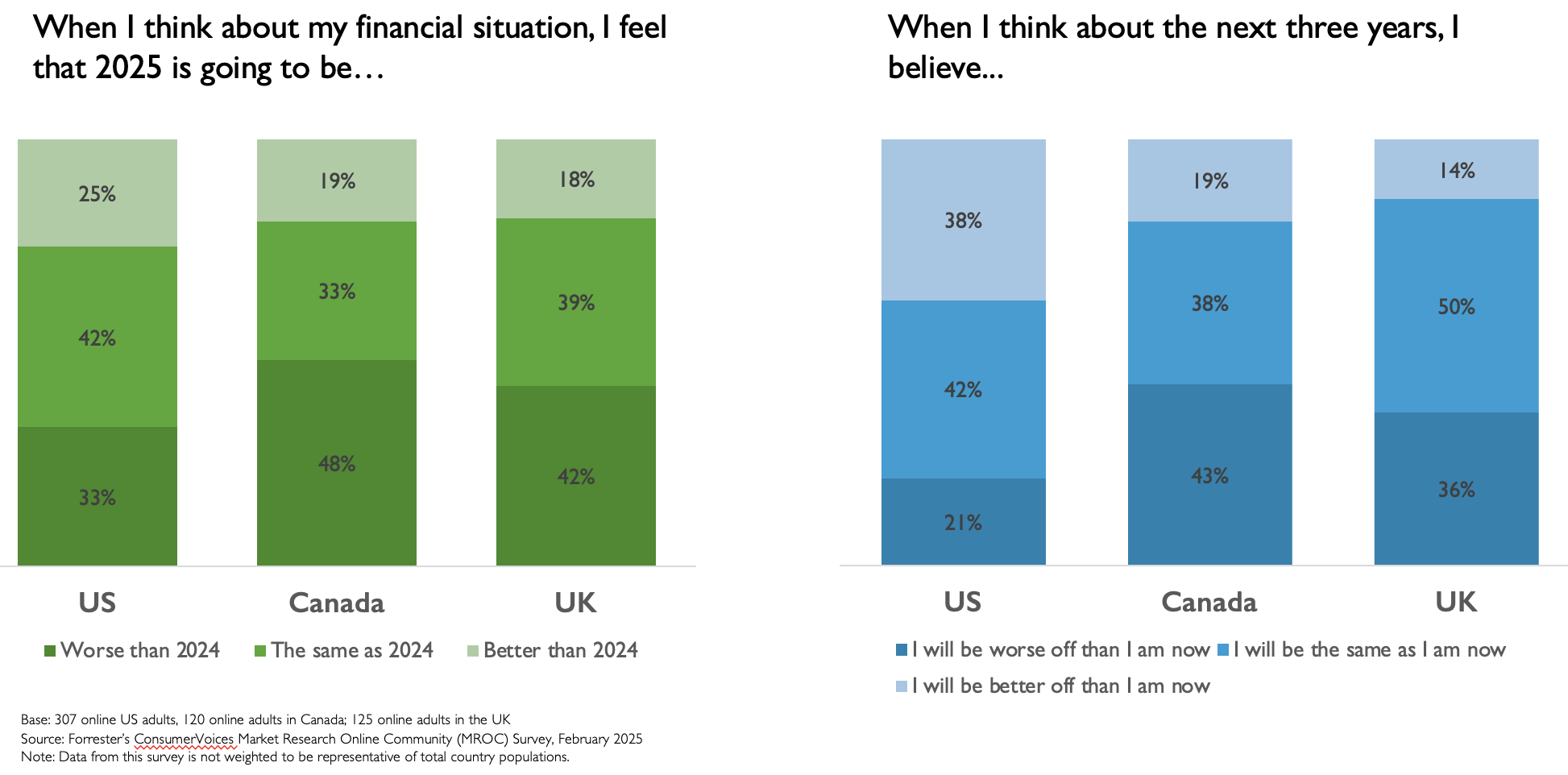

- Only a quarter of the respondents in the US feel like their financial situation in 2025 will be better than that in 2024; in Canada (19%) and the UK (14%), the outlook is far more grim.

- A third of US respondents feel that 2025 will be worse than the year before; yet again, Canada and the UK are more pessimistic (nearly half the respondents in Canada believe their financial situation will be worse!).

- The three-year outlook gets better for US respondents than the current expectation, as 38% expect to be better off in the next three years versus their current situation.

- In Canada and the UK, however, one doesn’t see that same improvement in outlook (19% and 14%, respectively, expect to be better off in the next three years — that’s pretty close to how they feel today).

In Their Own Words

When listening to consumers, it can often be hard to extricate the kitchen-table reality from the political polemic. This is especially true in the US, where emotions are running high as a new administration is widely cheered or jeered, depending on the audience. We asked consumers several questions about their outlook and spending expectations and have tried to abstract away from the political undertones to get at underlying sentiment and economic behavior.

Here are some of the key themes that emerged:

- Pessimism weighs down the consumer (much as it has for the last couple of years), and a sense of fait accompli pervades their outlook. Consumers tell us that they “feel like inflation and price of goods was high last year and believe it will continue to be that way for this year” and that while they are “hoping for improvements, the current economic climate makes [them] think things will likely stay pretty similar.”

- High prices are hurting, and in the US, a flurry of tariffs (implemented and threatened) has stoked fears of what consumers describe as “pouring gasoline on the inflation fire.” Most economists worry equally about the adverse effects of such trade policies on consumer pricing and economic growth (as we have described in a separate note about tariffs).

- Consumers are belt-tightening, and those who are not are resigned to forking out more for the same things. Some say they will economize by spending “less on eating out, entertainment — not taking a vacation this year,” while others expect to spend more because “streaming subscriptions go up in price regularly and food costs are going up, so restaurant prices will, too.” Increased spending is more about being resigned to higher costs than about sparking joy from purchases.

- Big purchases are becoming inevitable — while many consumers are “delaying a car purchase due to inflation” or making fewer purchases “unless absolutely needed … [of] home appliances and renovations and vacations,” others face the inevitable. After deferring big-ticket items for several years while they hunkered down during a tough economy, they’ve arrived at the end of the tether: “I just moved into a smaller but newer home, so now renovations — possibly an appliance purchase unless I can fix my existing appliance.”

(Tyler Castro contributed to the analyses and research for this post.)

Learn more: Read more about how tariffs will affect kitchen-table economics, consumer behavior, and brand strategy.

Follow my work: Go to my Forrester bio and click “Follow.”

Chat with me: If you are a Forrester client interested in discussing these topics, please schedule time with me for an inquiry or a guidance session.

Plan a session: If you are a Forrester client looking to host a strategy session on a related topic (for example, “the future of digital consumer experience related to AI”), please contact your account team or email me at dchatterjee@forrester.com.