Many Surveys, Small Impact: Forrester’s 2023 State Of VoC And CX Measurement Practices Survey

The results of Forrester’s 2023 State Of VoC And CX Measurement Practices Survey are in. They reveal some continued trends — and some interesting shifts.

Maturity Of VoC And CX Measurement Programs Shifts Up — Maybe

This year, there was a notable increase in customer experience (CX) professionals rating their voice-of-the-customer (VoC) or CX measurement program as having medium maturity compared to 2022 (see our 2022 report and our 2022 blog on the prior year’s survey results). Indeed, many respondents report doing important activities such as closing the customer feedback loop and aligning their program goals to business goals.

When we studied the data more closely, however, we noticed that many of these reportedly medium-maturity programs still hadn’t embraced key practices such as pretesting surveys, effectively collecting unsolicited feedback, and proving the business impact of changes in CX metrics.

Access all results

- Summary. The report The State Of VoC And CX Measurement Practices, 2023 discusses insights about program maturity and challenges, along with other key insights from the survey.

- Scope and skills. For insights about the size, responsibilities, and governance of VoC and CX measurement programs, along with the skills of involved employees, read Stretched Thin: VoC And CX Measurement Teams Struggle For Resources.

- Feedback sources. For insights about the types of feedback that programs are gathering and the value they receive from those insights, read Overreliance On Surveys Holds VoC And CX Measurement Programs Back.

- Tracking CX metrics. For insights about how programs track CX metrics in their organization and what their beacon metrics are, read Gaps In Metrics Hamper VoC And CX Measurement Efforts.

- Sharing data and driving action. For insights about how well programs engage stakeholders, show their business impact, and prove that investing in CX is worthwhile, read VoC And CX Measurement Teams Struggle To Lead Change.

- Technology. For insights about which tools programs are leveraging to ensure their success and the capabilities they use day-to-day, read CFM Tools Rule The VoC And CX Measurement Technology Stack; GenAI Is In Sight.

Deep Dive Into One Result: (Bad) Surveys Still Rule

You’re probably not surprised (we weren’t): Nearly all programs (96%) regularly collect and analyze surveys. But quantity does not equal quality. Only 67% of respondents are effective at collecting solicited structured feedback (like ratings scales in surveys) and only 50% are effective at collecting solicited unstructured feedback (like survey verbatims) — even though the top skill in VoC and CX measurement teams is survey and questionnaire design!

What is driving this lack of effectiveness? Most programs simply don’t send good surveys. Too often, organizations send surveys that feel like interrogations — voluntarily adding a negative touchpoint (the survey) to their customers’ experience.

1) Fix The Basics: Two Simple Tactics To Upgrade Your Survey Experience

There is no excuse for sending out surveys that are less than great. Use a few simple tactics to improve the survey experience:

Tactic 1: Pretest your surveys with customers.

Pretesting surveys with customers is not only a best practice, but it’s differentiating. Only 4% of programs do it! Show each survey question to customers and first prompt them to tell you what they think you are asking and then ask them what their answer is. What they say will tell you tons about confusion or ambiguity in your survey — or if it is just annoying.

Some of you tell us that this is too hard. If you really can’t get to customers, challenge yourself by doing the following with somebody who matters to you, like your boss, CEO, or spouse: Print the survey out and read it out loud to that person. If you feel embarrassed or annoyed while reading it aloud, don’t expose customers to it!

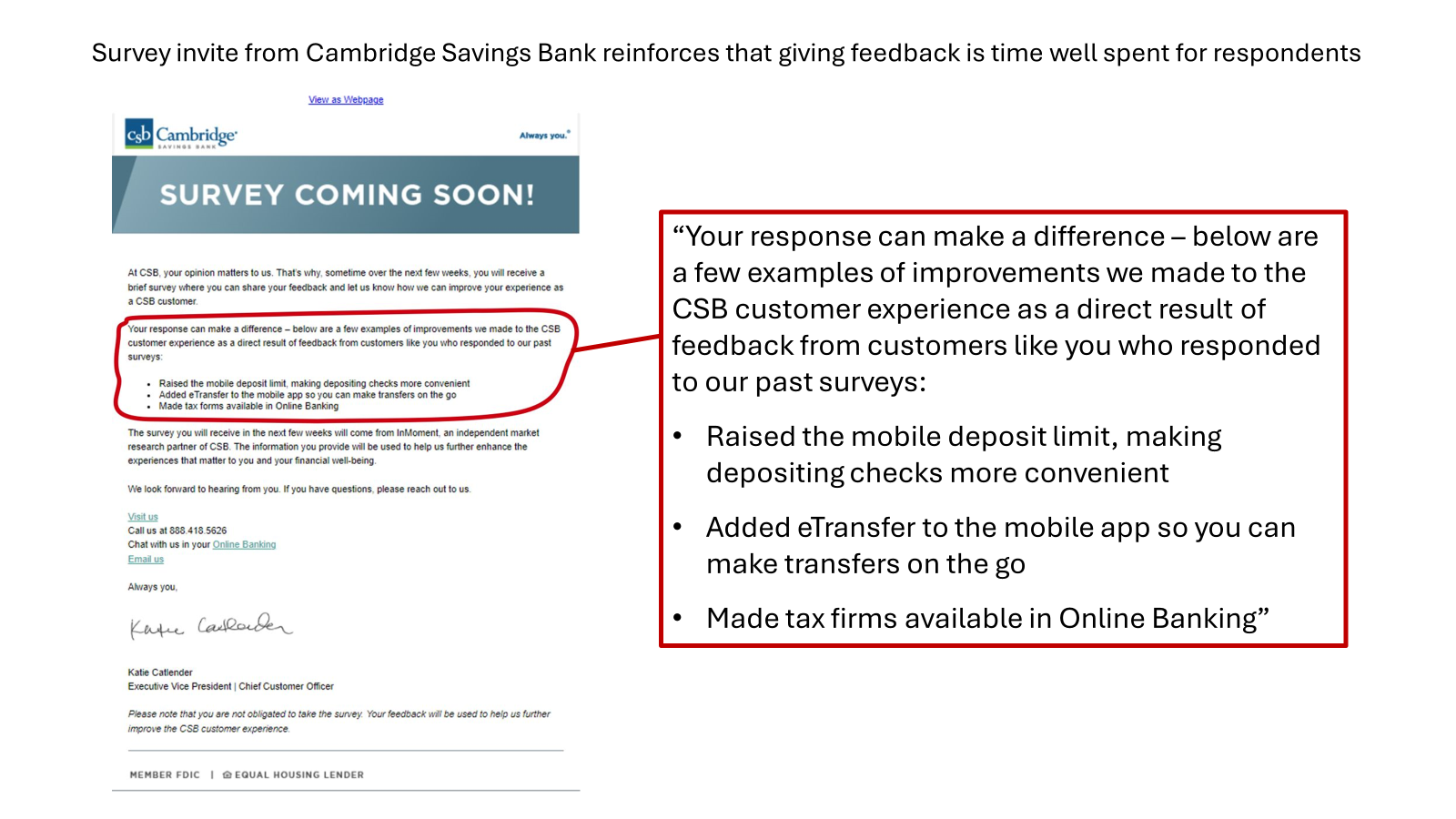

Tactic 2: Use survey invitations to close the loop.

It’s great that 75% of programs close the customer feedback loop, but this may be another case of quantity not equaling quality. One way to close the loop well is to use your survey invitations to show that your organization has acted on previous feedback. This will help customers understand the value of taking your surveys instead of feeling like they’re shouting into the void.

A great example of this is Cambridge Savings Bank’s (CSB’s) approach, shown below. The survey preview email lists three specific actions that CSB has taken based on past feedback. This reinforces that giving feedback is time well spent for respondents.

Source: Cambridge Savings Bank email to Maxie Schmidt

Source: Cambridge Savings Bank email to Maxie Schmidt

2) Accelerate Your Path To Impact — Put Surveys On The Backburner

Customer-focused organizations have a future-proof VoC program that looks beyond surveys to analyze unstructured, unsolicited feedback (e.g., call transcripts). Only then can they better understand and monitor customer experiences. That’s especially important, because transactional surveys capture feedback for only five of 100 interactions. For example, a leading US financial services firm ran a pilot call-listening program and was surprised to notice long pauses — from both agents and customers — when discussing electronic signatures. The team didn’t track e-signatures in surveys or call disposition codes, so the organization didn’t know that it was a customer pain point. Digging in a bit more, the team discovered that agents were not able to help with this pain point because it was managed by a third-party vendor — an insight only found by going beyond surveys.

3) Build Your Empathy For How Stakeholders Could Get Value From VoC and CX Measurement

All the data and insights in the universe are only useful if they drive decisions. You told us that your stakeholders aren’t as engaged as you hope: Only 42% of survey respondents said that stakeholders ask for insights, and only 44% say that stakeholders are confident in the metrics you produce.

Solving this is bigger than the last lines of this blog. It starts with you and your team building empathy for your internal customers. Ask us how.