Marketers In APAC: Unlock Greater Value With Adjacent CDP Functionalities

As an analyst closely observing the martech landscape, I’ve seen customer data platforms (CDPs) become indispensable for marketers in APAC. My latest report, The State Of Customer Data Platforms In Asia Pacific, 2024, uncovers the following insights:

- The popularity of CDPs continues to grow in APAC. Rising consumer awareness around data privacy and tighter regulations is pushing marketers to invest in first-party data, yet customer data concerns still pose challenges. In 2024, 23% of B2C marketing decision-makers in APAC are using CDPs, with 26% planning to adopt them within a year.

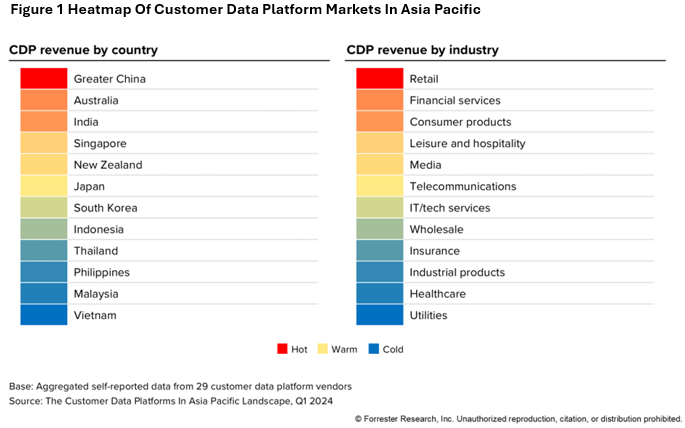

- A diverse CDP market has evolved in the region. The APAC CDP market is diverse due to varying vendor maturity and marketer interest (see figure below). Greater China, Australia, and India lead the market, with homegrown CDPs thriving in China and India and Western CDPs growing in Australia. Retail, financial services, and consumer goods are at the forefront of CDP adoption, excelling in first-party data use and industry-specific applications. In addition, customer analytics has become a CDP staple, driven by the need for deeper insights and predictive analytics.

Adjacent Functionalities Maximize CDP Value

Given the smaller teams and tighter budgets in APAC, marketers prefer versatile tools. To maximize value, they are incorporating a range of adjacent functionalities and use cases for CDP, such as:

- Consent management. Before CDPs can make customer data platforms actionable, proper consent is needed. By adding consent management features, some CDPs allow APAC marketers to comply with the region’s emerging privacy regulations.

- Identity resolution. CDP vendors may offer this as a differentiator, allowing marketers to integrate identifiers with behavioral, transactional, and contextual information, but note that the ease of configuring and customizing resolution logic varies across platforms, so marketers should evaluate this before buying.

- Advertising use cases. Since much of marketing and customer engagement takes place on third-party platforms, it is important to optimize ad targeting. Marketers can incorporate third-party data into CDPs to enrich first-party profiles and create precise microsegments that boost advertising effectiveness.

- Marketer friendliness. Marketing teams seeking to reduce reliance on IT and external vendors will gravitate toward CDPs that offer a user-friendly interface. As CDP vendors adopt advanced technologies like generative AI, we expect that marketers will be able to use conversational means to interact with CDPs.

Refine Your CDP Strategy To Accelerate Value Realization

Many CDP customers find value realization slow, limited, or challenging. To overcome this, marketers should recognize that CDPs benefit the entire organization, requiring a companywide strategy to coordinate skills and resources. Prioritizing scalable and value-demonstrating use cases, establishing cost management practices, and effectively tracking metrics and ROI helps marketers break through barriers and make progress.

For an in-depth exploration of the recent growth, emerging trends, and common challenges facing CDPs in APAC, read my latest report (client access only) and schedule a guidance session with me.