Microsoft Unbundling Teams From Microsoft 365 Is Just A Sneaky Price Hike

Microsoft announced — on April Fool’s Day 2024, no less — that it was unbundling Teams from its various Microsoft 365 plans worldwide.

While these new changes affect Microsoft customers worldwide, they mirror the changes that the company announced in August last year for its customers within the European Economic Area and Switzerland. This move is, of course, in response to the broader antitrust scrutiny that the company is under, following complaints from competitors such as Slack and Zoom that Microsoft’s bundling of Teams within Microsoft 365 constituted an abuse of its market dominance in workplace productivity software to restrict competition in the communication and collaboration tools space.

What’s Changed?

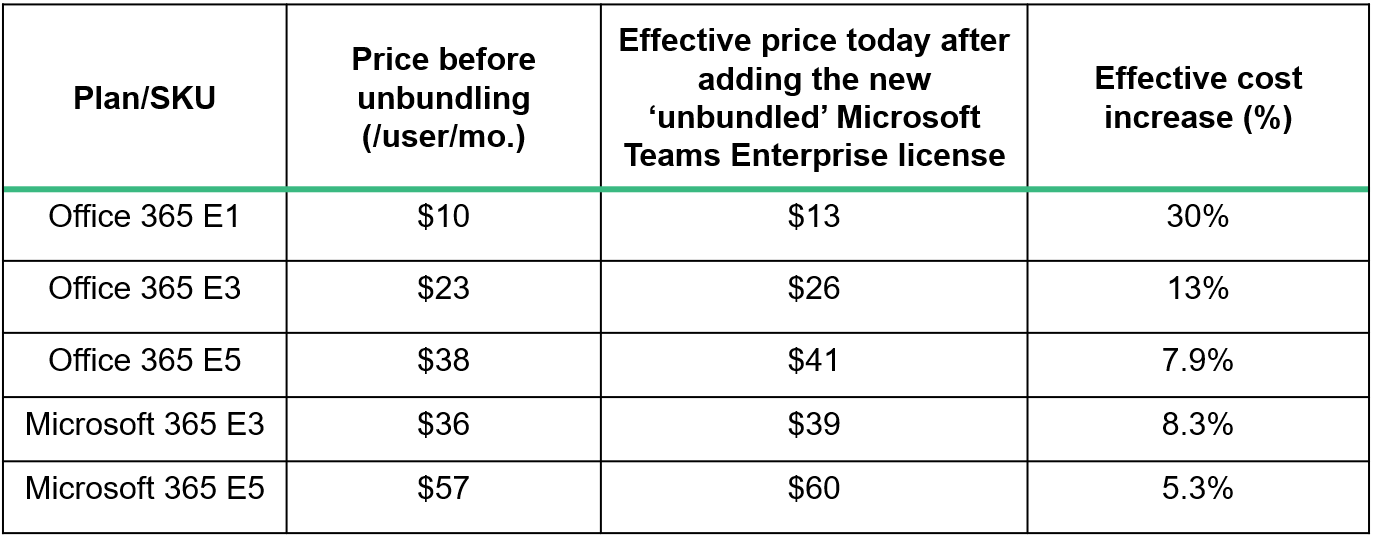

The changes to Microsoft 365 pricing due to this unbundling are already in effect, having started April 1. This represents a nontrivial price increase for most enterprise or business customers that wish to provide their workers with both Teams and Office 365/Microsoft 365 licenses. The table below provides a summary.

- Microsoft’s old pricing structure for commercial Microsoft 365 and Office 365 plans, which included Teams as a bundled product, is no longer available for sale. This is true both within the European Union as well as globally.

- Instead, Teams is now sold as a separate, stand-alone SKU (called Microsoft Teams Enterprise). The cost of this standalone SKU is $5.25/user/month in the US.

- All new customers of Office 365 or Microsoft 365 plans that wish to provide Teams to their workforce will now have to purchase two separate SKUs from Microsoft — one for the core Office 365/Microsoft 365 product and a second for Microsoft Teams Enterprise. For most customers opting to purchase both SKUs for their employees, this represents an unanticipated price hike of $3/user/month across plans, i.e., between 5.3% and 30% against the older, bundled pricing.

- Companies with existing subscriptions to the older “bundled” plans are temporarily insulated from this new pricing until renewal. Specifically, Microsoft states that “if [customers] wish to switch to the new lineup, they can do so on their contract anniversary or renewal” in addition to “[continuing] to use, renew, upgrade, and add seats to their current plans as usual.”

- The changes for Microsoft’s Business and Frontline plans are more lenient. For these plans, the older bundles continue to coexist with the new, unbundled plans.

- Finally, there does not appear to be any change to Microsoft 365 plans catering to government or not-for-profit organizations as of this time.

What This Means

- For customers, a pricing game. Microsoft has effectively turned the bogeyman of a wider antitrust investigation into an excuse to reprice its products in ways that are advantageous to Microsoft. The company has been steadily raising the price of an M365 license over the years. Consider this: Over just the last two years, the list price of an E5 license has gone up by over 70% (up from $35/user/month in Feb. 2022 to $60/user/month with the added Teams license as of April 2024). The price of an E3 license has gone up by 95% within the same timeframe. Unbundling Teams gives Microsoft further control and leverage to raise prices for Teams independent of the base M365 license cost. The company already has a history of absurd pricing constructs for add-ons, particularly for its lower-tier plans ($30 Copilot on a $2.25 M365 F1 plan, anyone?). Customers should not be surprised if there are further price hikes to Teams in the future.

- For regulators, the illusion of choice. From an antitrust standpoint, this move is too little, too late. Microsoft Teams has already won the battle against Zoom, Slack, and the plethora of smaller competitors. It is the dominant (if not the de facto) communications and collaboration tool for most organizations that are already on Microsoft’s productivity suite. Many customers will find it difficult to offer Teams to only a portion of their workforce and will be forced to bite the bullet on the increased price. At the same time, competing options like Zoom and Slack are already more expensive than Teams while being nowhere nearly as integrated into the Microsoft ecosystem.* Unless there is significant market realignment to the Teams price point, we do not expect competition to gain significant advantage at this point from Microsoft’s unbundling of Teams, thus ultimately defeating regulatory objectives.

- For Microsoft, the best of both worlds. The biggest beneficiary from this shift in pricing is Microsoft itself. The company continues to get to have its cake and eat it, too. Making the unbundled offerings the only option for customers to purchase gives Microsoft’s sales teams leverage to push higher-tier upgrades to existing Microsoft 365 or Office 365 customers. Moreover, Teams is more than just a communications app for many enterprises. It is increasingly baked deep into productivity workflows involving other Microsoft products such as Dynamics 365, Power Automate, and Copilot. Dissociating Teams from teams will prove to be rather disruptive for many enterprises. This means more revenue for Microsoft and continuously rising software costs for its customers.

*At time of writing, Zoom Pro costs $13.33/month/user and Slack Pro costs $7.25/month/user before discounts.