The Semiconductor Chessboard: Moves That Shape Tech’s Future

For decades, silicon chips served as the foundation of modern technology, powering everything from smartphones to data centers and enabling transformative advances in computing. But as artificial intelligence, electric vehicles, and next-generation networks demand faster speeds, greater efficiency, and more power, silicon is reaching its physical and economic limits. The industry is now pivoting to advanced materials to meet these demands, offering breakthroughs in performance and energy efficiency.

But this shift is not just about scientific innovations; it’s about strategic decision-making. Navigating this new era requires tech leaders to address supply chain vulnerabilities, geopolitical risks, and sustainability imperatives to ensure long-term success.

Going Beyond Silicon

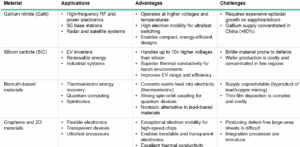

The semiconductor industry has relied on Moore’s law, the principle that the number of transistors on computer chips doubles approximately every two years. In other words, computing power increases exponentially over time. But sizing down silicon chips to smaller sizes has become increasingly difficult and expensive due to physical and technical limits making it harder to scale silicon-based chips for next-generation applications like AI and machine learning. To overcome these barriers, companies are turning to alternative materials that offer higher power efficiency to support demanding workloads, improved heat management for reliable performance, and faster processing speeds to meet the demands of emerging technologies.

While these materials hold the potential for transformative advances, they also bring trade-offs in terms of cost, reliability, supply chain complexity, and geopolitical risk. Navigating this transition requires rethinking procurement strategies, reassessing vendor relationships, and adapting infrastructure planning to remain competitive in a rapidly evolving technological landscape.

The Geopolitical Reality

The chip industry has become a geopolitical chessboard, with nations scrambling to secure critical materials and technologies. Key dynamics include:

- The US-China trade war. The US has imposed tariffs on semiconductors and critical materials, and in response, China has restricted exports of rare earth elements, including gallium, which are vital for advanced semiconductor materials. These trade barriers are fragmenting global supply chains, forcing organizations to rethink sourcing strategies and diversify suppliers.

- Taiwan’s dominance. Taiwan accounts for over 60% of global semiconductor manufacturing, with TSMC leading the industry. Its dominance ensures innovation but also creates risks for global supply chains in the event of regional instability.

- National policies. The US CHIPS Act and European Chips Act are driving significant investments in domestic semiconductor manufacturing. These policies aim to reduce reliance on foreign suppliers and mitigate supply chain vulnerabilities. Similarly, China is ramping up domestic production of advanced materials and chips to reduce reliance on other countries for materials and manufacturing.

What Tech Leaders Should Do

The semiconductor industry is entering a new era where technological innovation, geopolitical risks, and sustainability demands are tightly intertwined. As organizations depend on cutting-edge chips for AI, machine learning, and cloud-scale applications, IT leaders must adopt proactive strategies to navigate this volatile landscape. Here’s how:

- Diversify manufacturing. Invest in production facilities across multiple regions with stable trade policies. Partner with countries offering incentives for domestic manufacturing to ensure redundancy in supply chains.

- Plan for policy volatility. Build flexibility into procurement processes by maintaining diversified supplier networks. Use scenario planning to anticipate policy changes and adjust compliance procedures accordingly.

- Invest in sustainability. Develop circular supply chains that recycle materials like gallium and bismuth. Invest in energy-efficient manufacturing processes, such as AI-driven optimization, to reduce waste and carbon footprints.

- Leverage AI for efficiency. Use AI-driven simulation tools for chip design to optimize transistor layouts and improve power efficiency. Deploy AI in manufacturing to monitor defects, predict maintenance needs, and increase production yield.

If you want to learn more or have insights into the current semiconductor market, let’s connect. Forrester clients can access our exclusive reports and schedule a guidance session to explore current trends and solutions.