Three Features That Will Set Your Mobile Banking App Apart

Forrester has been tracking emerging capabilities, products, services, and features that customers will expect and demand on banks’ apps in the next three years. Here are three mobile banking features from the second of two reports we’ve recently released:

- Carbon footprint tools and green financial products. Forrester found that 35% of US online adults would find carbon footprint tracking tools useful on a bank’s app. This includes a majority of Gen Z (52%) and Millennial (56%) customers. A functionality that tracks the environmental impact of a customer’s financial activity is not yet common on bank apps, but a few brands lead: Danish bank Nordea tracks users’ carbon footprints by merchant categories such as transportation or groceries. And US fintech brand ATMOS Financial offers bank accounts that fund clean energy infrastructure and in-app calculations of the carbon impact of a user’s accounts.

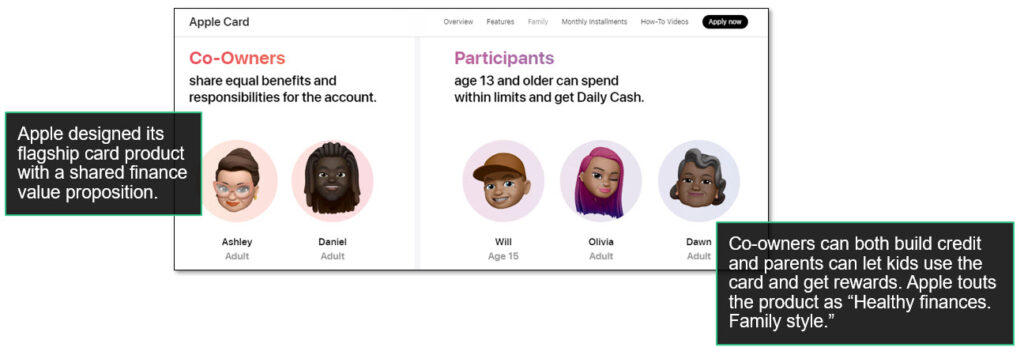

- Shared finance products and services. Millions of consumers are looking for better tools to help customers share financial activities. Shared finance products appeal to people such as married couples who want to jointly manage finances (examples include Ivella and Zeta), parents helping kids learn about money (GoHenry and Greenlight), and divorced parents co-funding their children’s education (Onward). Big tech brands, meanwhile, are moving into the banking space with disruptive shared finance products: Apple has designed its card products with robust shared-finance functionality (see screenshot below).

- Credit building and debt reduction products and services. When Forrester asked US online adults “Which type(s) of financial information or advice, if any, do you need?” the number one answer among Gen Zers was “Improving my credit score.” Bank of America lets app users get credit score updates from Erica, its in-app smart assistant. Capital One’s CreditWise service (on its app home screen) lets users monitor both their credit score and the factors affecting it. Chime’s Credit Builder product reports on-time payments to credit bureaus but doesn’t report credit utilization — helping customers access their available credit without having their credit score take a hit. Fintech brand Tally’s product, meanwhile, is designed specifically for debt management, including autonomous finance tools to pay down credit card debt.

What This Means For You

Digital strategy and execution teams need to be aware of the emerging features, products, services, and capabilities that your customers will soon need or want. The goal should not be to simply shove all of the mobile banking features we’ve identified into your app (especially since some of the features that differentiate banking brands have outsized impact on particular segments or audiences). Instead, your goal should be to explore which specific feature(s) will have the most impact on your target customers and your business outcomes.

Want guidance for you and your organization? We encourage you to reach out to us — let’s talk! Start by reading our latest report (and the previous one) from this “What’s Next In Mobile Banking” research series. You can also request an inquiry or guidance session with me or another analyst.

Image: Apple Card Promotes Its Card As A Shared Money Service For Families

[This post was coauthored by Aaron Suiter.]