TIER: How (Not) To Evolve Your Business Model — Kodak

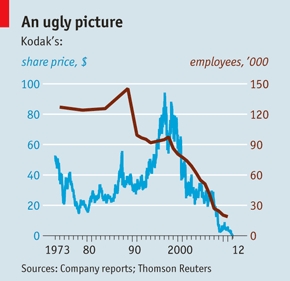

Kodak’s story is familiar as one of the corporate world’s great ironies: Kodak went bankrupt in 2012 due to the rise of digital photography after pioneering the technology years before competitors. According to legend, Kodak employee Steven Sasson invented the self-contained digital camera in 1975, only for management to tell him “That’s cute — but don’t tell anyone about it.” Yet the story of Kodak’s failure is about much more than one shortsighted technology decision. It is more about Kodak’s not understanding that value evolution would require its business model to evolve accordingly.

To use terms from my recent report, Growth Requires New Recipes, Not New Ingredients, Kodak failed at both value capture (growing by extending current markets) and value creation (growing by expanding to adjacent markets). In turn, this meant Kodak failed at value conversion (transitioning from capture to creation as circumstances and opportunities demanded and being productive between organic and inorganic growth).

- In terms of value capture, Kodak failed to extend its core market of photography, where losses started slowly then accelerated rapidly. In 1976, Kodak had 90% market share in the US film market. In the 1980s, Kodak lost ground to its Japanese competitor Fujifilm, which aggressively slashed prices, had a marketing coup by sponsoring the Los Angeles Olympics, and opened a US-based film-production plant. Between 1980 and 2000, Fujifilm tripled its US market share to 20%. Although Kodak had an initial lead in the digital photography market, poor pricing models and additional competitors such as Canon and Nikon brought Kodak from 27% US market share in 1999 to 15% in 2003 and 7% in 2010. Kodak shed its consumer photography business in the bankruptcy two years later.

(Source: The Wall Street Journal, “Kodak Is Losing Share In U.S. Market to Fuji”)

- In terms of value creation, Kodak failed to expand to adjacent markets. In the 2000s, Fujifilm responded to declining photography revenues by producing Astalift, a line of skin-care products that used the same antioxidant technology it had developed for its photographic film. Meanwhile, Kodak spun off its subsidiary Eastman Chemical into a separate business in 1994. Today, Eastman Chemical has 10 times the annual revenue of Kodak. Kodak’s one significant diversification play, the acquisition of Sterling Drug for $5.1 billion in 1988, ended six years later with the piecemeal sale of Sterling’s business units.

(Source: The Economist, “The last Kodak moment?”)

In turn, Kodak failed to convert value between capture and creation as circumstances and opportunities demanded. In other words, imagine a world where Kodak had opportunely moved from film to digital photography, using its technology to widen its market aperture to its health and commercial imaging businesses — and, at the same time, used its photographic and general chemicals expertise to develop pharmaceuticals and beauty products.

That world did not come to pass, but perhaps some glimpse of it is still to come. Maybe we are in for a new “Kodak moment.” In July of 2022, Kodak announced an investment in Wildcat Discovery Technologies to help develop batteries for electric vehicles. According to its press release, Kodak will “provide coating and engineering services in collaboration with Wildcat to develop and scale film coating technologies which are critical for the safety and reliability of the next generation of EV battery technology. … [This] represents [Kodak’s] continued expansion of our Advanced Materials & Chemicals group as we capitalize on our expertise in coating technology, developed over decades of film manufacturing … ”

Better late than never.

This research falls under Forrester’s tech insights and econometric research (TIER).