Q&A With Keith Fletcher, International Customer Experience Manager At E.ON

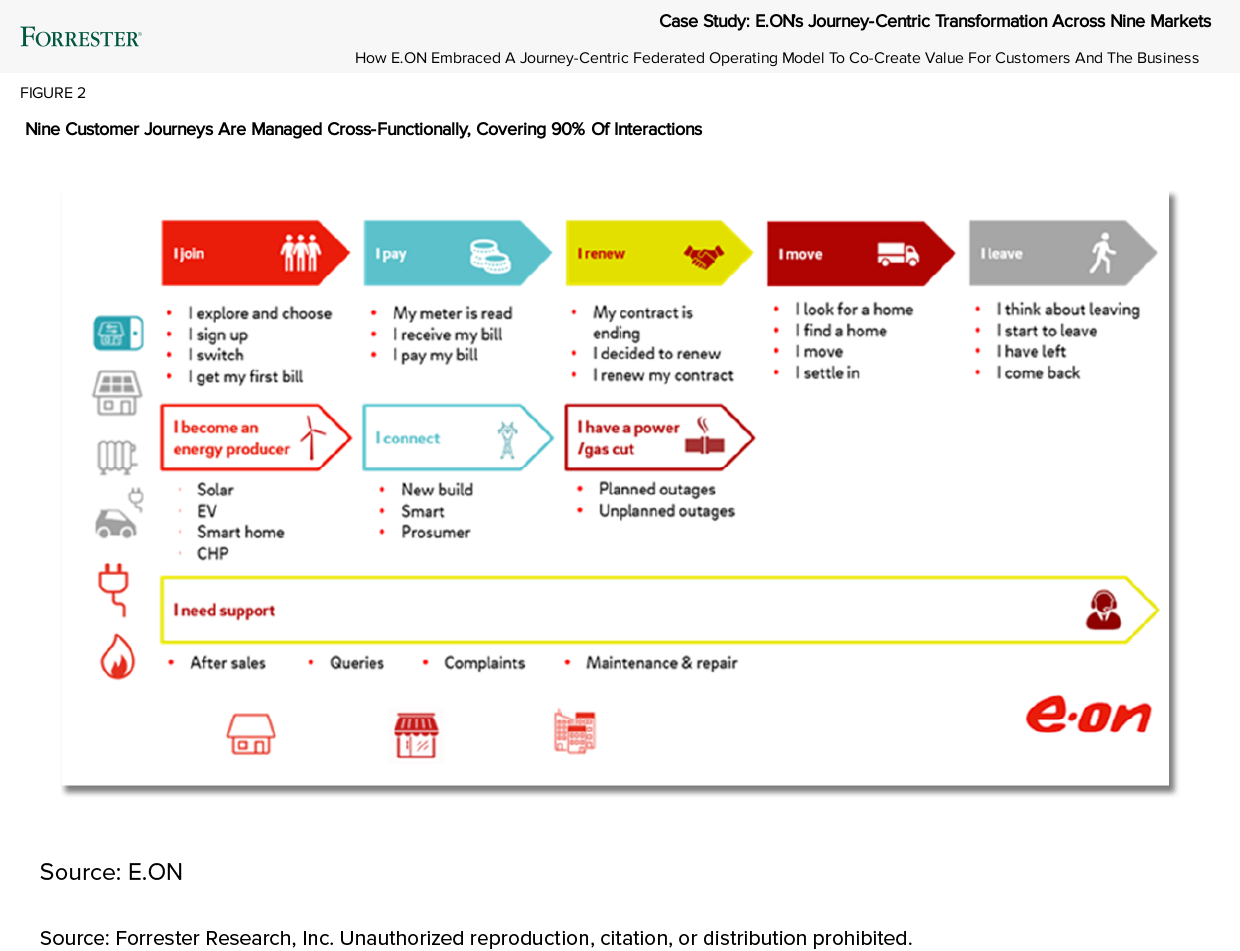

A few weeks ago Keith Fletcher, international customer experience manager at E.ON, joined me on stage at Forrester’s CX Summit EMEA to talk about E.ON’s approach to CX. Since 2008, E.ON has been on a path to use journeys, not processes, as the building blocks for sustainable growth. Its customer journeys are key to giving over 47 million customers access to a sustainable supply of electricity and heat — with the aim of becoming climate neutral by 2040. Effectively leading a journey-centric transformation requires pulling six operational levers — structure, culture, talent, metrics, processes, and technology — in concert.

Keith described how E.ON is the playmaker of the energy transition, explaining how great customer insight and experience is essential to making new energy work. Keith shared a lot. If you want a deeper dive you can listen to not one but two podcast episodes with Keith, and if you are a Forrester client you can read the case study that Joana de Quintanilha published, and even listen to the webinar.

As always with our mainstage speakers, the audience had a ton of questions for Keith. More than we could cover on stage, so Keith very generously agreed to answer all the questions offline. I’ve split the questions into four broad categories here, somewhat aligned to our seven steps of highly successful customer journey mapping research:

-

- Gathering customer insights.

- Mapping and managing journeys.

- Creating alignment and driving action.

- Measuring the impact.

To start with, Keith shared that what most impressed him at CX Summit EMEA was our Customer Obsession Award Winner, Nedbank, and their obsession with customer centricity. He was inspired by the company’s discipline and the detail. He was also impressed with how Nissan brought parts of their operation together to facilitate end-to-end customer experience.

A massive thank you to Keith for sharing so much and being so generous with his time and insights. On with the questions:

Gathering customer insights

- Who are your customers? Are you only mapping journeys towards the end user? Or do you map journeys related to the installers, etc…? Journey mapping tools are used to review the experiences of our customers, employees, and installers.

- What, other than surveys, are you using to measure customer satisfaction? How are you getting over survey saturation? Within the Qualtrics platform, we use rules to limit excessive surveying of customers. We monitor for fatigue and look at external sources of recommendation (e.g., Trustpilot).

- Can you share how you do your customer segmentation and how that feeds into your journeys? There is not a one size fits all approach on customer segmentation. We have varying degrees of data quality and system capabilities. A really strong journey will adapt for different customer segments.

Mapping and managing journeys

- Are your journeys globally founded? If yes — how are regional changes and deviations being mapped? At the beginning, when we started as a program, we did centrally support journey work. However, now we are at scale and in normal funding cycles, all resources for journey improvements are set within the individual business. Success and deviations from target are discussed with Net Promoter Score (NPS) performance dialogues and excellence rooms.

- Do you use a journey orchestration system? No, we do not use a standardized journey orchestration system. However, we do use Qualtrics as our standardized feedback mechanism across our journeys across all our regions.

- Do you have a journey mapping repository everyone refers to? If so, how do you keep all of them updated? We have a central customer insight library where regional teams can share their journeys/CX work.

- Are you also maintaining a ’central repository’ of customer journeys or is it all up to the market teams? We have a central customer insight library where regional teams can share their journeys/CX work.

- Are journey managers the same as change managers? If not, what are the differences? The customer journey manager is responsible for engaging with internal and external stakeholders, as well as identifying, prioritizing, implementing, and driving improvements under a strict journey governance framework. They are similar to a project manager (but a customer obsessed one). Of course, they need to understand change management and how it works, but their aim is to improve the customer experience of a particular journey.

Creating alignment and driving action

- How aligned are your CX efforts with marketing? Marketing and customer experience teams discuss activity on a daily basis. It is also vital that both understand their impacts in the operational business. We use performance dialogues, journey walk throughs, and excellence rooms to bring teams together.

- How do you manage priorities from customer journeys vs functions/process owners or value streams? Any conflicts? Conflict is a strong word. We try to have data-led conversations in performance dialogues and excellence rooms. The role of the journey owner is to ensure the functions/process owners’ voices are heard and acted upon.

- How can you keep an existing digital team motivated, updated, and ready to face the challenges coming from the market? Great question. Share the success. Show where digital experience has enhanced the customer experience. Celebrate their work and make their beta testing visible. Trying new stuff keeps their innovation and creativity on the ball.

Measuring the impact

- Regarding bonuses tied to NPS — is it for c-level/country managers or the CX leadership? Just wondering how high up the NPS bonus goes? E.ON’s short-term incentive bonus system is groupwide. It is spilt between profit (earnings per share) and customer (NPS improvement) . Details are shared within our company report.

- How do you separate the NPS result on the company side from the journey? Each country has four targeted journeys. Thus, the companywide target is a calculation made up of 36 individual journeys targets.

- What are the journey metrics that you monitor? The metrics differ for each journey. In our performance dialogues, we ask for a range of key performance indicators (KPIs) to be presented. Customer KPIs (such as journey NPS or complaint volumes) and business KPIs (such as number of interactions versus expectation, cost of interactions, or numbers of nondigital customers).

- How do you measure journey NPS? Quarter 4 to Quarter 4. We aim to track an improvement over a calendar year. We typically use email surveys triggered at a pre-defined moment near the end of the journey/after the journey. The sampling and design of the survey has strict minimum standards. Journey dashboards bring all the KPIs together to allow a full assessment.

- NPS seems to be important as tied to bonus and measure of success — how does it correlate with revenue? Has a model been created to correlate all this? Yes, we created a model that proved to our senior leadership that NPS delivers value (reduction of costs/retention of customers). We no longer invest time in the big model as it is accepted that improving NPS adds commercial value. At the journey level, a journey owner will decide how much they need to invest to improve the experience. They also seek to reduce the overall operational cost of their journey over time.

If you want to know more about How To Frame Your Customer Journey Mapping With A Clear Purpose, join me and Joana on the 16th July for an exclusive webinar.