The End Of Sales Force Automation As A Tech Category

Sales organizations face a significant challenge in the current technology market: an overwhelming number of solutions vying for their attention and promising to solve similar business problems. CRM platforms compete alongside newer categories such as revenue orchestration and a multitude of other categories focused on capabilities like sales content management, sales intelligence, AI-powered sales agents, and CPQ (configure, price, quote) software.

The Evolution From SFA To Comprehensive CRMs

Sales force automation evolved from the fractured market of low-tech digital Rolodexes. Tom Siebel’s vision helped scale a new market for software to meet the needs of growing B2B organizations. With Oracle and Salesforce entering the market in the late 1990s, what started as a productivity tool for sellers rapidly expanded into applications to support the entire customer lifecycle, giving rise to the concept of CRM. CRMs now support a wide array of business processes within B2B to acquire customers and manage customer relationships across all customer-facing roles in the organization.

The Seller Experience Got Lost In CRM’s Ever-Expanding Horizon

As the scope of CRM platforms expanded to support an ever-increasing swath of touchpoints and business models, CRM innovation focused on foundational capabilities, such as process automation and management reporting, while innovation for frontline sales capabilities stagnated. In that vacuum, a swath of point solutions including sales engagement, conversation intelligence, and others emerged that integrated and enhanced the value of CRM and fulfilled the promise of automation for frontline sellers.

SFA Has Become An Increasingly Ambiguous Tech Category

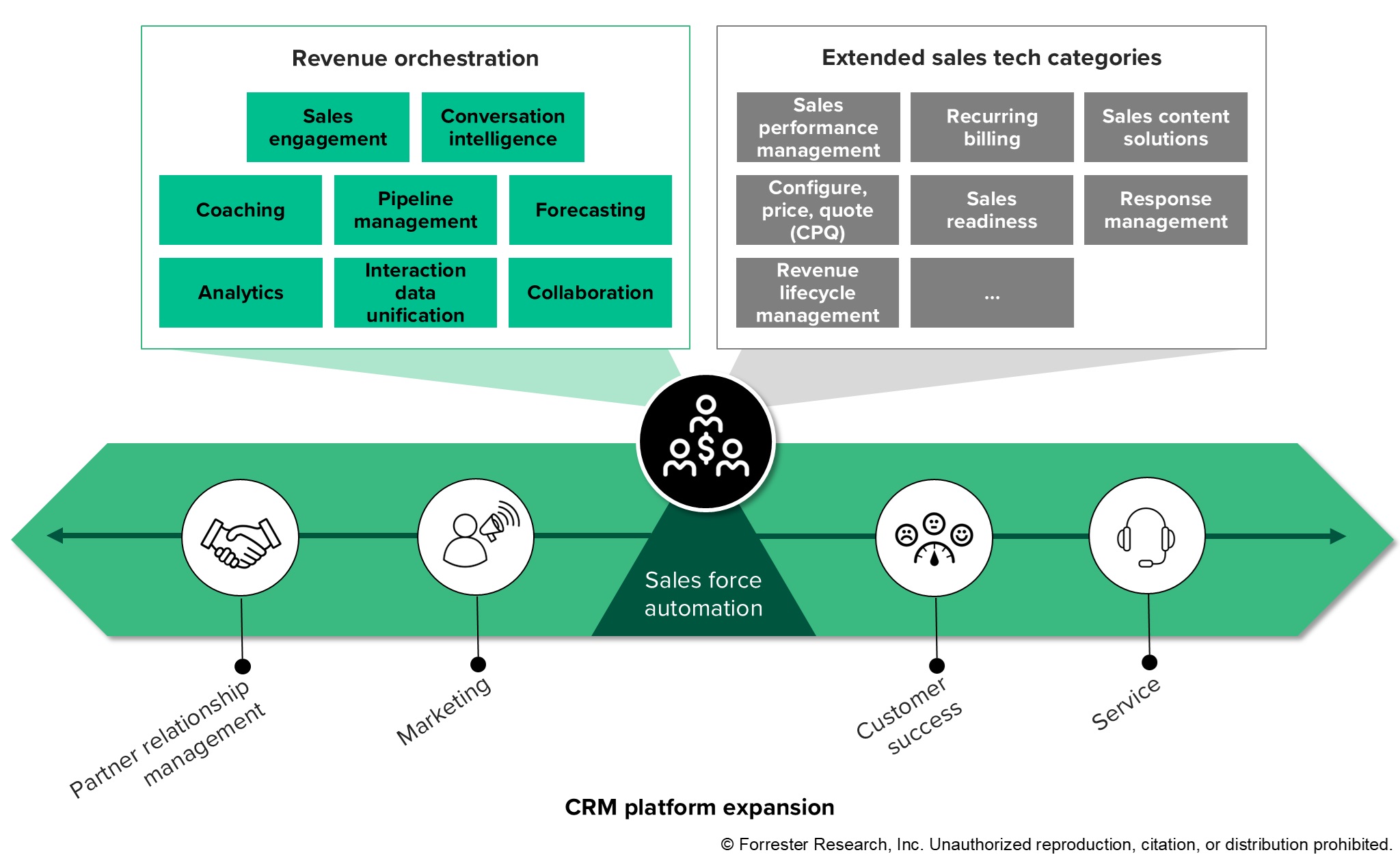

The range of capabilities captured under the umbrella term “sales force automation” has become vast, bringing a level of complexity in terms of SKUs, pricing, and sales tech-stack management. This has further distanced SFA from its core purpose of supporting sellers. Forrester believes that SFA needs to be distributed into categories that enable buyers to properly evaluate their capabilities to determine the best sales tech stack for their organization. These categories are:

- Core CRM data management. A CRM is a foundational technology that every organization must have to support its customer relationships. The foundation of SFA is business management of four core objects: leads, contacts, accounts, and opportunities. CRM purchases are increasingly led by technology leaders in partnership with the business, as they must meet the requirements of different parts of the organization. As a result, sales organizations often conflate the labels SFA and CRM.

- Extended sales tech technologies. These technologies extend the power of CRM to guide sellers through complex product configuration and pricing, optimized territory design and quota management, incentive compensation management, and sales content management to level up the effectiveness of frontline sellers. They also support new business and revenue models like partner relationship management, recurring billing, and revenue lifecycle management. But CRM vendors frequently bundle such capabilities in various SFA license tiers or offer them as add-ons, leading organizations to only evaluate the bundled capabilities of different SFA vendors instead of assessing the full range of offerings in the market.

- Revenue orchestration. The core purpose of revenue orchestration platforms (ROPs) is to deliver on the promise of a single pane of glass for the seller. Combining sales engagement capabilities for prospecting, conversation intelligence insights, and forecasting and pipeline management into a unified seller experience (theoretically), ROPs aim to maximize sales productivity and performance by placing the seller’s daily workflow and experience front and center. These platforms are primarily purchased by sales organizations with the support of IT.

CRM And ROP Vendors Face Off

CRM vendors bundle revenue orchestration capabilities with certain tiers of their SFA, adding to the confusion of what is and isn’t part of SFA. But highly integrated revenue orchestration solutions have thrown down the gauntlet to CRMs by matching their integrated user experience and capabilities that are designed to deliver real frontline impact.

Decouple CRM And Sales Tech Investment Decisions

Too many are overspending on sales technologies that are bundled within their CRM. Often, sales organizations don’t use technologies that they’ve licensed because of a lack of focused adoption, lagging capabilities, or even a lack of awareness that they have access to extended technologies. Unconscious bundling, which may be lucrative for vendors in the short term, ultimately reduces the effectiveness of sales organizations by driving up technology costs, limiting user adoption, and potentially driving complex customizations that reduce CRM agility.

To choose the right capabilities to support the seller experience, ensure that you:

- Understand CRM license tiers and add-ons.

- Assess the overlap between CRM and sales tech categories.

- Determine whether the function you need already exists in your CRM.

- Evaluate key providers. Use our Landscape and Forrester Wave™ evaluations to understand the advanced capabilities of solutions such as ROPs and others. Include additional license and integration costs and vendor management overhead in your analysis. Aim to adopt the smallest possible tech footprint that you need to support your operations.