The State Of CDP In APAC

Following the previously published report covering key CDP vendors in Asia Pacific, I interviewed 10 customer data platform (CDP) customers in the region and published a new report, The State Of Customer Data Platforms In Asia Pacific. Here are the key findings on the state of CDP in APAC.

CDP Popularity In APAC Varies By Type, Geography, And Industry

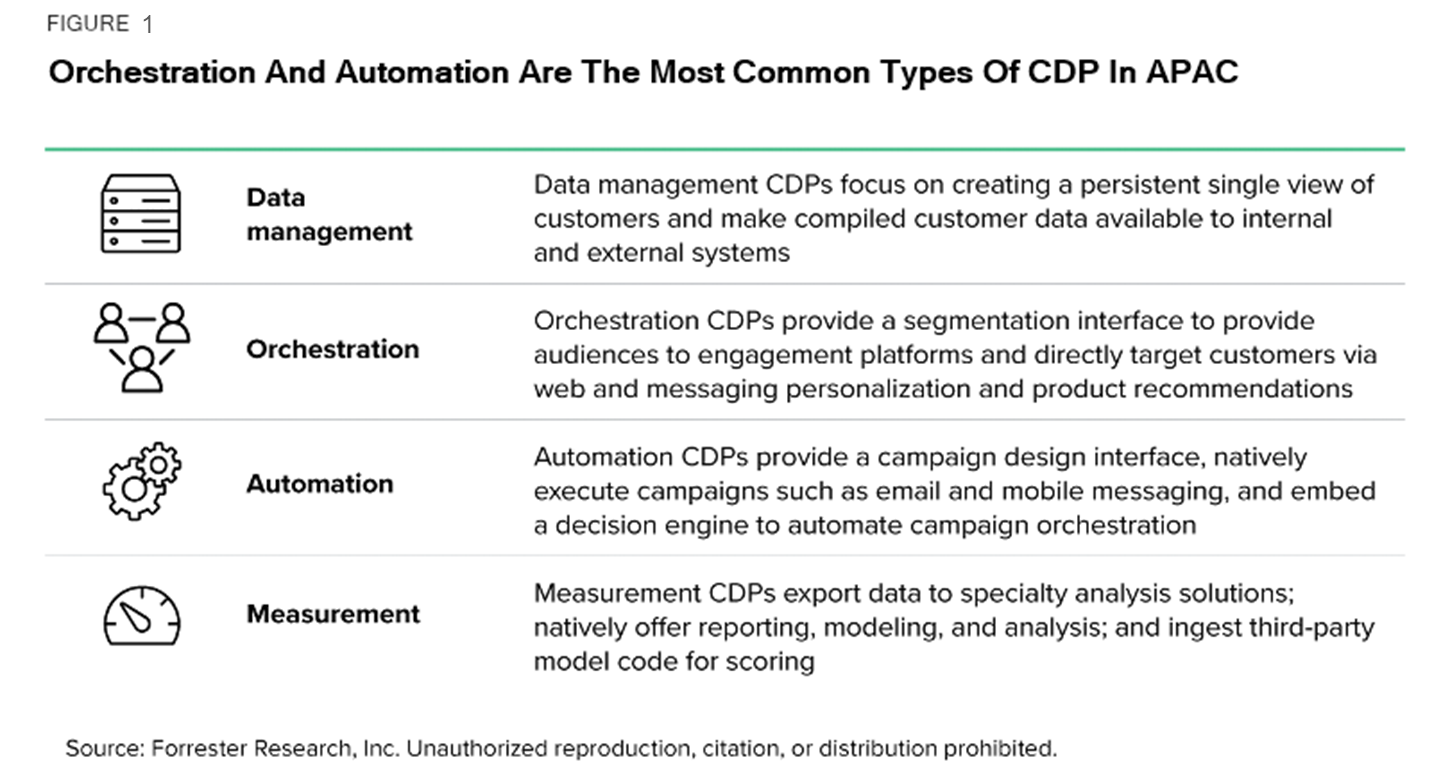

- Orchestration and automation are the most common CDP types. Among the four types of CDPs (see Figure 1), more vendors provide orchestration and automation CDPs than data management or measurement CDPs. That’s because functionality to support campaign orchestration is in high demand among APAC marketers, many of whom have yet to deploy a campaign orchestration tool such as cross-channel campaign management.

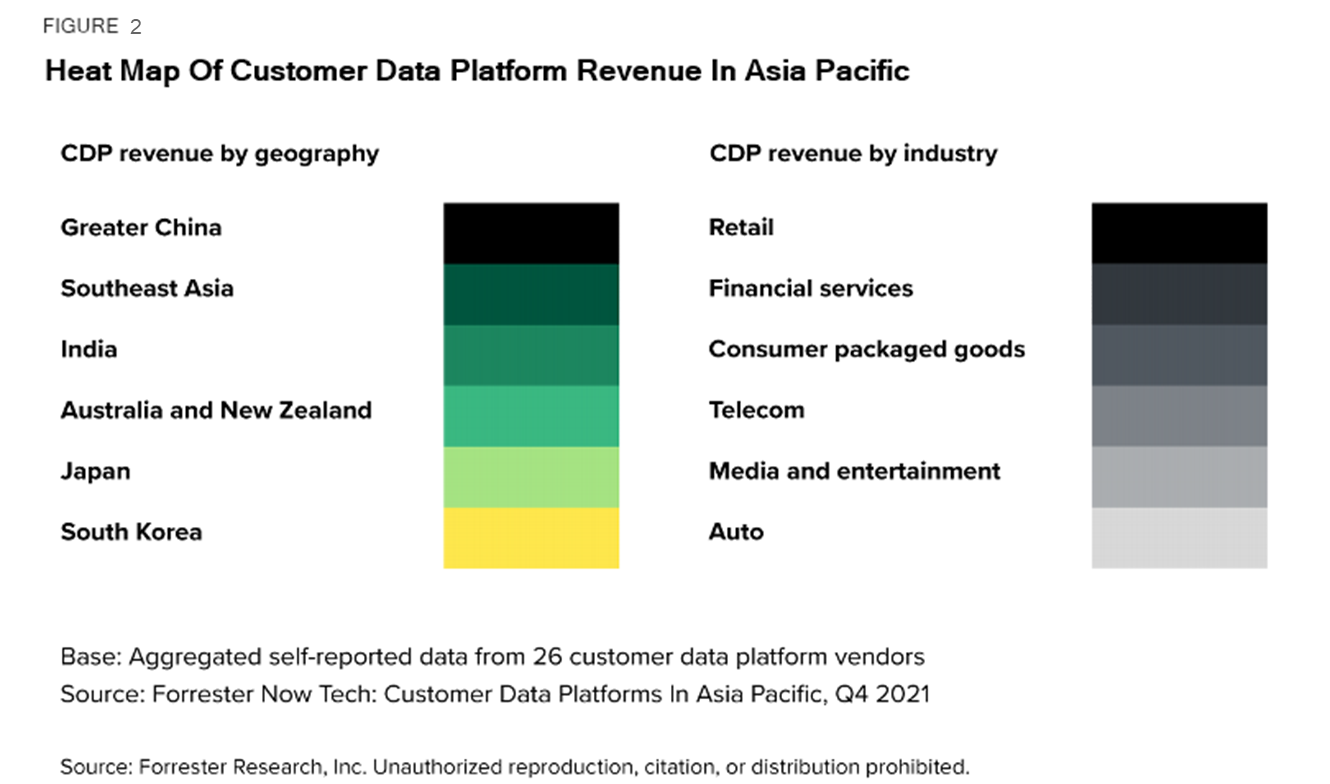

- Greater China and Southeast Asia are the hottest CDP markets. CDP vendors in APAC generate the most revenue in these two large, populous, fast-growing markets (see Figure 2). Marketers in these geographies have to deal with large volumes of customer data; unique digital ecosystems and market intricacies offer homegrown CDP vendors room to grow. Built on their existing adtech and martech offerings, these vendors are rapidly expanding their CDP business in the region.

- Retail and financial services are the front-runners in CDP adoption. CDP vendors in APAC generate the most revenue from retail and financial services firms. Compared with their peers in other industries, marketers in these two verticals have richer customer data assets and are more adept at collecting and using first-party data — so it’s no surprise that they’re more ready to invest in CDPs. Many vendors built early CDP use cases for these two industries and have more best practices to share.

CDP Clients In APAC Focus On Five Key Use Cases

Our research found that each APAC firm using customer data platforms defines use cases in its own way — some focus more on objectives and results, others on tasks and contexts. Summarizing and abstracting the common features of CDP use cases in the region identified five key ones:

- A single view of the customer. Marketers create and manage consumer profiles based on a persistent reference identifier of personally identifiable information and incorporating a range of data sources including customer, behavioral, and contextual data.

- Data orchestration for campaigns. This defines campaign audiences by selecting segments, applying rules, and distributing data to delivery endpoints such as email and mobile messaging systems.

- Segmentation. This involves constructing fixed and dynamic segments of consumers based on available profile data, contact history, and campaign performance.

- Reporting and dashboards. You can’t improve what you don’t measure; firms use CDPs to select prebuilt interactive reports and dashboards or create them ad hoc to measure and optimize performance.

- Data management. CDPs support data management tasks such as data merges, standardization, and transformation; enrichment tasks like data enhancement, data quality management, and data hygiene; and governance tasks such as defining and monitoring data access, usage, and distribution.

A CDP is an important investment — averaging a few hundred thousand US dollars annually — for marketers aiming to achieve data-driven marketing and make the best of their first-party data. You’re unlikely to get a positive return on your CDP investment, however, unless you prepare for and implement it well. Marketers in APAC who are interested in investing in CDPs should do their homework before investing in a CDP. To learn more about peer marketers’ success stories and key learnings of using CDP and better preparing their CDP investments, Forrester clients can access the full report and schedule a guidance session.