US Retail In 2030: E-Commerce Expands, Stores Still Matter

Forrester’s US Retail E-Commerce Forecast, 2025 To 2030 is live! This research provides a forecast for US total retail sales, e-commerce sales, and e-commerce’s share of total retail sales for 30 product categories, with historical data going back to 1998.

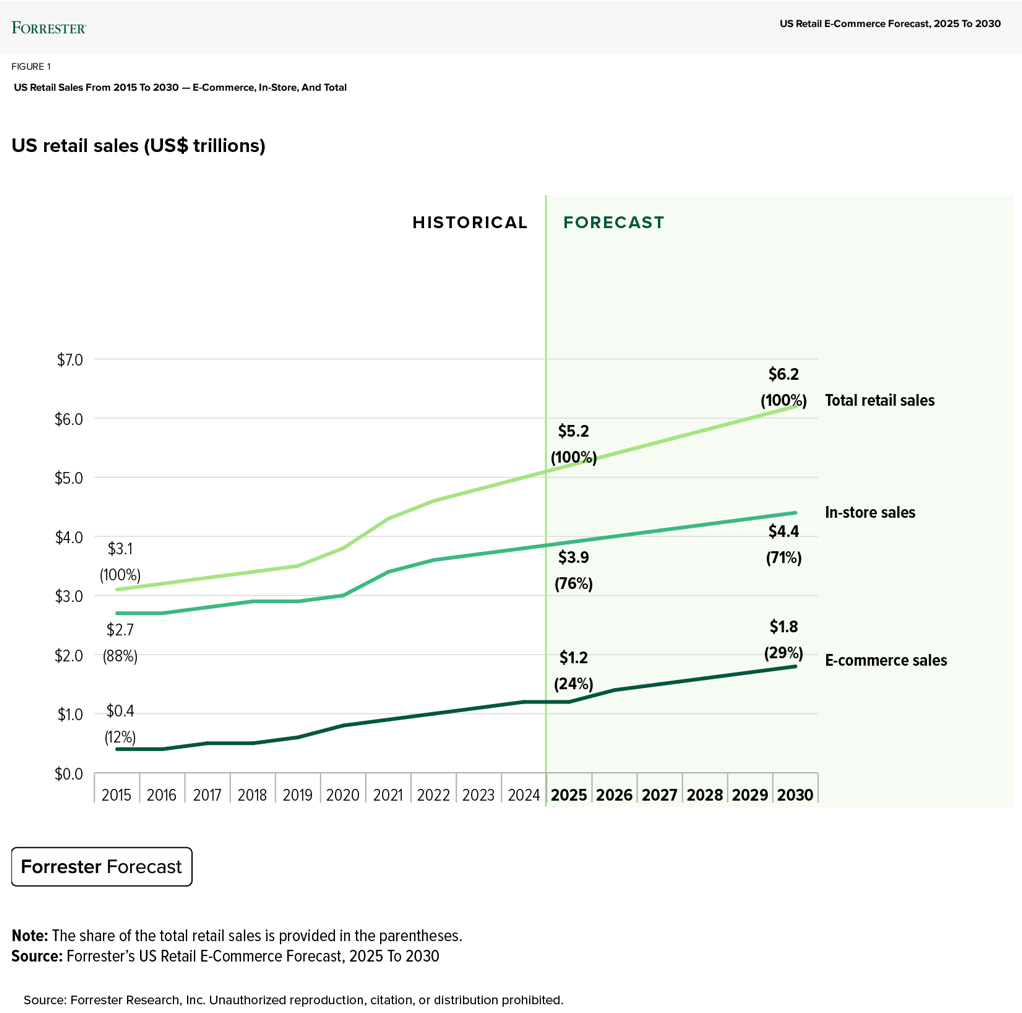

We expect a steady expansion of US retail sales over the next five years. By 2030, we project that US total retail sales (excluding automotive and gasoline sales) will reach $6.2 trillion, up from $5.2 trillion in 2025. A few highlights from our just-released forecast:

- Total retail sales. Despite tariff-related uncertainty early in 2025, US retail sales remained resilient, supported by strong consumer demand and preemptive buying. With stable inflation and interest rates, historically low unemployment, and wages outpacing inflation, US retail sales overall are set for continued steady growth. Spending patterns are diverging across income groups, however. Research from Bank of America and the Federal Reserve Bank of Boston indicates that total retail growth is driven by higher-income households that are benefiting from stock market gains and rising home equity, which boosts confidence and spending. By contrast, lower-income households remain focused on essentials.

- E-commerce sales. By 2030, US e-commerce sales will reach $1.8 trillion, accounting for 29% of total retail sales. E-commerce growth will result from demographic shifts as more consumers from Generation Z enter the workforce, along with logistics improvements that enable faster and more reliable fulfillment and technology innovations, such as agentic commerce. Retailer strategies like curated marketplaces (e.g., Best Buy, Lowe’s, Ulta Beauty) will enhance product selection and drive retail media growth opportunities.

- In-store sales. In 2030, 71% of retail sales will come from stores, capturing $4.4 trillion. The core advantages of offline retail — tangible experiences, immediate gratification, physical product comparison, social interaction, and personalized assistance — will continue to drive in-store sales.

Per Forrester’s Priorities Survey, 2025, retailers’ top five initiatives center on enhancing the in-store experience through technology. This focus highlights the continued importance of physical stores. Their top priority is empowering store associates to better serve customers, followed by improving customer self-service solutions for greater convenience. Retailers are also prioritizing initiatives to strengthen omnichannel capabilities to improve inventory visibility and broaden product selection — and to prevent shoplifting and theft to ensure a secure shopping environment.

Forrester clients: Be sure to download the accompanying Excel workbook by clicking the “Download” button at the top of the report. This workbook provides US total retail sales, e-commerce sales, e-commerce penetration, and online buyer population data for 30 retail categories.

The categories are broadly classified into two groups: nondurable goods and durable goods. Nondurable goods categories include clothing, flowers, food and drink, footwear, medical supplies, nutraceuticals, over-the-counter drugs, personal care, pets, and toys. Durable goods categories include car parts, computer hardware, computer peripherals, consumer books, consumer electronics, furniture, garden supplies, household goods, jewelry and watches, large appliances, office products, personal and small appliances, sports equipment, and tools and home improvement.

The Excel workbook also includes data for highly digitally penetrated discretionary categories such as computer software, music, videos and DVDs, and video games.

Want to learn more? Please schedule a guidance session with me to discuss the forecast in detail.