Wealth Managers: Impact-Oriented Investors Need Your Help

Impact-Oriented Investors Are Waiting For A Reason To Take The Plunge

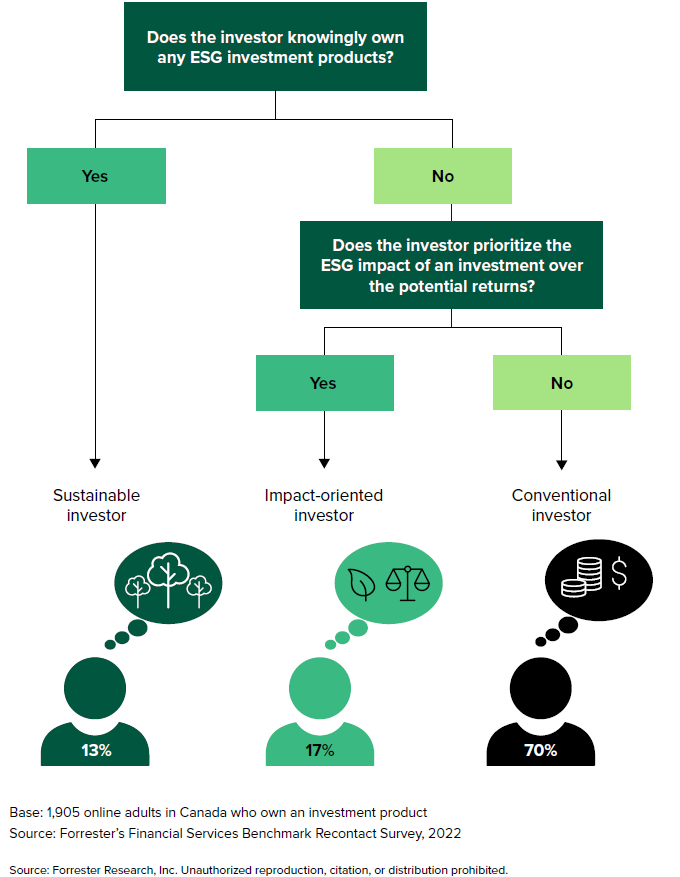

Data from Forrester’s Financial Services Benchmark Recontact Survey, 2022, found that 15% of US online adult investors own sustainable investment products — a group we call “sustainable investors.” They are younger, wealthier, and more educated than the average investor. But wealth managers should also see a big opportunity in the 17% of US online adult investors who we call “impact-oriented investors” (see graphic below). They prioritize the impact of their investments but do not yet own sustainable investment products, which we define as:

Products with which the manager considers environmental, social, and corporate governance [ESG] criteria as part of the investment decision-making process.

What Are Wealth Managers Doing?

Many wealth management firms provide customers with tools to compare the environmental, social, and governance impacts of individual stocks to help them choose from hundreds of sustainable funds, portfolios, and bonds. But our research indicates that impact-oriented investors want impact, return, and transparency. Sustainable and impact-oriented investors share concerns about the transparency of ESG metrics: One US investor told us that they would be more willing to invest in these products if there was “transparency that the investment is truly sustainable, not merely greenwashed.” We predict that trusted third-party data — rather than self-reported data — will rule as greenwashing sensitivity increases. New players such as Ecolumix are trying to fill this need. Traditional wealth management firms will have to respond to this need for independent assessments of ESG credentials.

How Will They Do This?

My recent report, The Top Emerging Technologies In Wealth Management, 2023, identifies sustainability ratings and ESG analytics as an emerging technology that offers: independent ESG benchmarks and ratings; real-time ESG-related corporate and investment risk monitoring; and advisor screening tools that filter and identify securities based on investors’ values. Forward-looking investment firms will leverage this technology to create ESG dashboards so that investors can monitor their portfolio’s ESG impact in real time and advisors can better align investors’ portfolios with their values.

Our report on US impact-oriented investors is one in a series that includes reports on investors in Canada, Italy, and the UK. They include insights and quotes from individual investors as well as Forrester Analytics’ Consumer Technographics® survey data. Should you wish to discuss our findings further and you’re a client, schedule a guidance session or inquiry with me. Not a Forrester client? Contact your Forrester account team and tell them, “I want Forrester Decisions!”

[This blog post was coauthored by Aaron Suiter.]