The Long-Term Impact Of The $100,000 H-1B Fee? Higher IT Service Prices And More Offshore

On Friday, the Trump administration issued an executive order imposing a $100,000 fee on new H-1B visa applications. This directly impacts IT service providers’ practice of bringing offshore IT talent on H-1B visas to serve US companies. They aren’t the only ones impacted, though — it also challenges the similar talent model followed by tech giants such as Amazon, Google, Meta, and Microsoft. Even the US university system relies heavily on employees with H-1B visas. For IT service providers, it directly impacts their operating models and might potentially impact margins.

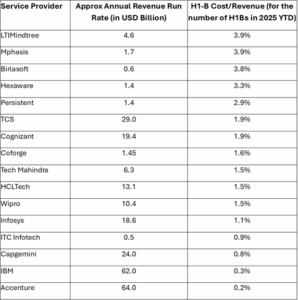

Large Indian IT service providers have traditionally been big users of H-1B visas, but over the last few years, they’ve reduced their H-1B visa workforce to well below 50% of their US-based workforce. They do so with local hiring, nearshore centers, and automation as fallbacks. The largest IT service providers could face a $500 million increase in annual fee, however, if they choose to maintain their existing staffing practices with H-1B visas. Midtier and smaller IT service providers would face disproportionate pressure from the H-1B fee due to their higher visa dependency relative to revenue. Also, their people-centric business models leave them with little maneuverability (see figure below). If the $100K H-1B fee is enforced, technology leaders must prepare for three immediate consequences:

- IT service delivery costs will go up. If providers are to maintain current visa-dependent staffing models, the $100K fee will significantly inflate costs, and most will respond by sharply curtailing new H-1B petitions, effectively removing a key talent channel. This reduction in foreign talent supply, combined with the Trump administration’s directive to the Department of Labor to raise prevailing wage thresholds, will drive up employee costs across the board. Buyers should expect a 2–3% increase in onsite billing rates for new contracts as providers pass through higher labor costs and restructure delivery models.

- Delivery models will shift toward offshore execution. We predict increased offshoring, with Indian professionals and major IT vendors likely to intensify hiring and client support from India and other offshore countries, negatively affecting US-based delivery but potentially boosting India’s tech employment and offshore business. Technology leaders must inventory their project portfolio to see what can be effectively delivered entirely offshore — such as mainframe modernization or cloud migration — as well as actions like product development that require a global delivery model with significant staff in the same or similar time zone. Clients can also explore how to leverage their global capability centers to mitigate this impact.

- Complex projects and innovation will suffer. Indian IT service providers will struggle to staff specialized roles that require niche talent onsite in the US, especially for projects with high collaboration intensity. This constraint will also affect US-based tech firms, as reduced access to global expertise slows cross-border knowledge exchange. Over time, the rising cost and complexity of securing work visas may make the US less attractive for international talent, impacting its role in global innovation networks.

Cost Of H-1B (2025 Numbers) As A Percentage Of Annual Revenue

Over the next few months, we expect to see IT service providers:

- Offer more remote shoring strategies. The new visa fee accelerates the shift away from the traditional offshore-onsite (global delivery) model to more remote-oriented models, such as nearshore or fully offshore models — especially for routine and commodity work. Onsite presence will shift toward senior architects, program managers, and client-facing leads, as opposed to entry-level roles. For the next few years, providers will keep most of their existing onsite base (since renewals are exempt), but the onsite part of the pyramid won’t replenish at the same rate. Instead of renewals and new ones annually, they’ll now only add new petitions that they can’t do without.

- Reinforce investments in AI-powered delivery to raise productivity. Providers are already investing heavily in AI delivery platforms: These platforms automate swaths of the software delivery lifecycle, led by AI-powered analysis, coding, and testing. Already they’re using agents to shorten delivery times and lower overall costs by as much as 20–30%. This visa fee will create more urgency to scale up engineer-agent delivery pods to achieve the margin benefits and productivity throughput that enterprises need.

- Continue the pivot to more value-aligned pricing strategies. On the managed services side, they’ll shift to more outcome-based or productivity-based contracts. Providers will look for more control over their resourcing model in lieu of price concessions. This will allow them to manage project delivery without having to worry about the costs of running managed services from onshore. Buyers will have to learn to manage project success through managing outcomes instead of through direct control over provider resources.

Even if we take a macro view, we come to the same conclusion: The US will spend close to $700 billion in tech consulting and outsourcing spend in 2026. If service providers file as many H-1Bs as they filed in 2025, we’re looking at a roughly $2 billion cost impact — a ~3% hit on their margins, which is significant. The industry may partially absorb it, but it’ll likely move away from using H-1Bs. It will achieve this by forcing the global delivery models to shift further from onshore toward offshore and nearshore operations.