There Are Only Two Major Opportunities For OMS Vendors To Win New Deals Right Now

It’s a tough market for everyone in commerce and commerce tech right now. There are lingering market circumstances, such as a lack of interest in B2C commerce replatforming. Among consumers, one major retail CEO notes observing “stress behaviors,” and a VP at NielsenIQ sees a “conservation mentality.” Uncertainty across global economies is causing analysis paralysis for many businesses. So what do things look like for the order management system (OMS) market?

Digital businesses will still adopt OMS solutions, but we expect that most will do so in limited, specific ways. I see most OMS adoption in the next one or two years coming from companies as 1) a first-ever packaged OMS purchase or 2) mini-adoption to solve a specific problem.

A less likely scenario is a complete replatforming for businesses that already have an OMS. This situation is similar to what’s happening in the B2C commerce solutions market but for very different reasons. In commerce, most digital businesses that were ready to move to a modern, cloud-based solution already have done so recently. And once they’re using one of these solutions, they’re unlikely to find “greener grass” from replatforming to another vendor in that class.

Likely OMS Adoption Scenario Number One: A First-Ever Packaged OMS Purchase

In OMS, on the contrary, there’s still a huge portion of the market that is using a homegrown solution or a highly customized enterprise resource planning connector to solve for OMS. These projects were a good idea at the time — likely a decade ago or more. Now, they are aging and don’t scale well given modern customer requirements and the strides that vendors have made across commerce technology. And they certainly won’t serve inventory availability, in near real time from all stores and warehouses, during the milliseconds of the digital experience when a customer is most likely to abandon the cart.

If you’re still managing orders, inventory, delivery promising, and fulfillment orchestration with anything other than a modern, packaged OMS, it’s time for a change. You’re one of many digital businesses ready — right now — for your first packaged OMS.

Likely OMS Adoption Scenario Number Two: Mini-Adoption To Solve A Problem

More digital businesses are buying their commerce tech incrementally. Call it the old “strangler pattern” as you whittle away at your legacy tech, replacing it bit by bit. Call it “composable” as you add just the modules you need. Call it “augmentative” as you realize that what you’re composing might be pieces of solutions within the same category (e.g., modules from a newer OMS on top of your original OMS).

Using Forrester’s Function-First Tech Buying Framework, businesses begin by identifying the problem they need to solve and then identify the bare minimum tech they require to tackle that problem. Forrester introduced this model for buying tech nearly three years ago, and it’s now widely in practice across the market. Particularly in uncertain economic times, digital businesses are looking for short-term bang for their buck.

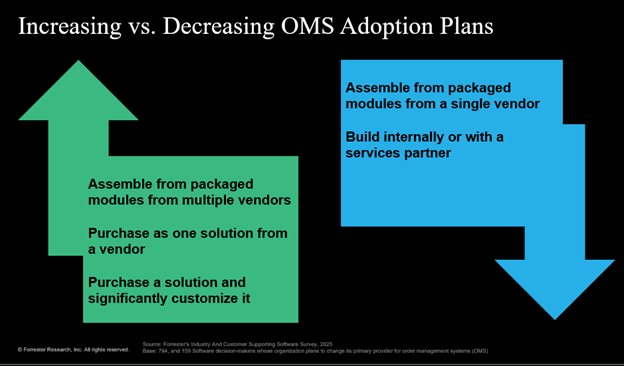

In OMS adoption, this means modular buying, not full-solution purchasing. In Forrester’s Industry- And Customer-Supporting Software Survey, 2025, digital businesses indicate that they plan to move toward multivendor, modular solutions; single-vendor, complete solutions; and customized, packaged products. They’re moving away from buying modularly from a single vendor, and the largest drop is in their intent to build an OMS from scratch.

I’m pleased to see increased trust in packaged products — even when businesses plan to build on top of them. I’m also fascinated to see the move toward modules from multiple vendors, as I uncovered in my recent report, Dual-OMS Strategy Pays Off When The Secondary OMS Improves Revenue — Forrester’s Dual-OMS Total Economic Impact™ (TEI) Study.

Some companies will do a clean replacement of their OMS with another. But I suspect that even when digital businesses intend to replatform, they’ll make more incremental changes over time rather than a full rip-and-replace.

What does this mean for your relationships with vendors? These shifts in models (e.g., increased modularity or deep customization) call for adjustments to how you pay for your tech. Look for more flexible pricing that’s more closely tied to functionality. Push for guarantees on ROI with real, contractual concessions if the numbers don’t deliver. In a market that’s squeezing budgets and blowing up plans, it’s a great time to negotiate with vendors that need their foot in the door.