US Economic Outlook, 2026

Forrester’s US Economic Outlook, 2026 report is live! This report analyzes the performance of the US economy in 2025 and provides Forrester’s outlook for 2026.

The US economy performed better than consensus expectations in 2025, despite tariff-related uncertainty. Key US macroeconomic indicators like inflation and unemployment rate appear stable and consistent with historical averages. But even with fewer headwinds for the US economy heading into 2026, organizations must take into account several key factors in their planning:

- Technology capex may yield limited returns. Business investment in 2025 was driven largely by AI-related technology spending. Strong technology investment has masked weakness in other capex areas, particularly transportation equipment. We expect this trend to continue in 2026 as firms expand data centers and increase their spend on hardware and software. The Congressional Budget Office notes that AI’s effects on economic growth and productivity are uncertain in both timing and magnitude, indicating that broader economic benefits may be uneven or slow to materialize.

- Consumer income groups are increasingly bifurcated. Research from Bank of America and the Federal Reserve Bank of Boston indicates that total consumer spending is increasingly driven by higher-income households benefiting from stock market gains and rising home equity. In contrast, lower-income households show greater evidence of trade-down behavior and spending restraint, as essential expenses account for a larger share of their budgets. The expiration of enhanced Affordable Care Act subsidies will likely double premium costs for millions of lower-income households, further straining their discretionary spending.

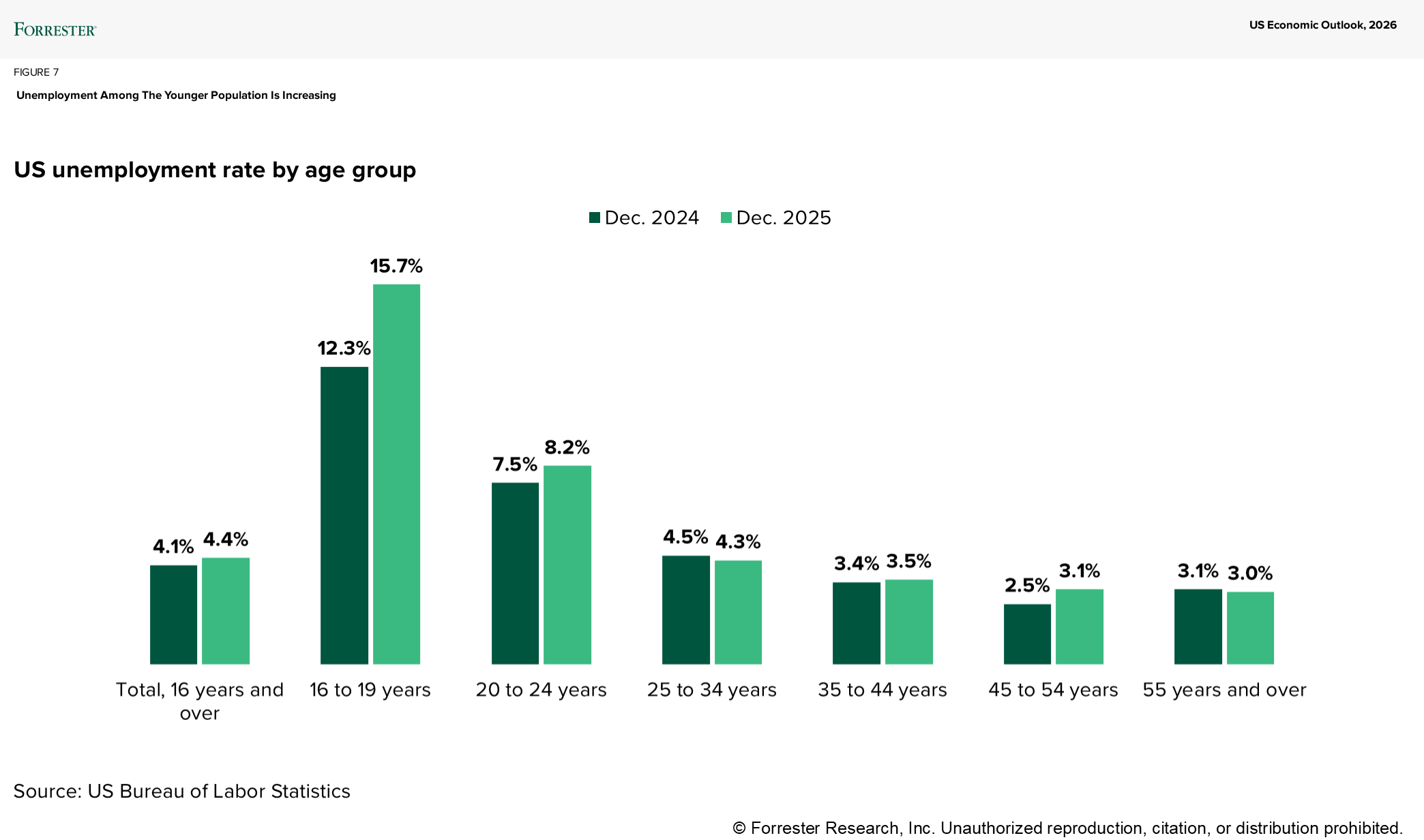

- The labor market is cooling. Job growth slowed markedly in 2025 — job additions fell to less than one-third of 2024 levels and to one-quarter of pre-pandemic norms. Trade-exposed sectors appear to be among the most affected; for example, manufacturing employment is down by over 70,000 since the April 2025 tariff announcements. While the labor market appears stable at the headline level, unemployment among younger workers has increased. Between December 2024 and December 2025, the unemployment rate for those ages 16–19 increased from 12.3% to 15.7% and for ages 20–24 from 7.5% to 8.2% (see figure below).

Business and IT leaders must remain agile and adaptive to evolving economic signals. To thrive in 2026, organizations must embrace “always on” scenario planning, prioritize customer‑led investments, reduce technical debt, and experiment with emerging technologies.

Forrester clients: Want to learn more? Please plan to attend the client-only webinar or schedule a guidance session with me to discuss the report in more detail.