Which French Bank Offers The Best Customer Experience? — Results Of The Forrester France Banking CX Index Rankings, 2023

[This blog was cowritten by Julia Swerdlow.]

Good customer experience (CX) is essential to gain customer satisfaction and loyalty. Companies that excel in customer experience are set apart from their competitors and obtain higher revenue.

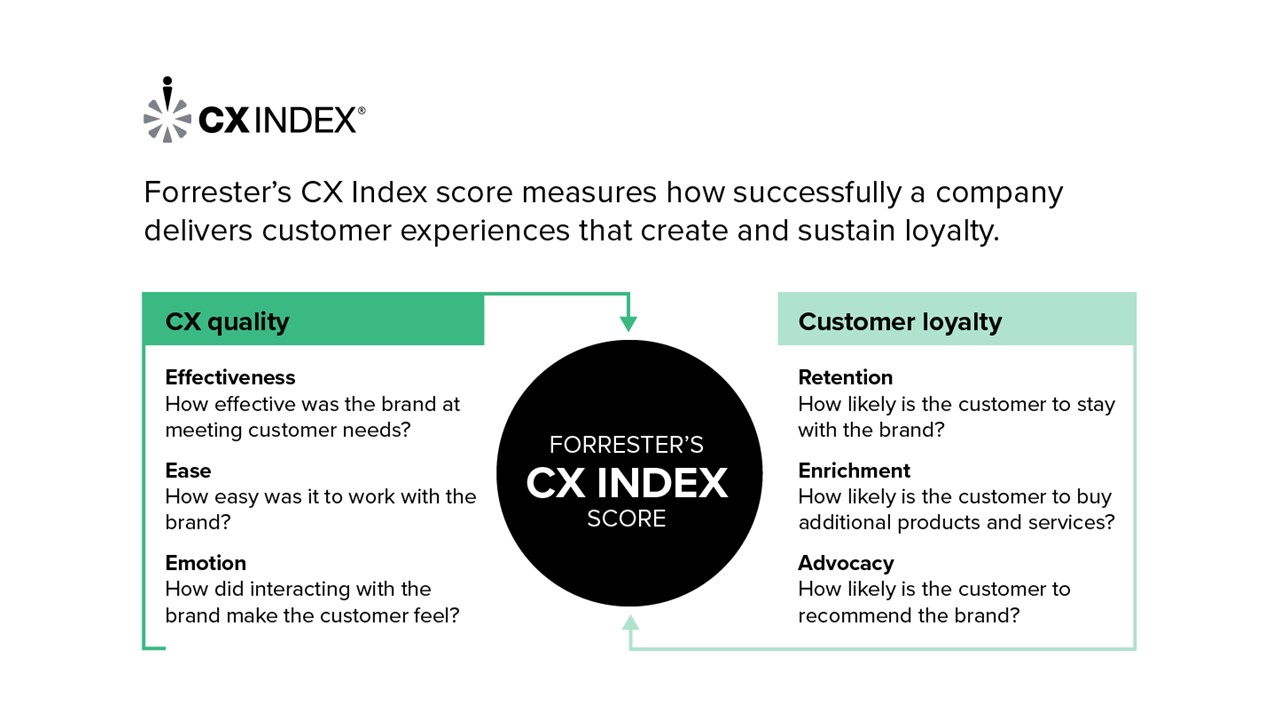

Every year since 2016, Forrester has surveyed the clients of several European banks to measure their perception of the delivered experience from their respective banks. The three main dimensions of customer experience are evaluated in this survey: effectiveness, ease, and emotion. Each company included receives a final score, the Customer Experience Index (CX Index™) score, which evaluates its ability to deliver a customer experience that generates loyalty. This score can be considered like a “grade” that clients would give to this company for the quality of their customer experience.

This year, we evaluated the CX quality of eight French banks and published the scores and rankings of these banks, alongside the main drivers of a customer experience that generates loyalty, in our study The France Banking Customer Experience Index Rankings, 2023. Here are some of our key findings from this study.

- Customer experience in the French banking sector continues to improve but remains under the European average. Here’s the good news: Nearly every bank included in our banking CX Index in 2023 has improved the quality of its CX, so that France has increased from the “poor” category to the “OK” category. It’s important to put things in perspective, however. The quality of CX in the French banking sector is still lower than the European average, in addition to the German, Italian, and UK average. A little more concerning: Only one French bank out of the eight evaluated received a score above the European average.

- Mutual banks outdo traditional banks. Among the eight banks evaluated in our banking CX Index for France, three are mutuals, and it’s these three mutuals that received the best scores this year! We also found that mutual banks surpass traditional banks on the emotional dimension. Clients of mutual banks are more likely to think that their banks share their values. Crédit Mutuel is the leader of the banking CX Index for the eighth consecutive year, surpassing its peers across the three dimensions of CX quality: effectiveness, ease, and emotion.

- Customer service is a key driver of the quality of CX. To improve their CX and the loyalty of their customers, banks must understand which drivers have the strongest impact on customer experience. This year, among the 33 drivers identified, the most important driver pertains to the ability of customer service representatives to be able to resolve problems and issues the first time they are contacted.

To find out more about the results of the banks evaluated in our banking CX Index in addition to the drivers of CX, read our reports, The France Banking Customer Experience Index Rankings, 2023, and The European Banking Customer Experience Index Rankings, 2023. You can also contact us to speak with one of our expert analysts.