Six Ways That Prime Fuels Amazon’s Retail Growth

In early June, I attended Amazon Prime Analyst Day with my colleague Fiona Swerdlow and a select group of retail-focused analysts. Amazon now has over 200 million Prime members across its 26 global markets. Prime drives higher purchase frequency, conversion rates, and lifetime value. Fast delivery, member deals, and a broad portfolio of services turn Prime into a daily utility for members.

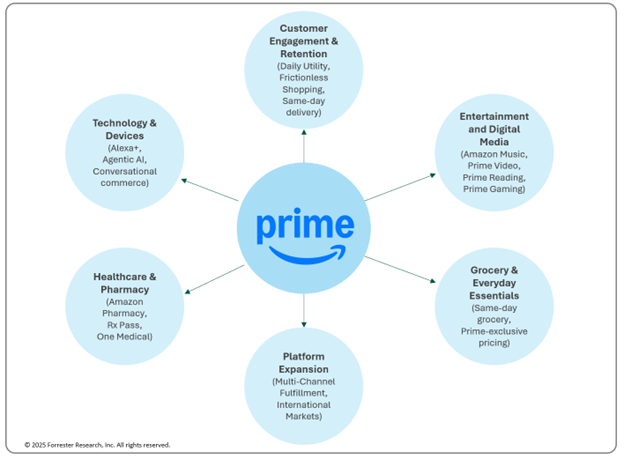

So where is Prime headed for yet further growth? Amazon is investing in six primary retail initiatives to enhance Prime’s value and reach:

- Conversational commerce with agentic AI. Amazon’s devices business — including Echo smart speakers, Fire TV, and Alexa-enabled products — is the gateway to Prime-enabled shopping. Earlier this year, Amazon launched Alexa+, an AI-powered voice assistant that will be $19.99 per month (but free for Prime members) and is capable of executing tasks such as managing grocery orders. The more than 600 million Alexa-enabled devices across the globe serve as agentic AI shopping interfaces, turning every conversation into personalized experiences and a potential transaction.

- Healthcare subscription services. Amazon Pharmacy is expanding its footprint in the prescription drug market in the US. US Prime members receive free two-day delivery on prescriptions, discounts on generics, and access to RxPass — a $5/month subscription for over 50 commonly prescribed medications. In major US metro areas, Amazon is also expanding same-day prescription delivery, using its logistics network to further differentiate its healthcare offering.

- Fulfillment and Prime benefits beyond Amazon.com. Amazon Multi-Channel Fulfillment and Buy with Prime help merchants simplify their operations by using Amazon’s fulfillment network. It provides Amazon with new revenue streams via fulfillment and delivery. With adoption from brands such as Adidas, Belkin, and Steve Madden, as well as Shopify and Salesforce Commerce Cloud integrations to automate the order fulfillment process, Buy with Prime helps brands offer Prime shopping benefits directly on their direct-to-consumer (DTC) sales channels. Amazon asserts that Buy with Prime helps DTC merchants attract and convert more shoppers, with merchants experiencing a 16% increase in revenue per visitor. Furthermore, 40% of Prime members indicate that they are more likely to make a first-time purchase from a DTC store that features the Prime logo.

- Grocery delivery services. US Prime members get unlimited grocery delivery on orders over $35 from Amazon Fresh, Whole Foods Market, and an array of local grocery retailers on Amazon.com with a $9.99 monthly or $99.99 annual grocery delivery subscription. They also benefit from grocery deals, delivery in as fast as 2 hours, and integration with Alexa for voice-enabled shopping. In 2024, Amazon generated over $100 billion in gross sales of grocery and household essentials in the US.

- Global same-day and next-day delivery. Fast, reliable shipping remains the heart of Prime’s value. In 2024, Amazon delivered over 9 billion items globally, either on the same day or the next day. Amazon’s regionalization initiatives in the US and the growth of same-day delivery facilities contributed significantly. Combined with a $4 billion investment for US rural delivery expansion, Amazon aims to bring faster delivery in less densely populated areas.

- International expansion. Amazon Prime’s global expansion strategy focuses on delivering a localized offering to drive membership growth in emerging markets. For example, the recent Colombia Prime launch bundles free and fast international delivery, Prime Video, and local pricing.

Amazon Prime: Key Focus Areas To Drive Customer Value And Engagement

Forrester clients: We highlighted in our US Online Retail Forecast, 2024 To 2029, as well as in our blog post comparing Amazon and Walmart, that by 2029, we project that these two companies will account for a combined $1.5 trillion (or one-fourth) of US total retail sales and $1.1 trillion (or two-thirds) of US online retail sales.

Forrester continues to closely track evolving competitive dynamics through our US Retail Competition Tracker and Global Online Marketplace Tracker. Please schedule a guidance session with me to better understand the shifts in US consumer spending and the changing revenue and profitability shares among major retailers. And don’t miss out on Forrester’s total experience research and my sessions on US economic trends and outlook at CX Summit North America in Nashville, taking place this week (June 23–26, 2025).