Highlights From The UK Auto And Home Insurers CX Index, 2022

UK Customers Will No Longer Pay For Their Loyalty To Insurers

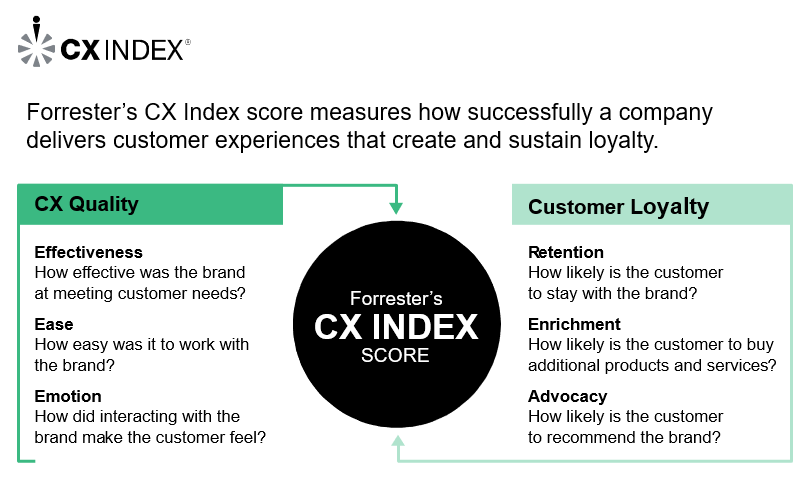

Customer experience (CX) leaders grow revenue faster than CX laggards, cut costs, reduce risk, and can charge more for their products. That’s why Forrester publishes an annual CX benchmark using its Customer Experience Index (CX Index™) methodology. The CX Index measures how well a brand delivers customer experiences that create and sustain the loyalty of its customers. Each brand is assessed on the three dimensions of CX quality (effectiveness, ease, and emotion) and receives a final score, the CX Index score, that measures its capacity to deliver experiences that generate loyalty. This score is a bit like a “grade” that customers would give to this brand for the quality of its CX.

In 2022, we surveyed 11,484 European customers of 39 auto and home insurer brands in France, Germany, Italy, Spain, Sweden, and the UK. In the UK, Forrester surveyed 1,767 auto and home insurance customers to determine how they perceive their experiences with six major UK auto and home insurers.

CX Quality Bounced Back To 2019 Levels As UK Insurers Received An Offer They Couldn’t Refuse

After a dip in 2020 and 2021, the average CX quality of the UK auto and home insurance industry improved significantly in 2022. In 2021, the Financial Conduct Authority introduced numerous measures to protect UK insurance customers, particularly from the practice known as “price walking,” in which insurers continually increase premiums on renewal. UK insurers are now banned from offering cheaper deals to new customers, boosting the importance of loyalty and retention strategies. The top three UK insurers (LV= General Insurance, Direct Line Group/Churchill, and Admiral/Diamond/Elephant) improved on all three dimensions of CX quality — effectiveness, ease, and emotion in particular.

LV= GI Leads The UK Ranking With Quality Experiences

LV= General Insurance has ranked first or second in the UK auto and home insurer CX Index every year since 2016, and its CX quality improved significantly for the second year in a row. Our CX Index shows that LV= GI offers the most effective, easiest, and most emotionally positive experiences of all European auto and home insurers included in Forrester’s CX Benchmark Survey. LV= GI focuses on empathy and building strong customer relationships: Customer service representatives are not targeted on metrics such as average handle time or percentage of calls answered but rather on the quality of interactions with their customers.

Feeling Valued Drives Loyalty The Most In The UK

How customers feel about their experience has the biggest impact on customer loyalty. Unfortunately, UK auto and home insurers perform worst on emotion when it comes to CX quality. To drive loyalty, insurers need to empower customer service representatives to answer all customer questions. This includes work on all dimensions of knowledge management and ensuring effective collaboration across insurers’ ecosystems. Top brands in the CX Index continuously focus on enabling easy access to relevant information and ensuring that all client interactions are captured in one place. These efforts translate into tailored experiences.

For a more detailed analysis of the UK CX Index results — including every brand’s score and the CX drivers and emotions that drive loyalty the most — check out our reports: The UK Auto And Home Insurers Customer Experience Index Rankings, 2022 and The European Auto And Home Insurers Customer Experience Index Rankings, 2022, or contact us.

(Zaklina Ber contributed to this blog.)