Introducing The APAC Financial Services Customer Trust Index, 2022

Earning and defending customers’ trust, considering the current volatility in financial markets, the infamous downfall of Credit Suisse, the collapse of First Republic Bank, and the ongoing banking scandal in China, requires a special commitment, not lip service. Customers want to feel confident that their investment managers, banks, and insurers are reliable and trustworthy. They also expect genuine empathy and care from the firms to which they entrust their nest eggs and financial hopes.

Earlier this year, we launched the Financial Services Customer Trust Index to assess the level of trust that customers have in their financial services (FS) providers. Sadly, customers across Asia Pacific (APAC) generally rate their trust toward their banks, investment managers, and life insurers as weak or — at best — moderate. In certain geographies, the situation is more dire than in others, revealing sectorwide vulnerabilities and challenges to earn and retain customer trust. For example:

- Less than half of customers in Hong Kong, Australia, and Singapore trust their banks.

- Less than a third of customers in Australia, Hong Kong, and Malaysia trust their investment managers.

- Less than a fifth of customers in Hong Kong and Singapore trust their life insurers.

Measuring How Well APAC Financial Services Brands Earn Customer Trust

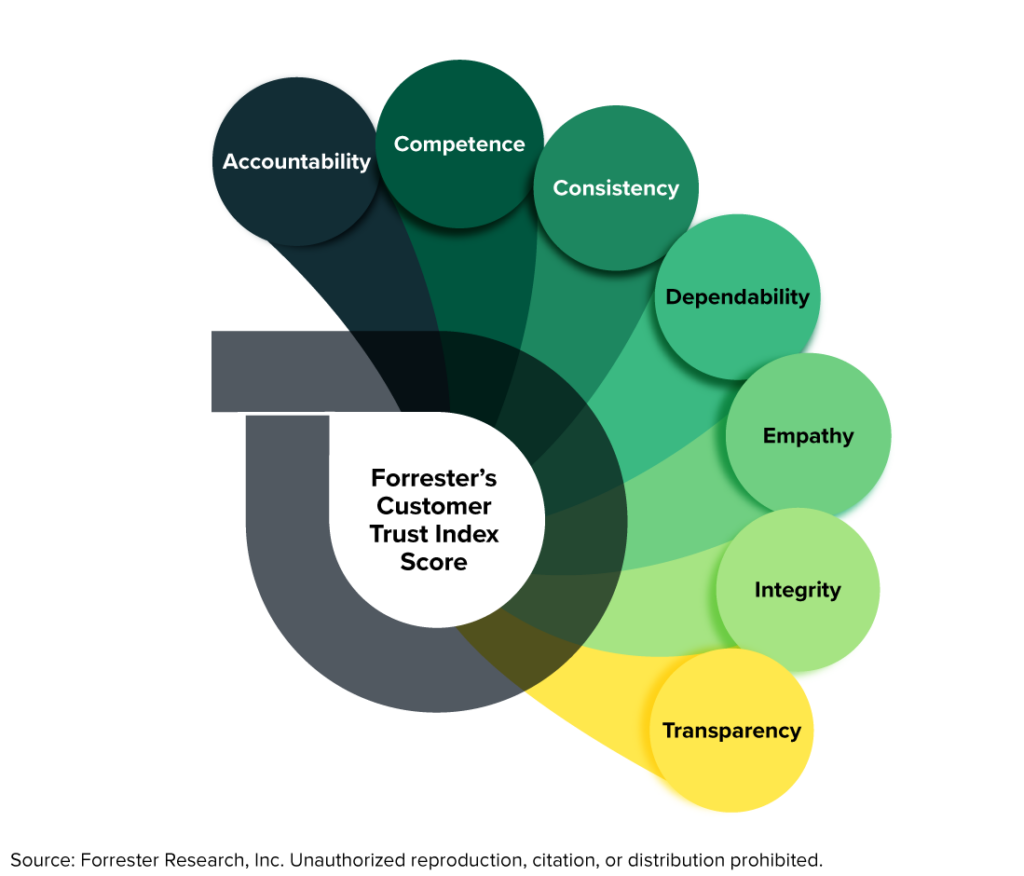

While financial services leaders intuitively agree that customer trust is important, they lack a clear understanding of what drives it and how to measure it — so we developed the FS Customer Trust Index to measure a brand’s ability to earn customer trust. As our research shows, firms stand a chance to reap financial, competitive, and reputational benefits when customer trust is strong. When it’s weak, they lose those benefits and must fight harder to win business.

Our customer trust measurement methodology goes beyond simply assessing the level of customer trust by generating a unique benchmark. It also offers a strategic roadmap for building trust in any given market and prioritizing specific enhancements most likely to boost revenue and yield additional benefits. Using scoring models, we identify key trust levers that significantly impact customers’ trust. The unique combination and prioritization of these levers forms the trust blueprint, guiding financial services firms in each sector to effectively strengthen customer trust. This approach also takes into account geographic differences, considering social, cultural, and demographic variations. For example:

- Chinese banking customers want dependability, competence, and transparency.

- Indonesian banking customers prioritize competence, dependability, and empathy.

- Malaysian life insurance customers require accountability, consistency, integrity, and transparency.

- Hong Kong’s life insurance customers expect consistency, empathy, and competence.

- Australian investment customers seek empathy, competence, and dependability.

- Singaporean investment customers demand empathy, dependability, and accountability.

The Benefits Of Earning Trust Go Hand In Hand With The Costs Of Losing It

Customer trust is dynamic and can fluctuate, presenting both opportunities for growth and challenges to overcome. Through our surveys and data analysis, we were able to confirm vast behavioral differences between customers who either trust or distrust their financial services providers. These behaviors translate into four distinct outcome categories that extend to:

- Revenue. Customers who trust their provider will buy additional products or services from that brand, prefer that brand over its competitors, and refer or recommend a friend or a family member. Customers with low trust will do the opposite on all fronts.

- Engagement. Customers who trust their provider will readily engage with the brand more often, share more personal data and information about their lifestyle goals and preferences, and be more responsive to various communications. Customers with low trust are unlikely to do the same.

- Forgiveness. Customers who trust their provider will forgive a brand for product-related mistakes, give a brand a second chance in case of an ethical breach involving certain executives, and show additional patience if there is a temporary technical glitch affecting service delivery. Customers with low trust will not be so lenient and instead will more likely sever their relationship.

- Brand. Customers who trust their provider will try other services offered by the brand, even if they are unrelated to their core offerings and will trust other companies that are affiliated with the brand. Customers with low trust are less likely to follow suit and instead will shun that brand.

Trust Is Hard To Earn And Easy To Burn — How Forrester Can Help

Trust isn’t abstract; you can earn it and strengthen it. Every engagement with a customer is a chance to earn, reinforce, or, on the flip side, destroy trust in your brand. To increase customer trust, financial services brands must design and execute deliberate trust strategies — but before that, they must first stop guessing and start measuring customer trust to understand what drives it. To get started:

- Use the FS Customer Trust Index to assess trust in your brand. Our Customer Trust Index methodology can help your organization assess customer trust of your brand and what drives it. You can use that information to form long-term trust-building strategies equipped with knowledge about the current trust gaps and blind spots.

- Develop a deliberate action plan. You can’t address all trust drivers for every audience and region at once. Forrester’s FS Customer Trust Index can help you understand and prioritize the drivers that are most likely to have a meaningful impact on perceptions of trust for a given audience.

- Benchmark against your peers and set trust targets. We can help you benchmark your firm’s customer trust levels against relevant peers in your geography and set a strategic trust target appropriate to your business. Trust targets will help track and embed strong accountability mechanisms in your overall customer strategy.

- Align trust with and integrate trust into your customer experiences. Use Forrester’s data-driven frameworks to connect trust with every aspect of your customers’ experiences. Forrester’s Customer Experience Index (CX Index™) shows that higher trust correlates with higher CX quality and drives loyalty behaviors such as retention, enrichment, and advocacy.

Please read the full version of the reports for more details such as country-specific customer trust scores, analytical insights, relevant examples, and sector-specific recommendations.

About This Research

The APAC Financial Services Customer Trust Index, 2022, covers three sectors — consumer banking, investment management, and life insurance — in seven geographies (Australia, China, Hong Kong, India, Indonesia, Malaysia, and Singapore) based on survey data collected from 17,900 consumers. Forrester clients can access the APAC research below.