TIER: Technology Is An Engine For Growth, So Budget Accordingly

You might have had the bad fortune — though I certainly hope not — of experiencing the delays, cancellations, and lost baggage caused by Southwest Airlines’ software crisis this holiday season. And if not, you probably saw the headlines, which ranged from the serious (“Southwest Cancels Thousands More Flights; US Government Vows Scrutiny” and “Southwest’s December Meltdown Could Cost Up To $825 Million”) to the amusing (“Southwest Stole Christmas” and “Southwest Airlines Becomes The Grinch That Stole Christmas Travel”). But for me, the headline story for Southwest is an issue that I have increasingly seen crop up in the market recently: a failure to properly budget for technology growth.

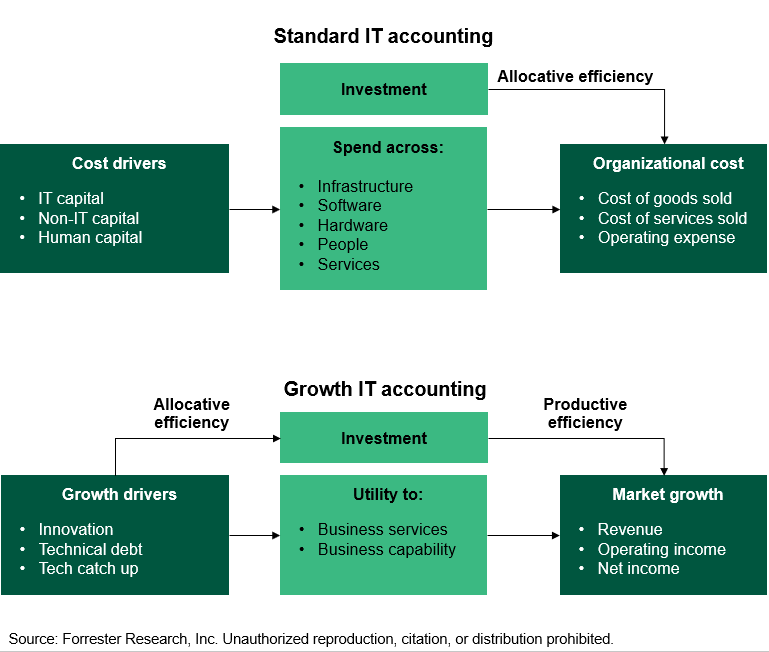

For the past few decades, Southwest appears to have budgeted for technology on an “allocative efficiency” basis, focusing on optimally allocating costs to meet current demand. In doing so, it appears to have largely neglected “productive efficiency,” or focusing on maximizing future outcomes given current cost constraints. In other words, Southwest managed its technology portfolio as a near-term cost instead of a long-running investment driving growth (see figure below). This misguided approach resulted in an unmanageable level of technical debt, exposing Southwest in the most public way possible — the failure to deliver an acceptable customer experience.

Southwest is hardly alone in neglecting productive efficiency. Most companies have this issue, and in extreme cases, it can lead to a company’s failure — especially when paired with a failure to properly convert value. Think of Sears, Kodak (look forward to my blog on this topic later next month), or the UK travel company Thomas Cook.

But in today’s economy, which is threatening a downturn, it is particularly important to consider the long-run implications to today’s technology investments. Tech executives may well be asked to cut costs in the next few months. But when doing so, they should consider not only how cuts will affect today’s bottom line but also how future outcomes will be shaped. Here are three quick hits to consider when budgeting for technology:

- Define opportunity cost across the entire tech portfolio.

- Prioritize tech investments to maximize future utility of tech’s capabilities.

- Demonstrate tech portfolio’s impact on financing market growth in the long run.

For my full set of suggestions, take a look at my new report, TIER: Technology Is An Engine For Growth, So Budget Accordingly. And if you have any questions, feel free to schedule an inquiry or guidance session!

This research falls under Forrester’s tech insights and econometric research (TIER).