What The Massive US CHIPS Act Means To You

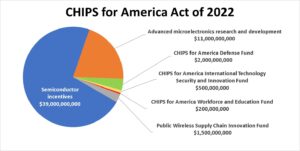

President Biden just signed the CHIPS for America Act into law as part of a larger $280 billion CHIPS and Science Act appropriation. This “CHIPS Act” allocates $54.2 billion in funding to support US domestic technology innovation, primarily aimed at the semiconductor industry. Much of the lobbying that brought this act to reality is focused on national security. Proponents point to the declining competitive position of the United States in the global semiconductor market. Less than 12% of the world’s chips are made in the US, down from 37% in the 1990s. Washington sees this trend as a threat, as other countries have been investing heavily in their domestic semiconductor industries. After the usual political wrangling, the bill passed both the Senate and the House with broad bipartisan support.

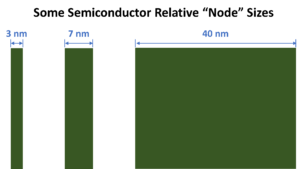

One important point to note is that the CHIPS Act dedicates $2 billion to “mature nodes.” While much of the excitement in the semiconductor world is focused on the most advanced sub-7-nanometer (nm.) technologies, less advanced chips above 40 nm. represent a huge proportion of the overall semiconductor market. The main reason is cost, but they are also reliable. Most IoT devices, such as a Ring doorbell or a Honeywell barcode sensor, are popular because they are cheap enough to warrant mass adoption. You can only hit these price points with inexpensive chips. They also need to be more tolerant of extremes in temperature, vibration, humidity, or corrosive elements. The most advanced chips operate in the relatively luxurious environment of a data center.

Our research shows these mature nodes to be among the worst shortages because their low cost and reliability make them so popular and manufacturing (“fab”) capacity is limited. The automotive sector has been especially sensitive to supply constraints with mature nodes. Read the news to get a sense of the pain involved with cars. For even more painful evidence, try to buy a new car! I’ve been trying unsuccessfully for months! Carmakers need chips — lots of them — and they haven’t been able to get enough.

A few points are worth noting about the CHIPS Act:

- This isn’t a bailout for chipmakers. The government funds in this act have lots of strings attached. Chipmakers need to commit to serving national security and community economic development. Watchdogs will be scrutinizing the investments carefully.

- American manufacturing requirements restrict who gets this money. Only a handful of tech companies qualify for this funding. Most chip companies such as AMD, NVIDIA, and Qualcomm are “fabless,” meaning they don’t manufacture their chips — someone else does. They don’t get anything. The three manufacturing behemoths are Intel, Samsung, and TSMC. Intel is the lone American company here, although Samsung and TSMC have large fab operations in the US. A few smaller US players include names like GlobalFoundries, Micron Technology, and Texas Instruments. Foreign companies qualify for CHIPS Act funds but only for their investments on American soil.

- Fifty-four billion dollars doesn’t go as far as it used to! Building new fabs is insanely expensive — upward of $20 billion for an advanced fab and $2 billion minimum for a less advanced fab. The big three fab operators collectively committed to hundreds of billions of US expansion. CHIPS Act funding won’t make much of a dent here. As this money gets divided across its many recipients and spread across five years, disbursements will be in much smaller slices.

Now that the CHIPS Act has passed, expect that:

- Nothing much will happen in the near term. The big problems in the semiconductor market will take a long time to resolve. Additional capacity is in the works, but it won’t be available until 2024, delayed from our original prediction due to lingering supply chain issues and the Ukraine war. Also, the US government will need to establish oversight bureaucracy before it can disburse any investments.

- Buying a new car, PC, or server will remain problematic. These persistent issues will impede chip deliveries, so products that need the chips will also be delayed. Prepare to pay more for products, wait longer, or buy alternatives.

- Softening demand will bring slight relief. The current economic woes are impeding tech spending. Intel just announced a big earnings miss for the quarter. We expect AMD, NVIDIA, and other chipmakers to also report weaker earnings. This softer demand will help alleviate the chip shortage but not significantly. While reduced from the exuberant tech spending during the pandemic, tech demand remains high.

- IoT and edge computing initiatives will remain wise but will be delayed. Edge computing, fueled by an explosion in IoT-powered connected technologies, is still an emerging business superpower. Smart companies will not waver from this expansion, but restricted supply of chips — both mature and advanced nodes — will temper growth.

- STEM education will commence quickly. A big focus of the CHIPS Act fosters a vibrant academic effort to prepare a workforce for semiconductor manufacturing. Universities and job training programs are already gearing up in preparation for this funding, especially in localities where these fabs are being built. Places such as Phoenix, Austin, and Columbus, Ohio, are targeted for these new fabs, but existing locales like Hillsboro, Oregon, and the Hudson River Valley of New York will also benefit.

- Local communities will soon build out supporting economic ecosystems. A major string attached to this funding is how the chipmakers must support building out local economic development plans. When a new fab appears, local hotels, restaurants, and other businesses emerge. Fab suppliers like ASML, Air Products, and Applied Materials will establish a local presence.

- The language of the Act will continue to strain relations between the US and China. The resounding theme of the CHIPS Act focused on the US competitive position versus other countries, especially China. The signal to China is an aggressive one, so expect China’s rhetoric in response to also be aggressive. Complicated business relations between the two countries have suddenly become even harder. Plan for the inevitable friction in your business execution.

- Geographic diversity will help everyone, including China. Despite the hawkish rhetoric that drove the CHIPS Act through Congress, the even bigger benefit of enhanced US supply is a more diverse supply chain. Just shy of 80% of chips are made in Asia. By shifting more of the supply to US and European soil, the chip supply is more resilient to disruptions that surfaced during the pandemic.

- Tech buyers and vendors will enjoy a return to boom times by 2025. Both the chip shortage and general economic factors will clear up by 2025. That feels like a long way off, but it should already be in your strategic planning’s visible horizon. Count on renewed technology investment for that time frame. The products will be different by then, but at the heart of every one of them will be the same precious ingredient: chips.

As always, please reach out to Forrester if you want to discuss this topic more. There’s never a dull moment in the tech business, especially now!