COVID Drives M&A Activity In DevOps And IT Management

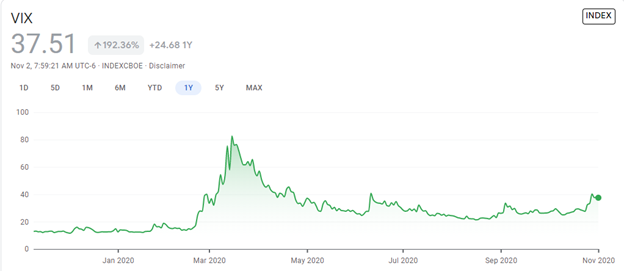

Your trusty DevOps Theme Team here! As Forrester analysts, we keep an eye on mergers and acquisitions; it’s part of our job. It’s certainly been an interesting eight months or so since the pandemic hit. A cursory glance shows 25-plus acquisitions in the last eight months in the DevOps and related IT management spaces, and this feels like an elevated pace. In fact, the pandemic has increased uncertainty, and the market (according to the VIX Index) remains volatile relative to historical standards. We think that this volatility is resulting in some attractive bargains, with investors wanting to shift more to cash and with company leaders feeling a desire to be part of larger enterprises.

Therefore, it’s a good time to reflect a little on mergers in software. Growth-by-acquisition software firms are nothing new. The industry ecosystem is based on VC-led innovation that either leads to IPOs or (more frequently) acquisitions. Some firms specialize in acquiring and assembling portfolios. Computer Associates (CA) was one of the first to perfect such a business model. IBM, HP Software, BMC, and many other old-guard software firms also grew in large measure by acquisition.

The well-known downside of acquisition, however, was pithily stated by Oracle’s Larry Ellison, who said that CA was “where software goes to die.” Portfolio firms assemble cash cows and milk them; they are less often in the business of innovation. And from a customer perspective, the whole is often less than the sum of the parts. While sales teams at portfolio companies speak glowingly of integration, the reality is that with stretched engineering budgets, a “platform” of acquired products tends to be lumpy and disjointed, requiring the customer to address hard integration questions that ideally the vendor should solve.

Some of the old portfolio companies have themselves been acquired (CA by Broadcom; HP by Micro Focus). But we’re observing new players emerging, as well. Atlassian in particular is assembling a diverse portfolio that presents integration challenges, as is Digital.ai. The acquisition of Chef by Progress Software (run by a CA veteran) also seems to be more of a portfolio play.

Regardless, customers do appreciate integrations that “just work.” And integrations at least at a technical level are somewhat easier these days, with REST/JSON APIs, generally greater maturity in stitching systems together, and a growing ecosystem of vendors specializing in bridges of various forms. For examples of vendors that acquire and then integrate, look at GitHub and GitLab, each of which has acquired companies that specialize in pre-release security testing. In both cases, the acquisitions represent new features that get built into the existing user experience, rather than extra products sold separately. ServiceNow also tends to fully integrate acquisitions on the Now Platform.

In conclusion, the success, or failure, of any acquisition that fills a niche or larger capability gap needs to be judged by how well it fits into the broader vendor product ecosystem, providing seamless value for the customer. If the new acquisition is a gatherer and processor of data that can readily be integrated into the main platform, then it’s a win. If all you end up with is another loosely integrated dashboard that requires constant context switching to utilize, your gains are marginal at best.

Here for your benefit is our joint list of acquisitions that made our radar, with occasional notes.

| Target | Acquirer | Date (press releases linked) | Category | Notes |

| Tinfoil | Synopsys | 2020-01 | Security | Adds DAST and API scanning technology to Synopsys |

| Hunter2 | Veracode | 2020-01 | Security | On-demand education for security skills for developers |

| Arxan | Digital.ai | 2020-04 | Security | “Security by design” at front end of lifecycle to enhance Digital.ai’s DevSecOps capabilities |

| Numerify | Digital.ai | 2020-06 | CDRA/AIOps | AIOps and beyond analytics relevant to integrated digital pipeline. Will serve as central data model. |

| Octarine | VMware | 2020-05 | Security | Enables VMWare to better secure containers |

| Experitest | Digital.ai | 2020-06 | CDRA | Strengthens testing/QA capabilities |

| Fuzzit and Peach Tech | GitLab | 2020-06 | Security | Enhances GitLab’s DevSecOps capabilities with advanced testing |

| Sweagle | ServiceNow | 2020-06 | ESM | Takes ServiceNow CMDB deeper into element-level configuration management |

| Compuware | BMC | 2020-06 | ITOM/CDRA | Signals BMC’s ongoing commitment to mainframe market |

| Aptage | Planview | 2020-07 | Project portfolio | Murray Cantor (lead Rational quant and math whiz) — built engine operationalizing concepts pioneered by Don Reinertsen — queuing and cost-of-delay analysis for prediction/decision support |

| Mindville | Atlassian | 2020-07 | ESM | Fixes key weakness in Atlassian Service Desk CMDB/ITAM capability |

| Rancher | SUSE | 2020-07 | Cloud-native | Kubernetes management platform acquired by SUSE |

| Drone | Harness | 2020-08 | CDRA | Strategic response to Armory with Spinnaker; Harness needed a community play |

| Undefined Labs | Datadog | 2020-08 | CDRA | Extends Datadog reach into upstream development, left-shifting analysis of potential performance problems |

| Zephyr | SmartBear | 2020-08 | CDRA | Strengthens Smartbear’s presence in Atlassian ecosystem |

| Lens | Mirantis | 2020-08 | Cloud-native | Brings in Kubernetes-native IDE |

| Chef | Progress | 2020-09 | Infrastructure automation | Portfolio company best known for legacy 4GL, led by CA veteran. Chef impacted by immediate layoffs, including some from engineering team. |

| SaltStack | VMware | 2020-09 | Infrastructure automation | Deepens VMware’s configuration management capabilities |

| MobileIron | Ivanti | 2020-09 | Unified endpoint management, ESM | Fills a historical gap in Ivanti offering with a long-time leader in mobile device management; bolsters Ivanti’s Zero Trust capability with MobileIron’s passwordless authentication capabilities |

| Rundeck | PagerDuty | 2020-10 | ITOM | Adds runbook automation to PagerDuty’s incident response platform |

| Plumbr, Rigor | Splunk | 2020-10 | CDRA | Expands Splunk’s APM and DEM capabilities |

| ComAround | BMC | 2020-10 | ESM | AI enhancements for BMC Helix |

| Portshift | Cisco | 2020-10 | Security | Cloud-native application security capabilities and expertise for containers and service mesh in Kubernetes environments |

| Signal Sciences | Fastly | 2020-10 | Security | Web application security to strengthen Fastly’s “cloud to the edge” strategy |

| Element AI | ServiceNow | 2020-11 | ESM | Cross-industry AI applications; founded by Turing Award winner Yoshua Bengio, “godfather of AI” |

| Pulse Secure | Ivanti | 2020-12 | Security | Secure access and mobile security solutions |

For Forrester clients, we are at the ready to take inquiry about these or any other DevOps acquisitions to give you our opinion about whether it will integrate with success or not.