European Banks See A Drop In CX Quality, Mirroring Global Trends

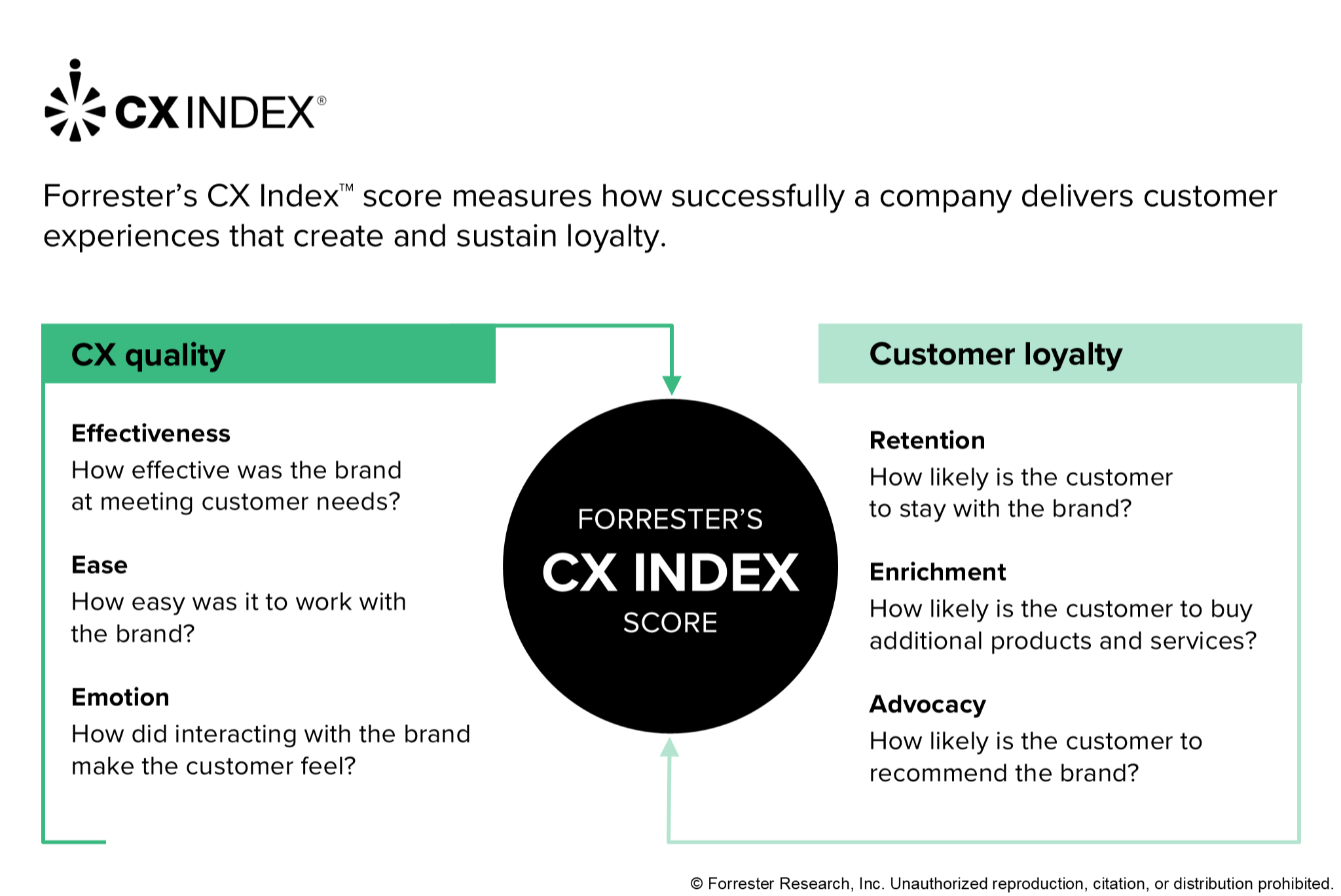

At Forrester, we talk a lot about the importance of customer experience (CX). We’ve shown the potential benefits that organizations can achieve by improving CX (though the actual impact varies by industry or even by individual organization) and have helped plenty of organizations make the business case for CX by calculating their return on investment. To help organizations measure CX quality, we’ve developed the Forrester’s Customer Experience Index (CX Index™), which, unlike Net Promoter Score℠ (NPS), measures CX perceptions as well as outcomes. In 2024, we surveyed 18,058 European adult customers of 60 banking brands in France, Germany, Italy, Spain, Sweden, the UK, and, for the first time, Poland and the Netherlands. While 2022 and 2023 saw stagnation in CX Index scores among European banking brands, in 2024, European banks joined other regions and industries to see a significant drop — a worrying sign with significant business implications.

CX Quality Dropped Significantly Across European Banking — And Is Middling

Great CX is a journey, not a destination. Organizations can’t rest on their laurels as technology changes the art of the possible, newcomers disrupt status quo, and external factors like COVID and inflation reset customer expectations of companies and the value they are getting. Across industries and geographies, we have seen precipitous drops across all three dimensions of CX quality: effectiveness, ease, and emotion. European banks have now joined their counterparts in the US, Canada, and Australia in experiencing significant drops in the quality of their CX. We found that:

- Challengers and mutuals outperform traditional banks, yet most are stuck in CX mediocrity. The average quality of CX dropped significantly and declined in all evaluated countries compared to last year. Unfortunately, no single country improved its average CX quality. Challengers and mutuals continue to outperform traditional banks on CX. While there are clear CX leaders and laggards, banking brands are mostly clustered within their packs — this presents a clear opportunity for banks to differentiate with the quality of their CX.

- Plain communication and transparency drive loyalty the most in Europe. What can European banks do to drive CX improvement? Focus on the drivers that are most important to their customers. While the top drivers of CX Index scores differ per country and brand, overall, communicating in plain language and having transparent prices, rates, and fees are most impactful when it comes to customer loyalty and revenue.

- Hybrid CX creates the best experiences according to European banking customers. A combination of digital and physical channels evokes the easiest, most effective, and most emotionally positive experiences for European banking customers. While ease and effectiveness determine whether customers perceive their interactions with a bank as intuitive and satisfactory, emotion has the highest impact on customer loyalty. We urge banking brands to consider how hybrid experiences can be woven into their customer journeys to create experiences with empathy and impact while also exploring how they can drive an emotional connection with digital experiences — given how many customers are now digital-only.

For a more detailed analysis of the European CX Index results — including every brand’s score and the CX drivers and emotions that drive loyalty the most — check out our report, The European Banking CX Index Rankings, 2024, or schedule an inquiry with us.

Related Forrester Content

- The European Banking CX Index Rankings, 2024

- The France Banking CX Index Rankings, 2024

- The Germany Banking CX Index Rankings, 2024

- The Italy Banking CX Index Rankings, 2024

- The Netherlands Banking CX Index Rankings, 2024

- The Poland Banking CX Index Rankings, 2024

- The Spain Banking CX Index Rankings, 2024

- The Sweden Banking CX Index Rankings, 2024

- The UK Banking CX Index Rankings, 2024