Announcing The Forrester Wave™: Process-Centric AI For IT Operations (AIOps), Q2 2023

The artificial intelligence for IT operations (AIOps) platform market is continuing to shift. As a follow-up to The Forrester Wave™: Artificial Intelligence For IT Operations, Q4 2022, a technology-centric evaluation, I have now also evaluated AIOps vendor solutions that approach AIOps from a process-centric perspective. My report about the different perspectives of how to approach AIOps explains the different ways that enterprises are tackling AIOps efforts. These process-centric AIOps vendors tend to enter the AIOps market from the IT operations management (ITOM) and IT service management (ITSM) markets as opposed to monitoring or application performance monitoring (APM).

The ultimate goal of AIOps solutions, regardless of perspective, does not change. Trying to compare vendors across the two different Wave evaluations, however, is an exercise in futility. First, the evaluation criteria and scaling are different. Secondly, no two evaluations are the same, because a Wave is a comparative analysis, not an absolute determination against an industry marker. Trying to compare vendors across two different evals is strongly discouraged, because the results will inevitably be misleading without additional deep analysis and my guidance on the details of my assessment.

This latest Wave, The Forrester Wave™: Process-Centric AI For IT Operations (AIOps), Q2 2023, focuses on process-centric AIOps solutions, which drove the entry criteria, in addition to single code base and/or user interface, stand-alone products that are not part of a portfolio or group of products, and relevance to Forrester clients. Operationally aligned and technology-centric AIOps vendors were not included in this research. As a reminder, the Wave’s capabilities are based on the AIOps reference architecture, which defines the 18 capabilities required to deliver AIOps solutions.

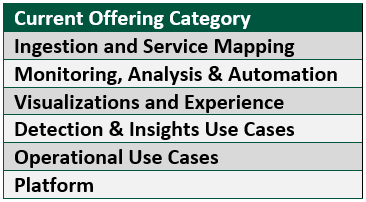

As with all Wave research efforts, the evaluation looks at criteria within the vendor’s current offering, strategy, and market presence. For this research, 22 capabilities were grouped into six categories to evaluate the vendor’s current offering.

Evaluation Criteria And Participants

In total, 30 different capabilities across the three major sections were used to evaluate 11 vendors: Aisera, BigPanda, BMC Software, Everbridge, Freshworks, Moogsoft, PagerDuty, ServiceNow, SolarWinds, Sumo Logic, and UST. For a full working model of all 30 criteria and the associated weightings, download the full model linked at the top of the Wave report in the righthand panel. Note that three vendors (Moogsoft, SolarWinds, and Sumo Logic) chose to not participate in the Wave. Choosing to not participate does not exclude a vendor if the Forrester analyst determines that the vendor is a legitimate participant in the market being evaluated. Scores of nonparticipating vendors are based on the best publicly available information that the analyst can find, since detailed responses from the vendors were not provided.

This AIOps research pushed vendors to demonstrate the ability to provide business-focused insights through both native and third-party capabilities. The 30 capabilities address challenges that organizations are facing with today’s complex hybrid environments that span from the end user experience to the back-end mainframe and on-premises infrastructure. The objective of the evaluation was to identify which vendor could differentiate itself the most with strong offerings across all 30 capabilities, not just a subset of capabilities. The evaluation process includes responses to the 30 capabilities and a 2-hour briefing and demonstration to reinforce and/or support the responses.

This AIOps research pushed vendors to demonstrate the ability to provide business-focused insights through both native and third-party capabilities. The 30 capabilities address challenges that organizations are facing with today’s complex hybrid environments that span from the end user experience to the back-end mainframe and on-premises infrastructure. The objective of the evaluation was to identify which vendor could differentiate itself the most with strong offerings across all 30 capabilities, not just a subset of capabilities. The evaluation process includes responses to the 30 capabilities and a 2-hour briefing and demonstration to reinforce and/or support the responses.

All vendors demonstrated very strong offerings but not always across all 30 capabilities. For example, a vendor might offer a capability with a third-party integration but not natively. It might offer great technology modeling but not business modeling. Certain strengths might be desirable to some organizations with those particular needs but not others. These are just high-level scenarios that demonstrate the importance of identifying the right pairing of vendor strengths to the right organizational needs. Do not take the scoring as the end-all decision in terms of which vendor solution is best for your organization. You need to rebalance the scoring to align with your organizational priorities.

And The Winner Is …

The vendor best able to demonstrate a strong and differentiating offering across all 30 capabilities was BMC Software. It consistently demonstrated the ability to offer leading or near-leading capabilities that provide organizations the most flexibility when implementing a process-centric AIOps solution. BMC Software has a long history in both the process/workflow and monitoring areas. You may remember products such as, or formally known as, Remedy, PATROL, BladeLogic, Marimba, TrueSight, and others. The full Wave report goes into a lot more depth. Read the report to see the capabilities of each vendor and how they stack up against the rest of the process-centric market.

Join The Conversation

I invite you to reach out to me through social media if you want to provide general feedback. If you prefer more formal or private discussions, email inquiry@forrester.com to set up a meeting! Click Carlos at Forrester.com to follow my research and continue the discussion.