VMware Customers: Brace For Impact

October 30, 2023 came and passed — the date that marked the end of Broadcom’s fiscal year and the promised close for its $61 billion VMware acquisition. In anticipation of that timing, VMware shareholders were given until October 23 to decide whether to accept Broadcom shares at $142.5 per share or cash payment, of which 96% chose shares. But despite clearing a small hurdle with South Korea’s conditional approval, China delayed its approval until Tuesday, November 21. Reasons for China’s stalling is speculated as a geopolitical move in response to the US government’s latest chip sanctions against the country.

The deal is now set to officially close on November 22, 2023, just before the deal expiration date on Nov. 26. Now that the deal is officially closing, what should you know and expect?

What We Know So Far

Broadcom and VMware haven’t made much in terms of official announcements beyond three things:

- VMware will be rebranded VMware by Broadcom.

- Broadcom’s CEO Hock Tan promised no price increases on VMware products (though we have already bore witness to VMware renewals that have gone up in multiples).

- Broadcom announced at VMware Explore a $2 billion investment into VMware.

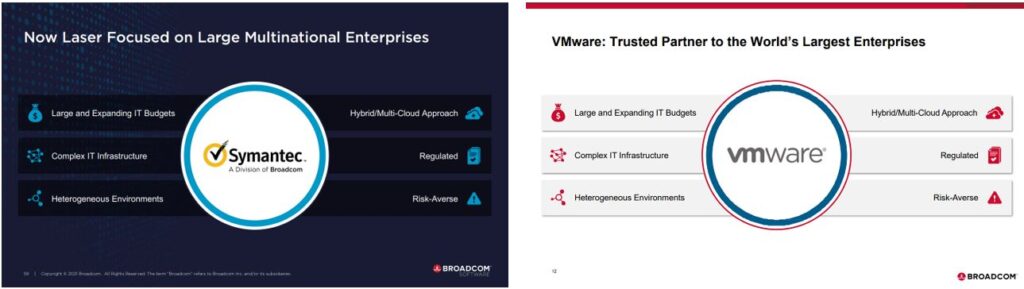

Beyond these, rumors abound with leaked emails of new job offers and anticipated massive layoffs at the end of October for VMware. But for a window into the future, simply look back to its previous two major acquisitions, CA and Symantec. Between the two companies, customer support reduced significantly, and innovation stunted from deprecated revenue investment in R&D (3% drop) and sales and marketing (22% drop). Broadcom claims that the VMware acquisition will be different, but its path seems to follow the same as Symantec’s. Their paths are so similar that they have the same “cut and paste” slideware (see the figure below).

(slides presented to investors for the announced Symantec acquisition [left] and VMware acquisition announcement [right])

What Should VMware Customers Expect?

Over the next few years:

- The VMware revenue stream will face challenges as customers leave in droves. Current and future customers wary of the Broadcom brand are looking at alternatives, even when VMware is the clear market winner in capabilities for a given market. And in several product lines, constant product reorganization and employee attrition means slower innovation with only incremental updates at best. VMware’s revenue stream will be challenged as its enterprise customers eventually escape the VMware stack. Expect massive workforce reduction to impact employees. This will further impact support quality and jeopardize future roadmaps. On the other hand, a massively reduced workforce could very well counterbalance some of its revenue losses.

- There will be significant streamlining and rebranding as VMware protects key assets. Once the acquisition has closed, lesser-performing products will likely sunset to meet Broadcom’s aggressive timeline of achieving an additional $3.8B in profitability in three years. Prior to Aria integrating under Tanzu, the Tanzu product line was ripe for picking off. Poor market traction and its inability to match market leader Red Hat OpenShift has led to its decline despite efforts to make it a key growth initiative at VMware. As Aria and Tanzu now fall under one business lead, Tanzu is under the protective umbrella of its high-performing products CloudHealth and Aria.

- vSAN will maintain HCI dominance — but competitors will report increasing interest. The latest release, vSAN 8, is a rearchitected hyperconverged infrastructure (HCI) offering adding features needed to maintain VMware’s dominant market position for HCI. But despite creating a large network of cloud providers, system integrators, infrastructure vendors, and sales channels in which to embed vSAN, customers still entertain alternatives. Direct competitor Nutanix claims to be reaping the benefits of buyers who are wary of future high license costs and of products with an uncertain commitment to innovation. Nutanix CEO Rajiv Ramaswami stated that “ […] the pending acquisition of our leading competitor … has been helping build a strong pipeline that we expect will extend for years to come.”

- An unclear future for Horizon and Workspace ONE will make room for competitors. As we stated previously, VMware’s value proposition as a leading end-user computing vendor will decrease its attractiveness under Broadcom’s record of poor customer support and slowed innovation. While VMware’s end-user computing (EUC) portfolio is still strong, it has always taken a back seat to the company’s infrastructure products. We wouldn’t be surprised to see VMware’s EUC business spun out of Broadcom as a result, but it’s too early to tell. Either way, the murkiness in the water creates additional room for competitors such as Microsoft Intune and Windows 365 to gain market share.

- Carbon Black complements Symantec on the endpoint side but has a lot of catching up to do. The company’s workload protection tools are widely used for hybrid cloud deployments and are considered the de facto standard for cloud migrations. VMware lacks key components, however: The endpoint security tool focuses on detection and response, leaving gaps in traditional endpoint protection. In the endpoint protection platform market (but much less strong in the endpoint detection and response/extended detection and response market), Carbon Black will complement its capabilities. Like Symantec, however, Carbon Black has fallen behind its competitors on the detection and response side in recent years, leaving Broadcom with the major hurdle of competitive parity on both sides of the coin. Beyond Carbon Black, the company lacks a true Zero Trust narrative to unify its disparate security solutions, leaving questions around the future of NSX.

An Incoming Crash Landing

While the deal has closed, don’t expect massive disruption immediately. VMware’s software is heavily embedded in many mission-critical applications in major enterprises. Plus, organizational change post acquisitions takes a while to fully set in. The next six months, however, will be telling about how Broadcom intends to navigate its newly found role in the cloud software world. Don’t hold your breath on a true success story in which VMware remains unaltered and its own independent entity. Do expect price hikes, degraded support, and a VMware with a more diluted value prop.