Agentic Commerce’s Success Centers On Overcoming Key Frontiers In Consumer Trust

Google and OpenAI Are Racing For Platform Advantage …

Google entered the agentic commerce race at NRF last week, announcing the Universal Commerce Protocol (UCP). UCP is an open standard for agentic commerce, which Google codeveloped with multiple retailers (Etsy, Target, and Walmart, among others) and tech partners (Salesforce and Shopify, among others). Google is second to market with an agentic commerce protocol after OpenAI’s Agentic Commerce Protocol (ACP) release last October — initiating a race for platform advantage in agentic commerce.

- Google’s UCP. Google focuses on broader commerce journeys by providing contextual offers based on consumer searches (likely the foundation for ad-based monetization). It also allows AI agents to authenticate customers and retrieve loyalty information. UCP goes a step further by permitting agents to display discount data during checkout — bringing loyalty and pricing to the agentic realm. It also introduced brand business agents that can function like digital sales associates.

- OpenAI’s ACP. OpenAI currently does not have a pathway for broader commerce journeys like UCP, except by offering merchants control for promotions and offers via 15-minute refreshes through its product data spec feed. Compared to Google, OpenAI is focused on compressing the commerce journey from discovery to “instant checkout,” has a head start in market with its protocol, and has established itself as the answer engine of choice among consumers.

As a well-established, trusted partner to brands and retailers, Google is racing to distribute its search-based commerce infrastructure: Shopping Graph, Merchant Center, and its payment network. OpenAI is building a new commerce infrastructure and pursuing faster merchant adoption with minimal changes to existing systems, as well as conversations through chat-based interactions that validate intent before surfacing products. The differing approaches highlight that brands and retailers might need different strategies for search-native and agent-native commerce in the future.

… But Consumer Trust In Agentic Commerce Still Lags

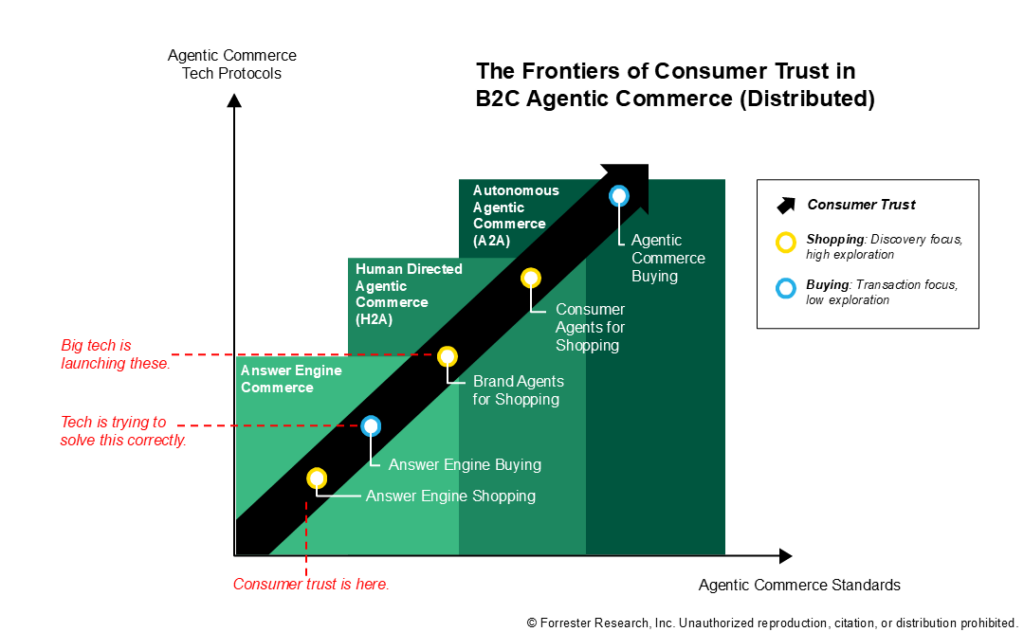

The idea of autonomous consumer agents that shop on our behalf is far from reality today. The pace of agentic commerce adoption is not set by the existence of the tech protocols but rather how brands and retailers leverage UCP and ACP to gain consumer trust. We need to cross several trust frontiers for agentic commerce to gain traction with consumers:

- Higher trust in answer engine shopping. Between February and October 2025, according to Forrester’s Consumer Pulse Surveys, US consumer adoption of answer engines for product discovery remained largely flat, growing from 18% to 19%. Without comprehensive and accurate product data, agentic commerce will continue to remain a mediocre product discovery tool, with transactions continuing to happen on other sites (Google’s Shopping Graph could accelerate this). Also, discovery on answer engines does not yet equate to conversion — Bain & Company found that Amazon and Google were far ahead of OpenAI in product discovery during the 2025 holiday season.

- Higher trust in answer engine buying. According to Forrester data, a majority of US consumers and UK consumers believe that brands will market to consumer agents, but few trust these consumer agents to act on their behalf — even for routine (i.e., low-stakes) purchases. Google’s announcement finally puts Google firmly in the agentic commerce payments race, as we foresaw, but agentic payments still have limited consumer adoption. In October 2025, only 8% of US online adults had used OpenAI’s Instant Checkout.

- Higher trust in agentic standards and consumer protections. Other practical considerations are still missing that would help consumers feel secure. For starters, 54% of US online adults are not comfortable giving up their personal information to generative AI tools. Then there’s the question of order issues. When an agent places an incorrect order because of inaccurately generated product content, who is liable for the return order processing? Still in its early days, Order Network eXchange is standardizing the operating language for agentic commerce operations.

The Elephant In The Room For Agentic Commerce In 2026

Digital commerce continues to evolve and experiment — remember the hype of conversational commerce? According to Forrester’s report, The Digital Moments Map, 2024: US, one in five US online adults indicated that they are comfortable using voice for commerce. If agentic commerce is to become a big channel in distributed commerce strategies, brands and retailers need to experiment with both ACP and UCP in 2026 before sponsored content and ads arrive alongside chat responses.

It is also important to put agentic commerce into perspective. By 2023, Amazon was already generating $484 billion in US e-commerce retail sales and dominated product discovery searches. By the end of 2025, Amazon had blocked every major LLM operator from its walled garden. In our view, it is a no-brainer for Walmart to announce (and perhaps even lead) the way for its product catalogs to be surfaced on ACP and UCP. On the other hand, given Amazon’s depth of consumer and household data, Amazon is well positioned to release the first set of consumer agents for households.

If you’re a Forrester client interested in de-risking your existing commerce operations while running controlled pilots across UCP and ACP in 2026, book an inquiry or guidance session with us! Chuck Gahun’s forthcoming research on distributed commerce strategies and commerce services evaluations will further help your brand or retail business pragmatically lean into agentic commerce. Emily Pfeiffer, Lily Varon, Rowan Curran, and Nikhil Lai are also available to speak with you on topics such as agentic commerce, owned properties, agentic payments, agentic AI, agentic commerce’s impact on retail media, and more.