A Match Made In Plastic? Capital One’s Quest To Acquire Discover

Capital One’s plan to acquire Discover will change the shape of the financial services landscape (though not the fundamental forces that drive growth and success — but more on that later). To help you understand the implications of the proposed merger, Forrester took a deep dive into our research and data (full report for clients here). Here’s some of what our research uncovered:

- There’s little overlap in the firms’ distinct customer bases. In the US, just 6% of credit card customers use both Capital One and Discover, even though 41% use at least one of the two. The two brands’ customer bases are demographically and attitudinally distinct from one another: Discover’s clients tend to be older, wealthier, more educated, and more likely to be married (at any age) — they are also less likely to have anxiety and fears about their finances. And each group faces specific financial challenges: Capital One’s customers are more likely to seek help with debt management, while Discover’s customers tend to focus on retirement planning and investing concerns.

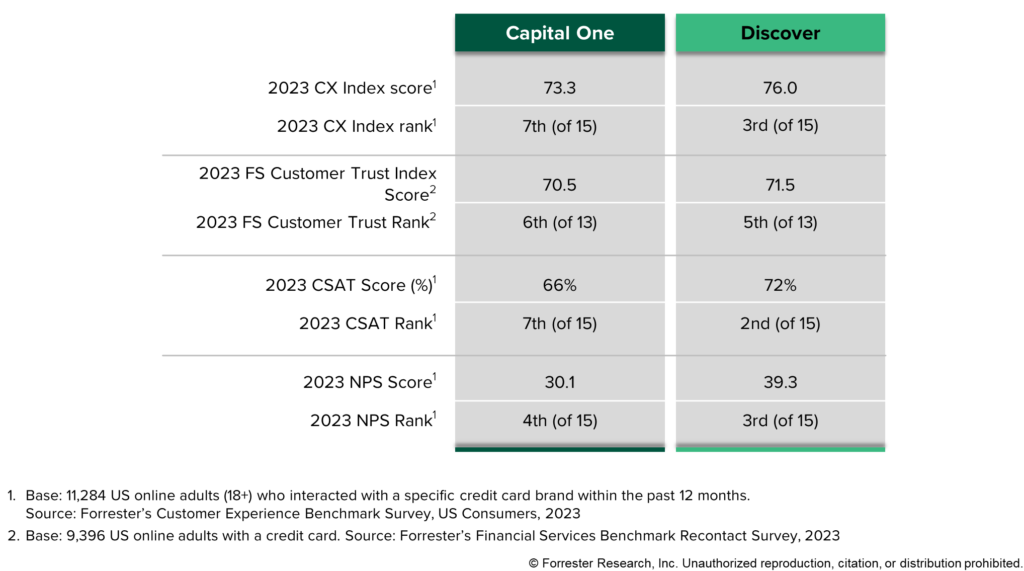

- Discover brings a strong brand value proposition (and crucial network heft). It’s not just their clients that differ: Our research reveals that Capital One and Discover have distinct brands — at least in the eyes of their own customer bases (see image below). Post-acquisition, this could mean that one company’s brand strengths drive deeper, stickier relationships — or it could mean that the weaker brand acts as a drag on the newly merged company. Specifically, we found that Discover has the slightly stronger brand across four metrics: Forrester’s Customer Experience Index (CX Index™), our Customer Trust Index, customer satisfaction (CSAT) percentages, and Net Promoter Score℠ (NPS). In Forrester’s April 2024 Consumer Pulse Survey, we asked US cardholders which attributes they associate with different brands and found that Discover’s customers are more likely than other card brands to say that it offers great rewards and customer service, while Discover has the largest share of customers saying that it is their favorite brand.

- Capital One offers a broad set of product and distribution options. Capital One earns above-average scores across most measures of brand strength, and it’s in an especially strong position in some areas that will prove valuable post-acquisition. For example, Capital One’s primary customers are more likely to say that they’d open another account with the brand and that they would “use additional products/ services from this company.” When asked “Thinking about your primary credit card, how likely are you to try a new product/service from the company, even if it is unrelated to the things you currently use from this brand?” 78% of US online adults who consider Capital One their primary card say that they would be likely or very likely to try an adjacent product from them (higher than the share for Discover). Capital One can leverage Discover’s network and cross-subsidize specific products to deepen relationships and drive profitable growth.

- Digital strategy will have a big impact on post-merger growth. We see key contrasts in how Capital One and Discover customers use and value different digital offerings. To oversimplify our findings a bit: Capital One clients use mobile apps, while Discover’s use online banking services. But digital experiences are mission-critical for both brands’ engagement and relationship models. As such, digital strategy will play a major role in determining the success (or failure) of combining the two companies. Capital One and Discover will need to use websites, apps, and other digital offerings to set themselves apart from the competition, or else they will struggle to achieve sustained, profitable growth.

- Ultimately, the move comes down to old-school business strategy in a digital age. The bottom line is that this proposed acquisition would combine two strong yet distinct brands. But the driving strategy behind this acquisition comes down primarily to the massive network that Discover has established over the past four decades: This competitive advantage (some might call it a “moat”), plus the strength of the brands, illustrate how this move is a case of old-school business strategy in a digital world.

For more insight on how digital business leaders at card companies can understand the implications of this acquisition, as well as how to leverage different strategies in light of this announcement, please check out our full report: The Brand, Business, And Digital Strategy Implications Of Capital One Buying Discover.

You can also contact us by emailing pwannemacher@forrester.com if you want to discuss more!